Introduction

An increase in the number of shareholder proposals aimed at ending the popular practice of accelerating a CEO's equity upon a change-in-control event could have an impact on the design of severance packages in the United States (US).

Ten companies in the Fortune 250 received shareholder proposals asking Boards of Directors to prohibit or limit accelerated vesting upon a change-in-control in 2014, according to data from ProxyMonitor. The average support level for these proposals was around 35% and two proposals passed among these companies. The overall number of proposals is higher when factoring in small and medium-sized firms. Institutional Shareholder Services (ISS) says four proposals at Russell 3000 companies passed last year. That compares to a total of just five accelerated vesting proposals that were filed by shareholders at large-cap companies between 2006 and 2013, according to ProxyMonitor.

Proposals in this area vary. Recent proposals have evolved from attempts to limit accelerated vesting solely to double trigger events—where awards are only accelerated if an executive loses his or her positon at the company after a change in control—to measures aimed at prohibiting acceleration of performance shares if performance conditions have not yet been met, and full bans on acceleration for any unvested equity.

Judging by recent support levels, this issue is gaining traction among shareholders. Several technology and life sciences companies have received anti-acceleration proposals in recent years, including Abbott Laboratories, DuPont, IBM and Oracle. The main proponents of these resolutions come from labor and union-backed public pension funds. Since support levels tend to be higher on these proposals relative to other executive compensation-related items, we decided to explore this issue a little deeper and highlight market practices we observe in this area at technology and life sciences companies.

Market Practices

Most corporate boards have responded to these resolutions by arguing that outright prohibitions on accelerated vesting during a change-in-control event would put their company outside of peer practices and present a challenge to attracting, motivating and retaining critical executive talent. These concerns are especially acute among newly-public technology companies and pre-commercial life sciences firms where the sale of the business is as likely as growing into a mature company.

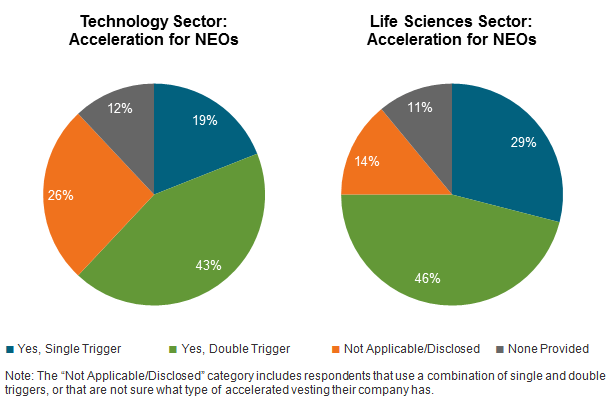

We find that acceleration of equity upon change-in-control is commonplace among life sciences and technology companies of all sizes and lifecycles. The majority of the 300-plus sector-specific companies polled in Radford's 2014 Severance & Change-in-Control Practices Surveys confirmed they accelerate equity upon a change-in-control for their named executive officers. Companies are making changes to their executives' accelerated vesting provisions—such as phasing out single trigger vesting or accelerating a percentage of the equity upon the sale of the company and the remainder upon termination—but few companies are outright removing the acceleration of a certain type of equity grants, such as performance awards. After all, the bulk of executives' compensation comes in the form of equity, including long-term incentives, and CEOs expect to be compensated for the value they delivered to shareholders during their time leading the company.

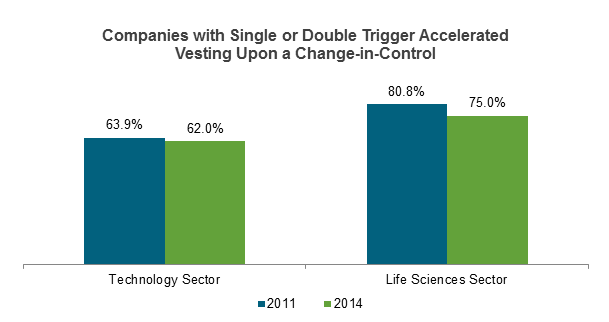

When we compare the results of Radford's Severance & Change-in-Control Practices Surveys in 2011 to our 2014 edition, we see that the percentage of companies accelerating equity (whether single or double trigger) has only decreased marginally in the past three years. The make-up of our survey populations in 2011 and 2014 is different, which accounts for some variation in the data, and further suggests that practices are evolving slowly.

Against the context illustrated in the chart above, companies appear reluctant to step outside of peer practices (so far). This is evidenced by Board of Director responses to recent shareholder proposals. According to most Boards, accelerated vesting allows executives to remain focused on protecting shareholder value and executing a deal objectively—eliminating potential conflicts of interest, notes Dean Foods in a supplemental proxy last year. Nonetheless, shareholder activism in this area has increased. At Dean Foods, despite making the case that accelerated equity improves CEO objectivity and amounts to less than 1% of the company's total market capitalization, 61% of its shareholders approved a non-binding measure that would prohibit the accelerated vesting of any equity award upon a change in control except on a pro rata basis up to the time of the named executive officer's termination.

In this type of activist environment, Boards should take careful note of the clarification ISS recently made to its existing policy on how it evaluates boards' responsiveness to majority-supported shareholder proposals. Beginning in 2013, ISS said it would consider recommending against the reelection of an individual director, committee and/or entire Board on the basis of failure to implement a shareholder proposal that received majority support the prior year. In a clarification of its policy, ISS says it won't issue a blanket withhold vote recommendation and will consider such factors as the board's rationale in its response to the shareholder proposal. For example, if the Board has a reasoned argument for only implementing part of a shareholder proposal, ISS will consider how reasonable and persuasive they believe the Board's argument to be. Nonetheless, corporate boards are expected to respond to majority-supported shareholder proposals— regardless of the ultimate action of the board.

Conclusion

It's not clear just how many companies whose shareholders approve these types of proposals will adopt the non-binding measures. Valero Energy reportedly said it would ban accelerated vesting of its CEO's performance awards following the passage of the related shareholder proposal last year. Gannett said it would consider adoption as well. But each company needs to make their own decision about whether the governance benefits of complying with a proposal backed by a majority of shareholders is worth the potential negative impacts on talent acquisition and retention as well as objectivity during the deal-making process.

As is often said in sports, the best defense is a good offense. We see this same mantra in the corporate governance space. A board's best strategy is to avoid an executive compensation-related proposal so they can continue to run their executive compensation programs in a manner they feel is most effective. To do so, it's important to gauge your investors' approval of your executive compensation policies. One measurement is through the Say-on-Pay vote. A positive by-product of the legislated vote is the annual dialogue we've seen occur between companies and their shareholders. This can, but doesn't have to, involve the Compensation Committee. If your company's legal, human resources or investor relations departments speak with investors about your company's executive compensation program, that feedback should be filtered up to the board so that no one is caught off guard when a shareholder proposal is filed.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles