ISS addresses hot topics in its new policy survey, such as gender diversity, using options in board pay and how to interpret pay ratios. Some of the questions could form policy changes.

The influential proxy advisory firm Institutional Shareholder Services (ISS) released its annual Global Policy Survey last month, which is the firm’s first step in making policy changes for the 2018 proxy season. The survey suggests many issues important to Radford clients are front and center for ISS. These include one share/one vote, use of options as a meaningful component of director compensation, how CEO pay ratios should be used by investors, gender diversity on boards and gender pay gaps among employees.

Some questions in ISS’ annual surveys form the basis of final policy changes for the upcoming proxy season, while other questions don’t go anywhere, and still others eventually become policy changes in future years (particularly if the issue is still very nascent in the governance community).

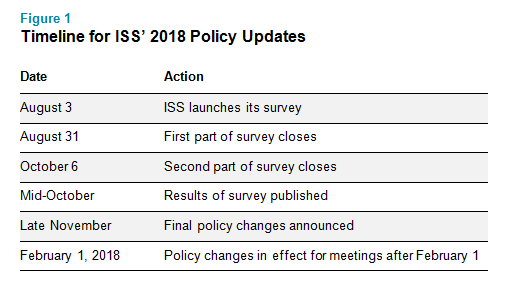

The survey results provide an indication of the views of investors and companies (with policy changes typically being driven by investor preferences over company preferences). ISS generally uses these results to inform its draft policy updates, which it will publish for comment. Figure 1 shows the timeline of ISS’ 2018 policy process.

ISS broke the survey into two parts for the first time. The first part is more philosophical, and seeks views on broader governance principles that have received attention lately. The second part is similar to detailed surveys of prior years, and seeks input on specific aspects of policy application. ISS will also be conducting roundtables and conference calls to collect input.

Below is a summary of the questions in ISS’ two-part survey that impact companies listed in the United States.

Part 1: Governance Principles Survey

Board Gender Diversity

Markets outside of the United States (US) have increased their attention on board gender diversity by requiring more disclosure, making best practice recommendations or mandating outright quota requirements (read our article UK Gender Pay Reporting Law Provides an Opportunity to Strengthen Rewards Programs for more details). There is also a growing belief within the US that gender diversity is important and can lead to better corporate performance. ISS asks whether it is a problem for a company to have no female directors, and what shareholder actions might be appropriate in response.

CEO Pay Ratios

CEO pay ratios will be in effect for the 2018 proxy season, barring any regulatory or legislative action. Such ratios and related disclosures are being proposed in the UK and Europe. ISS inquires as to how investors and issuers intend to use pay ratio data. (For more information about calculating and disclosing pay ratios, please see our latest article The CEO Pay Ratio Deadline is Looming; Here’s How Companies Should Prepare.)

Virtual or Hybrid Annual Meetings

Companies in the US, the UK, and some other markets, may conduct their annual meetings online using streaming video and audio technology. Many companies also conduct “hybrid” meetings, which is a physical meeting in tandem with a virtual meeting. Virtual-only meetings can represent a tradeoff between increased participation with lower cost, and reduced opportunity for face to face exchanges. ISS is soliciting views on virtual and hybrid annual meetings.

Cross Market Share Issuance and Buyback Proposals

There are differing requirements on share issuance and buybacks for US-listed companies and companies in European markets. ISS is asking for input on how to treat share issuance or buyback proposals for companies that are domiciled in one market but listed in another.

Part 2: Policy Application Survey

The second part of the survey seeks input across five familiar topic areas: board issues, compensation, environmental and social issues, capital-related issues and takeover defenses. The questions applicable to US and Canadian companies address the following topics:

Realized and Realizable Pay

The increased investor focus toward pay-for-performance has made performance-based compensation more common. Under SEC rules, the amounts shown in the Summary Compensation Table for grants of performance-based vehicles represent the accounting value and not what the executive officer actually receives. To illustrate the alignment between pay and performance, many companies include a graphic of the amount of pay actually realized or realizable. ISS is seeking input on whether and how to incorporate realizable pay in its quantitative methodology, either as a possible mitigating factor against pay-for-performance misalignment or excessive pay quantum, or to exacerbate concerns regarding excessive leverage in a pay program.

Non-Executive Director Pay Quantum and Structures

Pay levels for non-executive directors have risen in recent years, and director pay has been the focus of recent lawsuits alleging that the total amounts are excessive. ISS runs a quantitative screen as part of its QualityScore ratings to identify director pay outliers and then conducts a follow-up qualitative analysis. ISS seeks feedback on what factors should be considered in evaluating director pay magnitude and program structure, and what to do about perennial outliers. ISS asks whether the magnitude of director pay should be assessed against all companies, relevant stock market indices or 4-digit GICS peers or some other benchmark. They also question whether certain pay vehicles are problematic, including stock options— presenting a potential problem for companies that use options as a meaningful component of director pay. Many investors are wary of independent directors being paid in options (or performance shares, for that matter), claiming they can’t both mind the store on executives’ incentives and benefit from that performance.

Gender Pay Gap

The difference between the median earnings of males and females in a company has been the focus of shareholder proposals in the past two years. These proposals have asked companies to disclose policies and goals for reducing this gender pay gap. ISS is seeking input on whether companies should disclose such gender pay gap information, and if so, under what circumstances.

Short-Term Poison Pills

When a company adopts a short-term poison pill without a shareholder vote, current ISS policy evaluates such a situation on a case-by-case basis. ISS asks for feedback on whether a case-by-case approach is appropriate.

*****

We will continue to update our clients on these issues and the outcome of this survey to ensure that they are aware of how their governance and pay programs are likely to be viewed by external constituencies.

If you have any questions about these issues and want to speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles