Increasingly firms must be tuned in to the changing needs of clients. During his 2009 TED talk, Marketer Richard St. Curtis argued that we must stop discussing success as though it is a one-way street. Too often, he explained, we focus on everything that will lead us to success and, when ‘we figure we’ve made it, we sit back in our comfort zone’ and stop trying.

His criticism could easily be levelled at the general discourse about what it takes to be a great wealth advisor. In the many years we have been monitoring and analyzing this sector, the debate has hardly moved; the heart of the proposition is widely considered to be the personal relationship with most firms professing to be more customer-centric than their competitors.

If there is a secret for success for wealth professionals, then the common denominator – as St. Curtis argues – is agility. This does not simply mean being adaptable to clients who have differing concerns and objectives (although this is important). It means cultivating proven expertise to manage increasingly complex contexts for wealth preservation and creation.

Our latest research in conjunction with CFA Institute, which incorporates the views of 1,370 wealth advisors and 4,000 wealthy individuals, indicates that many wealth practitioners are unprepared for the changes which lie ahead.

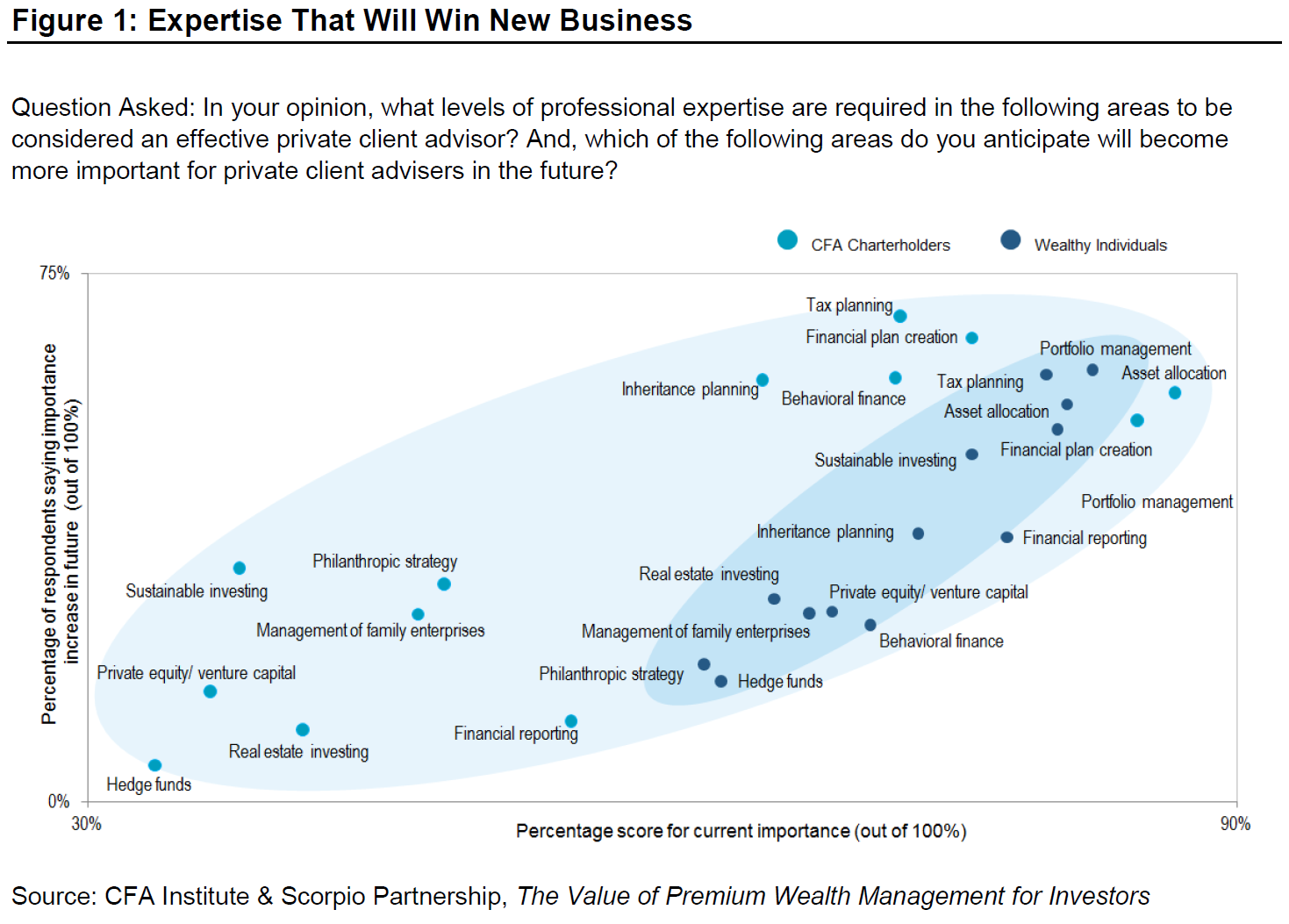

For example, the insight demonstrates that advisors believe that portfolio management, asset allocation and financial planning are the core territories in which professional levels of expertise are required. But while clients validate the importance of these areas, they also reference a broader range of enhanced expertise. Premium grade advisors need to have expert knowledge of sustainable investing, tax planning and philanthropy too.

Alongside the development of their IQ, wealth advisors must also cultivate their EQ. The differential for the advisor of the future is evidencing the emotional quotient by investing in a solid grounding in behavioral finance. This goes beyond relationship-building to navigating the behavioral impulses and cognitive biases that lead clients to deviate from their wealth strategy.

Enhanced expertise is so important to clients that they are increasingly looking for evidence of their advisor’s capability. Over 60% of wealthy individuals state that an advisor’s professional credentials are a key determinant of whether their wealth management firm is a responsible organization. This is more than those who look for transparency in the investment process or business performance.

In the future, designations are set to become even more significant, with 90% of millennial HNWs stating that the importance they ascribe to their advisor’s qualifications will become more important.

Successful, agile wealth advisors are also open to the fact that their role in the wider proposition is changing. While more than two-thirds of wealth advisors describe the core value of wealth management as having access to skilled professionals, investors believe that the strength and breadth of the digital offering is the main value-add of working with a wealth management firm.

That is not to say that the advisor is redundant in the process. As we have already seen, their expertise is highly regarded. However, it does show that clients are thinking more about the wider experience of working with a wealth manager.

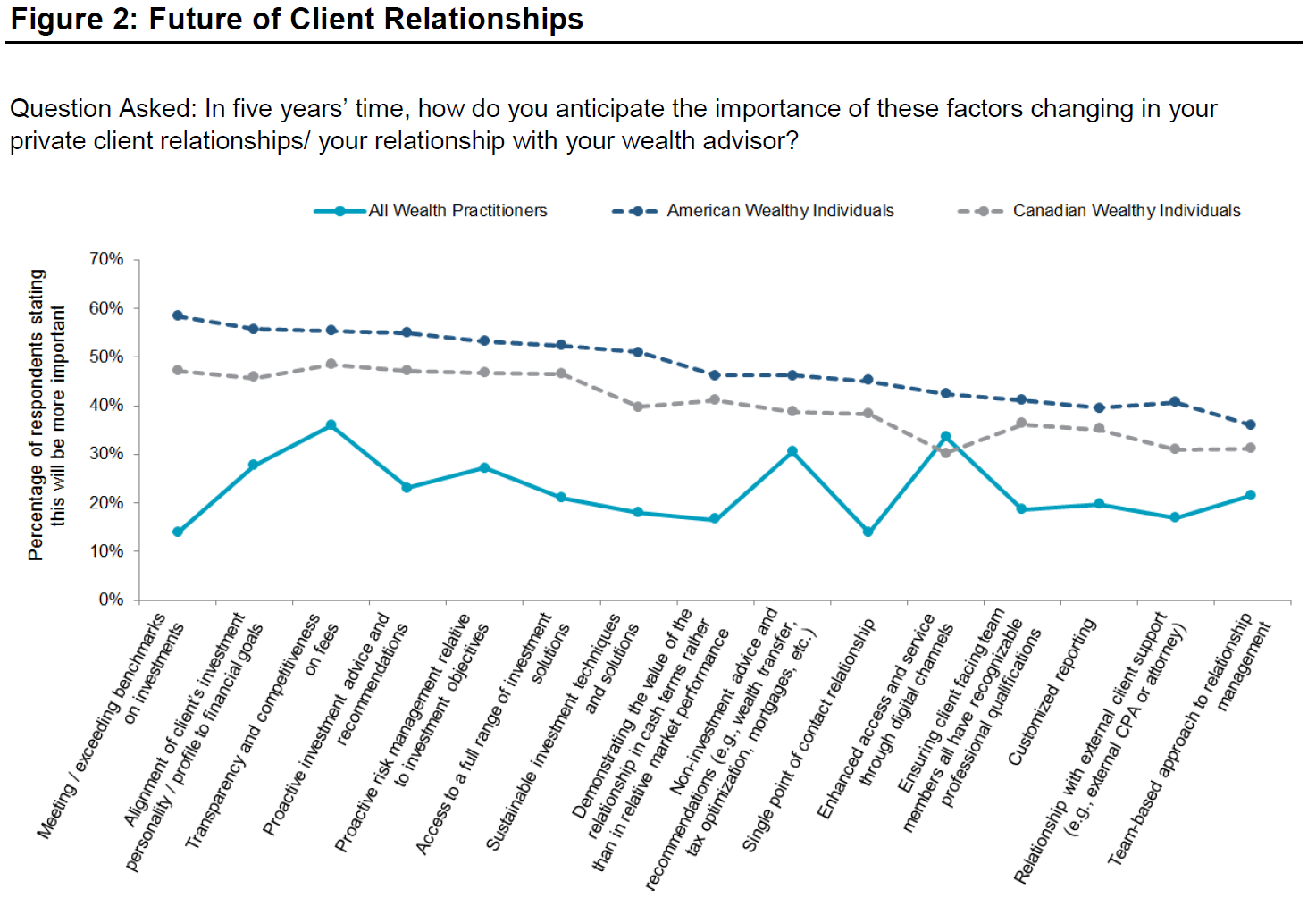

Advisors recognize that a change is coming, but they do not realize the extent to which it will impact on relationships. Wealth practitioners believe that fee transparency, non-investment advice and improving digital channels will be the most important development areas for the future proposition. For the clients they serve, expectations are being raised across every single part of the engagement including enhanced suitability, greater pro-activity in investment advice and delivering sustainable investment solutions.

To ensure that advisors have the flexibility to respond to changing client requirements for the relationship, wealth management business models will need to develop more comprehensive processes for determining whether client outcomes have been met. Currently, a third of advisors surveyed describe that they are incentivized for growing client assets. While this can serve as a good proxy for customer satisfaction, it does not deliver granular insight on proposition strengths and weaknesses.

To determine the most important development areas, businesses should be undertaking regular client insight assessments. By correlating client experience metrics – such as overall satisfaction, net promoter score and client journey score – with asset flow data, firms can develop a framework for improving client engagement. At present, just 15% of advisors surveyed are compensated based on client satisfaction, highlighting that this approach is not as pervasive as it should be.

Firms will need to be more tuned in to the changing needs of clients and empower their advisors to effectively service them. The advisors who excel will be those who continuously seek feedback from clients, are unafraid to adapt to changes in the proposition and who invest in professional education to help clients navigate the increasingly complex task of wealth creation.

Related Articles