The governance landscape has changed considerably since the last wave of underwater stock option exchanges. Here's how to determine if an exchange is right for you in today's world.

Initiating an underwater stock option exchange program might sound reminiscent of the Great Recession of 2008-09, but with stock market volatility surging, it's a concept that many of our clients are once again considering. We've already noticed a modest increase in the number of companies filing for an option exchange, and many more discussions are already underway. Depending on what the market does next, we could soon witness the next big wave of underwater option exchange programs. However, before jumping to the conclusion that an option exchange makes sense for your company, there are a number of significant issues to consider.

First, you should evaluate if an exchange program is a good fit for your company culture relative to other remediation options, including special retention grants of restricted stock or targeted cash awards for key employees. What would each of these approaches communicate to your staff about the future of your company, and what would be the resulting impact on morale? Next, you should consider the potential costs of an exchange program, both in terms of monetary expense and the impact on your legal, finance and human resources teams— exchange programs take time to create, implement and communicate. And finally, you should analyze the voting policies of your institutional investor base and the proxy advisory firms they subscribe to. Are the cards stacked against you from the onset, or do you enjoy a more forgiving investor environment?

In either case, whether your investors appear dead set against option exchanges, or display a willingness to consider exchange programs, understanding the evolving governance landscape is critical. A lot has changed since 2008, and to succeed today, you'll need an effective communications plan to convey your business case and prove that you are a good candidate for an exchange. (For additional insights on approaches pre-IPO firms can take to address underwater stock options and employee retention, please see our related article here.)

Are You a Good Candidate for an Exchange?

We believe there are only a small number of companies that fit the necessary criteria to be considered ideal candidates for exchange programs. To help you better assess these criteria, the list below highlights the key issues we council clients to explore before taking any action:

- Overhang, Burn Rate, and Available Shares: If you are thinking of replacing underwater options with new awards, your issued overhang will decrease. If you're thinking of granting additional stock awards, your issued overhang will increase. Either way, it's important to first evaluate your current overhang and burn rate. If issued overhang is already considered high based on shareholder and proxy advisor standards, as well as the limitations of your equity plan, then it will limit your alternatives to an exchange program. On the flip side, an exchange is a great way to reduce issued overhang, and the replacement awards do not count toward ISS' burn rate calculation when the program is shareholder approved.

- Percent of Overhang Underwater: How much of your total overhang is underwater? While there is no bright line for this test, as a rule of thumb, if at least half of all outstanding stock options are underwater, then an exchange is worth exploring. However, this line is often considered a minimum threshold, and firms often have much higher levels of underwater options in order to be viewed as viable candidates.

- Underwater "Depth" of Options: A company is not a good candidate for an exchange if most of their underwater options are within striking distance of being in the money. For example, if the majority of your underwater options have strike prices within 30% of where the current stock price is trading, or if the options are only recently underwater (e.g., in the past 12 months), the company is not a good candidate.

- Shareholder Concerns: Assess your shareholder base, including the percentage of shares held by your institutional investors, and determine the extent to which they tend to follow proxy advisory firm recommendations. Proxy advisors have specific voting policies on stock option exchange programs, which we will discuss in the following section.

- Business Case: While competitive pressure for talent may not be sufficient reason alone to offer an exchange it can be a huge piece of the overall rationale. Investors recognize that it is important for companies to put themselves in a strong position while executing a turnaround, and retaining top talent is an integral part of that. Communicating a compelling business case to your investors is equally important.

- Company Performance Outlook: As we mentioned earlier, companies need to examine the likelihood that their stock price might rebound in the next 12 to 24 months based on specific micro- and macro-economic circumstances. This process should involve developing a set of scenarios whereby underwater options would become in-the-money. Then management and the board should assess the likelihood of any of these scenarios playing out over the next one to two years, while keeping in mind it can take up to a year to successfully implement an option exchange program. Our technology and life sciences clients should think about any significant business events in the next year or two that could alter their stock, such as FDA approval for a new drug, achieving commercial status, or a new product launch. At the same time, engaging your workforce while executing on these major milestones may require retentive measures to address current underwater options now rather than waiting for the stock price to rebound.

- Cost of Executing an Exchange: If a company satisfies all of the above criteria, one final consideration before launching into an underwater exchange is the potential value created for eligible employees vs. the costs of executing an exchange program. These costs include internal resources and external advisors. For our small- to mid-sized clients, the average cost of an exchange program usually ranges from $50,000 to $100,000.

And lastly, at a more fundamental level, the decision to launch an exchange also comes down to whether or not you believe the market has reached its floor and your company's stock price will trend upward from that point onward. This further shrinks the list of willing firms at any given time.

Governance Considerations

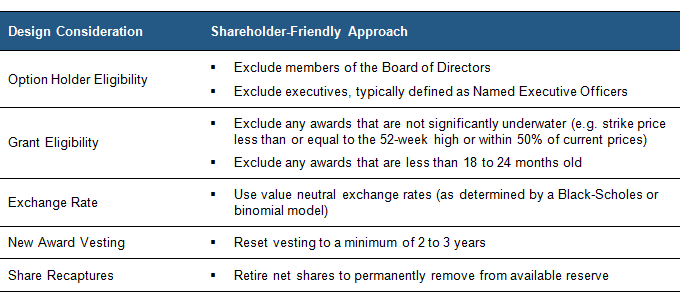

Shareholder and proxy advisory feedback on exchanging underwater stock options was not a significant concern until 2003, when the stock exchanges implemented rules requiring shareholder approval of such plans. Most investors and advisors are reluctant to approve exchange programs because it can appear unfair to other stakeholders to “move the performance goals” (i.e., strike price) implied when options are originally granted. Nevertheless, there are a number of key design provisions that should be included in any option exchange program to improve the chances of shareholder approval. These design factors are listed in the table below:

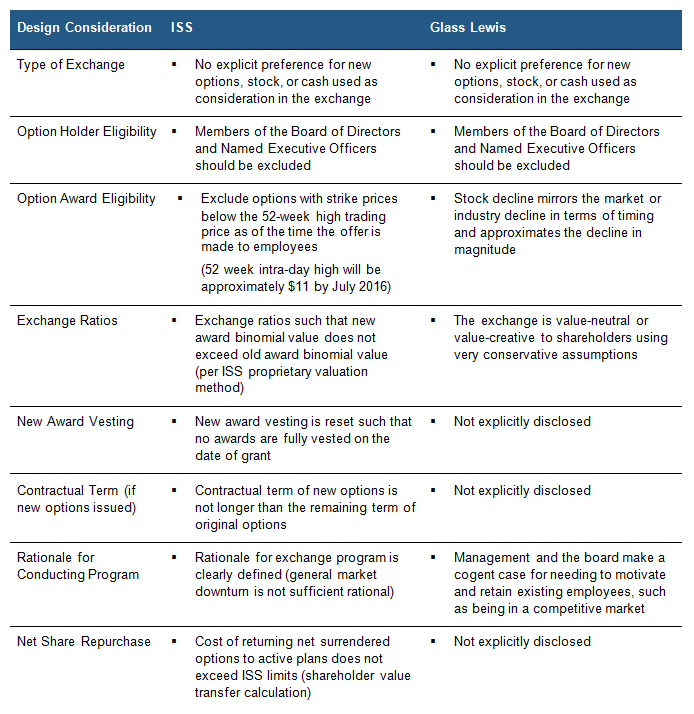

The chart below summarizes Institutional Shareholder Services' (ISS) and Glass Lewis' policy positons on key issues regarding option exchanges. Generally, the two firms are in agreement on many issues, such as excluding board members and senior management. Overall, ISS has provided more detail on what it desires in an exchange program, such as the eligibility for options based on stock price and the vesting, terms and exchange ratios used.

Next Steps

The decision to undertake an underwater option exchange should not be taken lightly. However, if a company goes through the checklists provided above and determines it makes sense to move forward, then designing an exchange that is highly mindful of investor and proxy advisory polices will be key in winning shareholder support. The cost of the program, including the time and resources required to execute an exchange, might be well worth the outcome of keeping your employees engaged. However, it's important to explore all of your alternatives as well as conducting a cost vs. benefit analysis of an exchange before taking action.

If you believe your company may be a candidate for an option exchange program, or if you would like to explore all of your alternatives, please contact us at consulting@radford.com. For more information about our underwater stock option services, please visit our website: radford.com/home/portal/.

Related Articles