Introduction

The prevalence of mandatory post-vest holding requirements embedded in equity awards continues to increase with each passing year, as companies pursue strategies to strengthen the corporate governance aspects of their equity compensation programs. However, an additional, and often overlooked, benefit of post-vest holding requirements is that companies are allowed to apply a discount for illiquidity when determining the amount of compensation expense to be recognized for a share of restricted stock or a restricted stock unit ("RSU") when the underlying share is subject to a prohibition on sale for a period of time after vest. In simple terms, companies can achieve significant cost savings if they design holding requirements to align with accounting standards and disclose their practices appropriately.

Yet, in our experience, disclosures related to discounts for illiquidity generally lack the rigor that one might expect under applicable accounting rules. Too often, the information provided by companies does not go far enough to provide either the “significant assumptions” or the “method” used for estimating discounts. In this article, we provide a summary of Accounting Standard Codification Topic 718's ("ASC 718") disclosure requirements related to illiquidity discounts, as well as our opinion on “best practices” to pursue at your organization.

Key Disclosure Requirements for Equity Awards under ASC 718

Taking a quick step back to set the stage for this article, we'd like to begin by reviewing the fundamental disclosure requirements for equity-based compensation under ASC 718. The most detailed disclosure requirements relating to equity awards are found in a company's annual 10-K. Pursuant to rule ASC 718-10-55-2, the minimum disclosures required for an award of equity-based compensation are as follows:

For each year for which an income statement is presented, both of the following (An entity that uses the intrinsic value method pursuant to paragraphs 718-10-30-21 through 30-22 is not required to disclose the following information for awards accounted for under that method):

- A description of the method used during the year to estimate the fair value (or calculated value) of awards under share-based payment arrangements

- A description of the significant assumptions used during the year to estimate the fair value (or calculated value) of share-based compensation awards, including (if applicable):

a. Expected term

b. Expected volatility

c. Expected dividends

d. Risk-free rate(s)

e. Discount for post-vesting restrictions and the method for estimating it.

As you may have noticed above, even the most basic disclosure requirements for equity-based compensation contemplate the potential for post-vest selling restrictions. As a result, ASC 718 explicitly requires the disclosure of both the methods used to estimate an illiquidity discount and all of the assumptions used in the analysis. Issuers are increasingly rigorous in their disclosure of the assumptions and methods used to value option awards and performance-based equity grants, and have similar room for growth when it comes to the illiquidity discounts created by mandatory post-vest holding requirements.

SEC Guidance for Estimating Illiquidity Discounts

It's not easy to quantify the impact of an illiquidity discount; there are a number of variables at play, and as a result, discounts must be estimated. Over the years, a number of studies were conducted to measure real-world illiquidity discounts using empirical data. These studies typically focus on examining the difference in price between unregistered shares of a publicly traded company issued in a private transaction (i.e., Rule 144 stock) vs. identical unrestricted shares of the same company trading on a national stock exchange. However, studies of this nature have limitations. To start, they rely on sample data that may not always be relevant to the specifics of your company. Furthermore, Rule 144 transactions typically have selling restrictions of six months to one year in length, which is often shorter that the holding periods companies put in place for equity awards.

The Securities and Exchange Commission (SEC) is aware of these limitations, and has provided companies with guidance to that effect. According to the SEC:

"[It is] not enough to simply cite the average marketability discount used by your investment banker or to highlight that the amount of the discount used falls within a broad range you noted in an academic study. As a starting point in evaluating these discounts, we try to understand the duration of the restrictions and the volatility of the underlying stock. Generally, the longer the duration and the higher the volatility, the higher the discount."

To conform to with SEC’s guidance cited above, most valuation practitioners now use theoretical option pricing-based models to estimate illiquidity discounts. Multiple mathematical models are available for use, the most prominent of which are the Chaffe and Finnerty models. Both approaches consider the specific duration of the restriction period created by a mandatory post-vest holding requirement and the volatility of the underlying stock when estimating potential illiquidity discounts.

For more information on these models, and how the illiquidity discounts are estimated, please refer to our article: Maximizing Your Investment in Equity Compensation with Holding Requirements.

Key Disclosure Requirements for Illiquidity Discounts under ASC 718

Given the fact that illiquidity discounts are almost always estimated using an option pricing model, we believe the disclosures necessary to satisfy the requirements of ASC 718-10-55-2 are analogous to the disclosure requirements related to employee stock options. The disclosure should identify the model or models used to develop the illiquidity discount, as well as the assumptions used with the model. Taking these items into account, we believe the disclosure sample provided below satisfies the requirements of ASC 718-10-55-2:

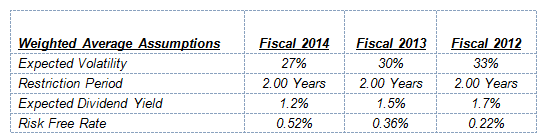

The Company periodically grants time vested RSUs. The RSUs vest over a period of three years following the date of grant. The shares of Company stock underlying the RSUs will be distributed on the second anniversary of the vest date. During the period between the vest date and the distribution date the employee may not sell or otherwise dispose of the shares. The Company has applied a discount for illiquidity to the price of the Company’s stock when determining the amount of compensation expense to be recorded for the RSUs. The discount for illiquidity for each RSU is estimated on the date of grant using the Chaffe model and the Finnerty model, and the assumptions noted in the following table. Based on the relative strengths of each model, a 60% relative weighting was applied to the discount developed with the Chaffe model and a 40% relative weighting was applied to the discount developed with the Finnerty model. Expected volatilities are based on implied volatilities from traded options on the Company’s stock. The expected dividend yield assumptions are based on the dividend yield on the Company’s stock as of the date of grant. The risk-free rates are based on the U.S. Treasury yield curve in effect at the time of grant. The weighted-average grant-date grant illiquidity discount during the years 2014, 2013, and 2012 was 12.4%, 13.7%, and 15.1%, respectively. The weighted average grant date fair value of RSUs granted during 2014, 2013 and 2012 was $82.06, $64.55, and $56.53, respectively, after the application of the illiquidity discount.

In our view, this disclosure example cited above aligns with the intent of ASC 718-10-55-2 because it specifically calls out the size of the illiquidity discount, the models used to estimate the illiquidity discount, and the assumptions used in the analysis. Unfortunately, examples of this quality are far and few between, suggesting that issuers have ample room for improvement.

Conclusion

We anticipate that continued pressure from institutional investors and proxy advisory firms on corporate governance issues, coupled with the financial accounting benefits of illiquidity discounts will contribute to increased adoption of mandatory post-vest holding requirements over the next three to five years. However, as the popularity of this practice accelerates, so too will scrutiny from auditors and regulators. When it comes to realizing the benefits of illiquidity discounts, companies will need to be more rigorous in the valuation techniques, assumption development and disclosure practices. To that end, we council companies considering mandatory post-vest holding requirements to carefully review the disclosure example cited above as a best practice model, and to review their valuation approach.

To learn more about the full set of governance and accounting benefits associated with mandatory post-vest holding requirements, please visit holdaftervest.com.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles