China's economic slowdown hasn’t dampened growth of its technology sector— salary increases and voluntary turnover are high, while hiring remains strong.

China's economy has been slowing down in recent years, with gross domestic product (GDP) growth expected to fall below 7% this year. While that’s a big drop from the double-digit growth recorded from 2003 to 2007, and again in 2010, it’s still an enviable number for most countries. It also represents a deliberate "new normal" in China as the country rebalances its economy towards a more sustainable model of domestic consumption and away from a reliance on exports and foreign investment.

These changes impact some industries, such as manufacturing and real estate, more negatively than others. The technology sector, however, is in a strong growth mode and more competitive than ever as reflected in the Radford Workforce Trends Report - Q3 2015 edition. The report shows that 60% of technology companies anticipate normal hiring in China in the next 12 months, and another 11% plan for aggressive hiring. This translates to significant growth expectations in the size of the workforce with 23% of companies expecting to expand their workforce by up to 15% and another 5% are planning for more than 15% expansion.

Multinational companies are increasingly competing with a larger domestic field of businesses for customers and talent as they expand their digital services and products into China. This is not surprising given the strong growth in hiring expectations in the Internet/e-commerce and software sectors shown in the Radford Workforce Trends Report.

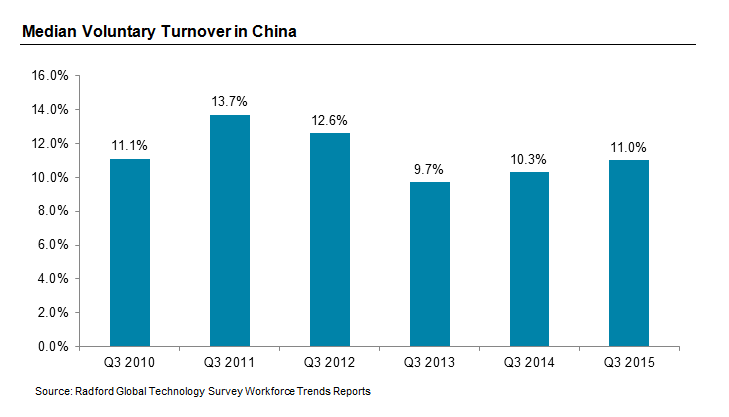

When companies are aggressively hiring, employee turnover tends to rise. Voluntary turnover remains high in China: 11% in the median and 17% at the upper end (75th percentile) for a 12-month trailing period. We find voluntary turnover above 10% can become particularly concerning for companies.

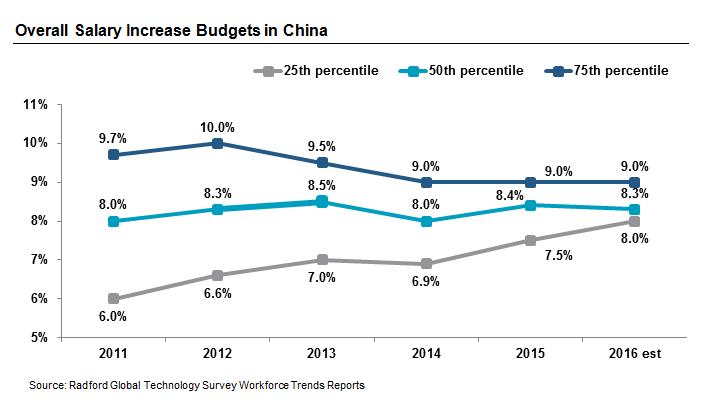

In light of all these factors, it is not surprising to see overall salary increase budgets continuing in the 8% to 9% range as they have over the last 5 years, with a median of 8.3% forecast for 2016.

As in the US, there is high demand in China for employees with particular skills, including software engineers and experienced managers that can work effectively in increasingly large, complex and global organizations, as well as those that possess the skills to thrive in the increasingly entrepreneurial start-up environment.

Next Steps

Overall economic growth in China is gearing down to a more sustainable level, but prospects for the technology sector are very promising. Disposable income for ordinary Chinese citizens is still increasing— representing an important consumer base for many technology firms, and in particular Internet/e-commerce companies catering to a more mobile, social and consumer-oriented society. China, by virtue of its large population and emphasis on higher education, produces more college graduates than most countries each year and thus is a global resource for job candidates with hot skill sets. Multi-national companies are competing with one another and with the growing number and caliber of domestic companies, to enter or expand their presence in China. Looking into the near- to mid-term future, we would expect to see overall salary increase budgets remain in the 8% range where they have been for the past five years and for voluntary turnover rates to stay above 10% overall, and well above that for key skill sets and highly qualified employees. Given this environment, companies need to not only manage their salary budgets by recognizing and rewarding the most productive employees, but do so within the context of a balanced and attractive total rewards package. They also need to ensure promising younger employees are developing in their career as the business grows.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.