Say-on-Pay support rises for technology companies in 2015, while there are signs that ISS' influence over investor voting could be softening.

Vote Support Rises

The fifth year of Say-on-Pay voting just wrapped up for most companies. A Radford report with in-depth results focused on the technology sector is available here. This article highlights some of the biggest takeaways from the 2015 Say-on-Pay voting season.

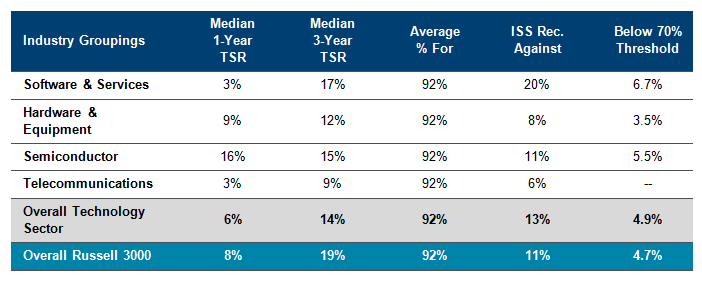

Within the technology sector there was cause to celebrate. Average votes recovered to 91.6% from a five-year low of 88.7% in 2014. For the broader Russell 3000, average votes were 92%, which is on par with the prior year.

Outright failures on Say-on-Pay are rare and materially lower for technology companies than a year ago at 1.6% in 2015 vs. 3.2% in 2014. Among the Russell 3000, Say-on-Pay failures also dropped to 1.7% from 2.1% last year. This reflects companies' increasing effectiveness at explaining and rationalizing their pay programs to institutional investors. This has, in turn, caused some shareholders to be more flexible with executive pay practices and willing to overrule ISS where they believe circumstances warrant.

While there was more parity between technology companies and the Russell 3000 when it comes to Say-on-Pay votes, there are differences between the factors that contribute to shareholder perceptions of pay. For one, technology companies are slightly more penalized by Institutional Shareholder Services' (ISS) "QuickScore" governance rankings related to compensation. Based on ISS' standards, prevailing compensation practices among software, hardware and semiconductor companies pose greater levels of "compensation risk." This contributes to ISS' greater willingness to recommend against Say-on-Pay. Indeed, ISS recommended against Say-on-Pay at 13% of technology companies in 2015 vs. 11% for the Russell 3000.

Influence of ISS

While ISS "against" recommendations for technology companies are materially higher than the Russell 3000, average shareholder support for Say-on-Pay rose. This suggests that institutional shareholders are breaking from ISS' voting recommendations in some circumstances. In this fifth year of mandatory Say-on-Pay votes, companies appear more effective and comfortable in their engagement with shareholders.

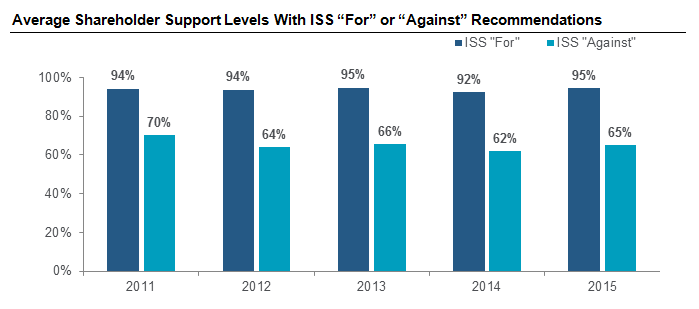

Similarly, the average support for companies with an "against" recommendation from ISS rose this year from 62% to 65%. However, we also don't want to minimize ISS' continued influence over vote outcomes. As we can see in the chart below, the difference in voting outcomes based on an ISS "for" or "against" recommendation is significant.

Connection to Performance

We continue to see a strong connection between Say-on-Pay support and company performance. For instance, one-year total stockholder returns in software are lower than other technology industries and the Russell 3000. At the same time, a larger percentage of software companies received negative ISS recommendations. The proxy advisory firm has flagged many of these software firms with a "pay-for-performance disconnect" under its methodology when stock awards are made at higher values at the start of the year, followed by the stock trending downward. As a result, software firms have a lower average level of shareholder support compared to other technology industries.

Technology companies also have a higher rating of "compensation risk" on ISS' GICS scoring system compared to the Russell 3000— largely driven by stock volatility and industry-specific compensation practices, such as limited performance-based equity programs tied to relative total shareholder return, single-trigger equity acceleration in change-in-control provisions, legacy tax gross-ups, fewer extensive clawback provisions, and smaller stock holding requirements.

To read Radford's complete report of 2015 Say-on-Pay votes in the technology sector, click here.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles