Introduction

In the past, our team has discussed at length how equity plan design decisions can significantly impact accounting costs for performance-based equity awards. This includes fundamental design decisions, like picking a performance peer group, as well as seemingly peripheral items such as whether or not to include a negative TSR payout cap in your equity plan language.

When we last visited this topic (you can read our most recent article here), we outlined five important plan design decisions that all companies should carefully examine to identity potential opportunities for mitigating the cost of performance-based equity awards with relative TSR metrics. These five opportunities include:

- Performance peer group selection practices;

- Developing and setting monetary value caps;

- Limiting awards when TSR is negative;

- Calibrating payout levels for superior performance; and

- Setting appropriate threshold, target, and maximum payout levels.

Today, we believe there is a sixth opportunity available to plan designers to maximize the perceived value of equity awards for employees while minimizing the real equity award expense for companies — mandatory post-vest holding requirements.

Mandatory post-vest holding requirements do not impact the timing or nature of award vesting schedules. Rather they limit the ability of employees, usually executives, to sell shares after awards are vested. In some cases, mandatory holding periods can stretch until retirement, but they typically range from one to three years in length. By virtue of obliging employees to hold vested equity, companies can achieve a long list of governance benefits, including the achievement of executive ownership guidelines and building a culture of long-term equity ownership. However, there is an additional silver-lining. Holding periods, when designed correctly to meet accounting requirements, can yield significant discounts in the accounting fair value of equity awards under ASC Topic 718 and IFRS 2 for a "lack of marketability."

Estimating the Value of Potential Discounts

Several theoretical valuation models can be used to calculate the impact that illiquidity periods have on an asset’s value (e.g., a stock award). The most prominent techniques are the Chaffe and Finnerty models, both of which conclude that mandatory holding periods lower the value of an award. Reductions in award values related to illiquidity periods are often referred to as discounts for the lack of marketability (DLOM). Theoretical predictions from both the Chaffe and Finnerty models are further verified by actual observations of privately-placed stock whose resale and transfer is restricted by Rule 144.

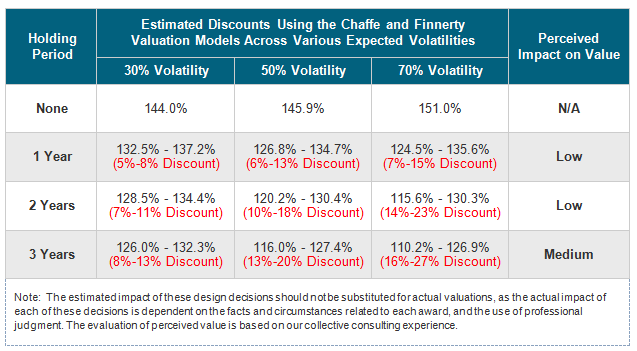

The following table estimates the reduction in award valuations using the Chaffe and Finnerty models, which can fluctuate based on the duration of holding periods and the expected volatility of the underlying stock. Please note that the discount associated with a holding period is not based on the design of the relative TSR component of a performance-based equity award, and will be similar to other relative TSR awards with comparable holding periods.

As you can see from the table above, regardless of the valuation model used, discounts for the lack of marketability related to mandatory post-vest holding periods climb as volatility and the length of holding periods increase. Depending on the specific facts and circumstances at your company, this means mandatory post-vest holding periods have the potential to unlock significant accounting value.

Conclusion

The overarching intent of any performance-based equity program is to pay employees fairly, such that incentive compensation is aligned with both corporate performance and shareholder returns. When developing performance-based equity plans, it is also important to consider key design decisions that have the ability to optimize the relationship between the perceived value of awards for employees and the overall accounting cost of the program for the company. Adopting mandatory post-vest holding periods is one design element that can help companies maximize their investment while being a good corporate citizen at the same time.

To learn more about the full set of governance and accounting benefits associated with mandatory post-vest holding requirements, please visit holdaftervest.com.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles