Saudi Arabia has announced a string of measures to cut its dependence on oil exports.

Saudi Arabia has announced a string of measures to cut its dependence on oil exports.

These reforms, economic and social, are intended to catapult the share of non-oil revenues and emphasize the country's position as an economic powerhouse. As these reforms unfold, what are the opportunities for financial institutions conducting business in the Kingdom and how should they prepare to leverage them?

Overview

The past few months have presented unpredictable consequences for oil exporting countries - the price of oil has nosedived by over 70% compared with June 2014 levels. The extent of the impact has been as unrelenting as the pace of the fall in the prices. These are troubling times for Saudi Arabia as the country faces an economic crisis of sorts - from its peak in 2014, Saudi reserves are estimated to have depleted by a whopping $150 billion. In 2015 alone, the Kingdom consumed $115 billion in reserves, when the crude oil prices averaged under $50 per barrel.

In response the Saudi government has unveiled a slew of socio-economic reforms. While on the one hand, the reforms aim to curtail the subsidy driven munificence, on the other, they seek to enhance the economic output. The country is considering the public listing of some of its 'crown jewels', including a 5% stake in the state-owned Saudi Aramco (through either the holding company or its downstream assets). The Saudi equity market is currently too small to absorb the mammoth value of the estimated IPO. Therefore, it is expected that a number of large valued companies will be offered prior to the Aramco listing. There are talks of similar IPOs for Saudi Airlines, the Saudi stock exchange (Tadawul) and affiliates of petrochemical major SABIC. There are also talks of possible privatization of hospitals and other public services in the country. The country's sovereign wealth fund, The Public Investment Fund (PIF), would be expanded to manage over $2 trillion in assets.

The country opened its stock exchange to foreign investors last year. However, the response has been fairly muted, due to tight restrictions around ownership limits. Some of these restrictions and requirements are either being scrapped or diluted. By the end of 2015, it was reported that only nine foreign institutions had applied for licenses to invest directly in the country. However, this number may rise significantly in the near future with the spate of reforms and the ease in the regulatory framework.

The Kingdom is also in the process of raising debt overseas. This, along with similar issuances from state-owned entities and other domestic debt issuances, may signal the emergence of Riyadh as an important regional bond market. It may compete directly with Abu Dhabi and Doha in this regard, and may start attracting more business regionally.

Key businesses impacted

All these changes herald big business potential for the local as well as the international financial entities operating in Saudi. Virtually all businesses from corporate banking to private equity will be impacted; however, we believe certain segments like project finance, investment banking advisory, debt / equity capital markets, equity research, and shares brokerage will more directly see big opportunities in the near future. There are direct implications for these businesses around organizational design, talent management, and reward management.

Organizational design

Since the financial crisis, most international banks have downsized their businesses in the broader GCC market (especially Dubai). Most of what remains for the bulge bracket investment banks is their Wealth Management businesses.

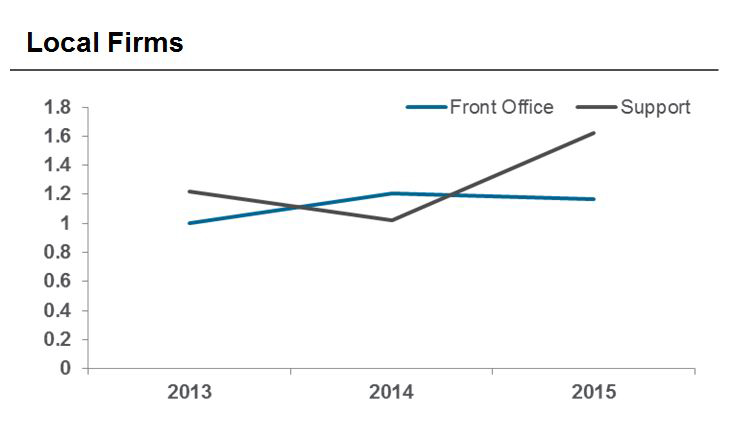

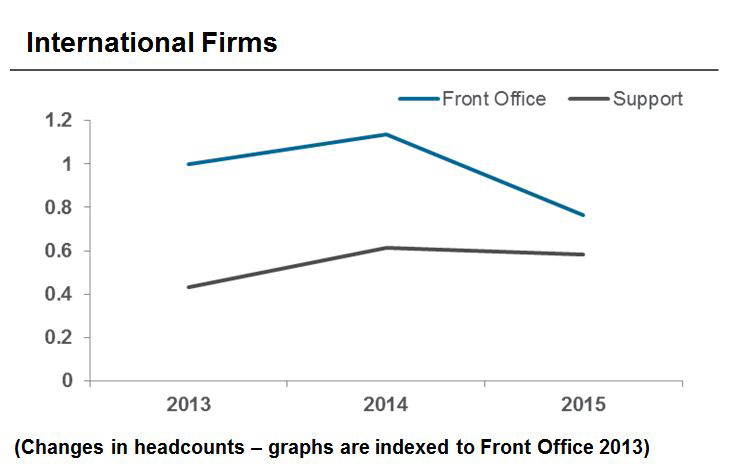

Over the last few years, the international firms based in Saudi have redeployed their resources - particularly for front-office functions. The local firms in contrast, have seen a marginal increase on front office and a substantial increase on the support function headcounts.

As seen from the graphs above, the international firms also tend to maintain a more favorable headcount ratio between front office and support - this ratio however, is seen to be narrowing down. The growth on the support function headcount has been mainly led by functions such as Compliance, Information Technology, and Risk.

As firms ramp-up their activity in the country, we could be seeing more international firms transfer staff from regional hubs (particularly Dubai) into the Kingdom. Whilst some of these transfers might be temporary or project-based, we also anticipate some permanent staff transfers into Saudi.

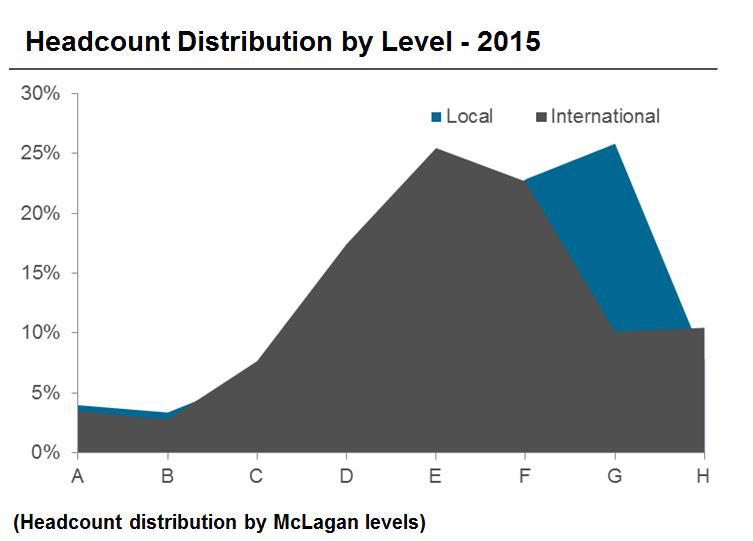

International firms have been seen to operate at relatively similar spans of control compared to the local firms. The chart below shows the relative split of headcount at various McLagan levels for international and local firms operating in the Kingdom. The international firms are seen to be slightly flatter at the lower levels, indicating marginal potential efficiency gains by increasing staffing at lower levels.

Talent management

International firms have traditionally relied on expatriate hires from international markets when quick staffing up is required in new and emerging markets. This is especially true for roles at the mid to senior levels across the front office functions. Such an approach had allowed these institutions to leverage the extensive cross-geography experience and focus on the bits that are relevant to emerging markets. In this approach, the international firms have typically not competed with the local firms for talent. In fact, talent hopping from one firm to the other within the market has also been relatively uncommon.

Whilst the proposed changes to the economic landscape in Saudi Arabia provided unprecedented opportunities for financial institutions, they will need to reinvent the way they recruit, motivate, and retain talent. Given these reforms and the nature of clientele (government and quasi-government entities) driving the change, it will be imperative that firms be ready to present a 'local face'.

We expect that with the significant opportunities, international financial service firms will be required to staff up locally, and most likely in the KSA. As a comparison, Strategy Consultants in the Gulf have seen a significant increase in their business and staffing levels at some firms exceeds 1,000 professional staff.

It will thus be important for firms to hire qualified local talent and not just for the junior roles. This will be a strong factor driving the upcoming war for local talent - the international firms will not only compete amongst themselves but will also compete with the local firms, including the capital markets arms of local banks. Given the relative scarcity of qualified local talent, particularly at the senior levels, firms should consider the value of creating succession plans and talent pools. For the long-term, the talent management focus should shift towards hiring suitable local talent at the junior levels and helping them manage their careers in the firm for the long haul. This approach is more likely to yield rich dividends than the expat frenzy hiring that international firms often display.

The Saudi economic reforms also target an increase in the female participation in the workforce from under 20% to 30% - financial firms should also consider tapping this important talent cohort.

Reward management

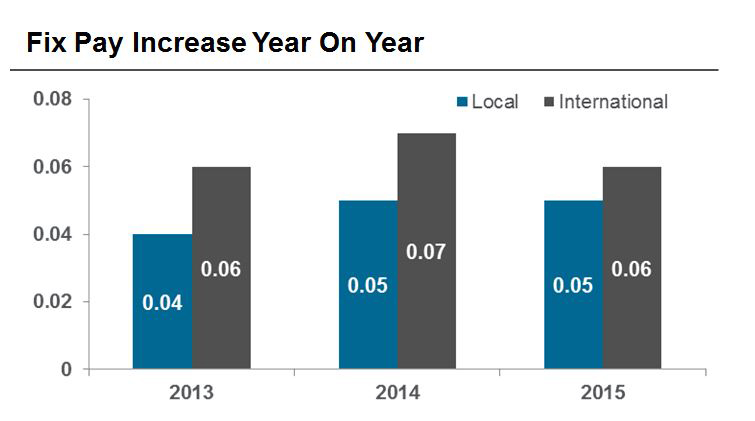

Most firms operating in the Kingdom have offered consistent pay increases to staff over the last two years. The percentage increases have been higher for the international firms indicating an increased propensity to pay for talent.

Most of the international players have been present in the Kingdom for over a decade. In the initial years, the firms focused on ensuring that the compensation packages reflected a substantial portion of expatriate focused 'perquisites' such as housing, club, and transport. Whilst the structures have been more rationalized in the last few years, firms should consider the impact of hiring more local talent in the coming years.

Expatriate compensation, in general, assumes a different meaning across the Middle East. With a substantial portion of the working population being of a foreign origin, international firms often don't differentiate them from expatriate hires into other countries. However, whilst such hires into other financial hubs like Singapore, London, and Hong Kong are more short-term in nature, the expat recruitment is often made through open-ended contracts in the Middle East. It is thus not uncommon for expats to be spending several years (or decades) of their working life in the region. Firms should consider migrating from a true expat pay structure to one that balances the needs of long-term expat hires as well as the local hires.

Allowances and benefits are key reward tools for attracting and retaining talent. In this region, particularly in the Kingdom, they serve as useful levers for firms to attract talent from international markets - they play a particularly important role around bridging reward gaps on pensions and social security. Most of the international firms in the GCC offer one or more allowances with a significant proportion going towards housing and living costs. Most of them use allowance grids, therefore they offer fixed quantum linked to the Corporate Title. International firms in GCC communicate allowances to employees as a percentage of base salary or fixed pay. Local banks communicate allowances as multiples of base salary. Common market practice is to offer five to six months base salary that equates to total as allowances.

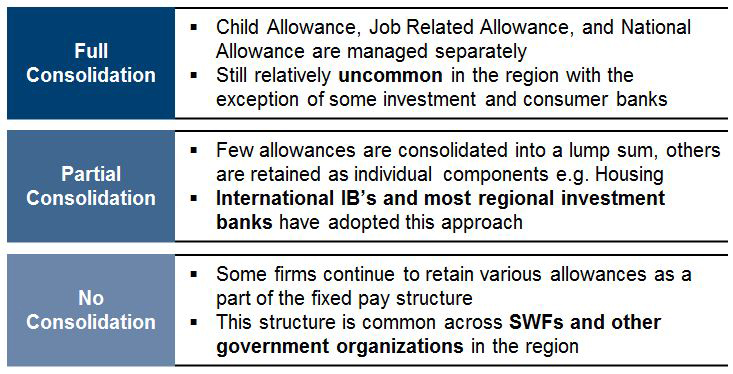

There is also an increasing trend towards the consolidation of allowance and benefit structures. Whilst one size does not fit all, firms could consider a range of alternatives towards achieving this:

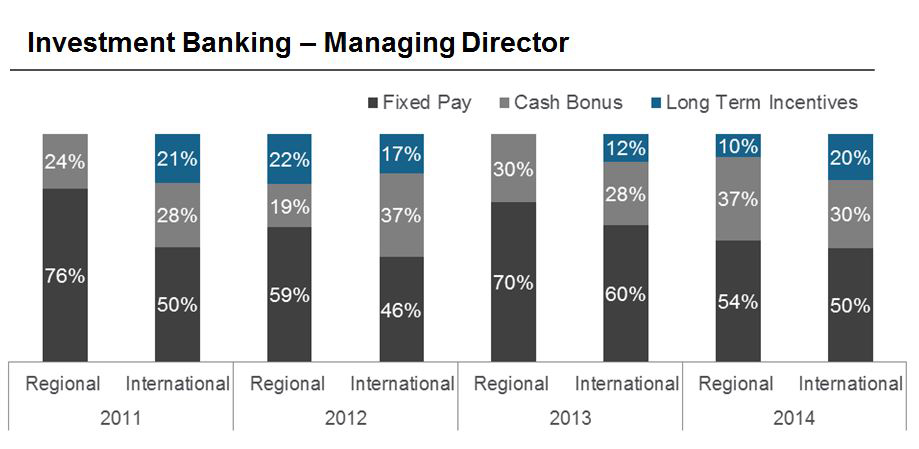

The international firms follow reward strategies that are unique to their business models in addition to being aligned internationally. When compared to the regional firms, the international ones offer higher compensation and reward structures that are more leveraged. Whilst the pay differentials have historically helped the international firms attract talent from the local firms, the local firms are fast catching up and many large local firms pay at comparable and in some cases, higher levels.

Local firms should and we expect will offer stock and stock options, which may prove to be very attractive in a booming market. Also, regional firms are not subject to many regulations around compensation structures or levels as their international competitors.

Firms must also consider the impact of their reward strategy on a diverse workforce often consisting of Saudi nationals, locally hired expatriates, internationally hired expatriates, and employees on secondment.

In conclusion

Competition amongst financial institutions is ultimately a competition for talent. As firms look to leverage the big potential in and from Saudi Arabia, they should carefully consider their approach on headcounts, organizational structures, talent management, recruitment, and compensation along with the interplay between these.

Firms should align these elements around their overall business strategy in order to ensure that they are ready and able to compete at the right levels for business in the Kingdom.

To read Part II of this article, please click here.

Related Articles