In March 2017 the Hong Kong Monetary Authority (HKMA) issued a note to all Authorized Institutions (AIs) in Hong Kong on the need for enhancing standards and practices in respect of governance and risk management and the role that culture reform would play in this process. The note contains practical guidance to AIs on the three pillars of culture – governance, incentive systems, and assessment and feedback mechanisms. It is applicable to AIs incorporated in Hong Kong, as well as firms that have a presence in the city, but are headquartered outside of Hong Kong.

Regulatory authorities in Europe have been discussing the importance of culture for a few years now, becoming more prescriptive since 2015. Closer to home, the Monetary Authority of Singapore (MAS) has stressed the need for the banking industry to reform its culture, particularly where it poses a risk to fair consumer outcomes. The latest draft FSB Supplementary Guidelines issued in June 2017 place significant emphasis on misconduct, framing supervisory expectations that regulators should, within the scope of their authority, monitor and assess the effectiveness of firms’ compensation policies and procedures in managing misconduct risk. Once these guidelines are final, it is expected that all G-20 regulators will proceed to implement them immediately. In fact, some have already taken steps towards doing so.

Summary of the Circular

The guidelines are applicable to all AIs that are locally incorporated. AIs that are incorporated overseas must also implement similar frameworks and mechanisms that are tailored to their circumstances. All AIs must comply with the guidelines within a year of the publication of the circular, i.e., by March 1, 2018.

The circular provides guidance on the following three pillars:

- Governance: Top management in AIs is advised to lead by example and establish a culture that promotes prudent risk taking and fair treatment of customers. AIs are also recommended to have a dedicated board-level committee, chaired by an independent non-executive director, to oversee culture related matters.

- Incentive Systems: Incentive plans and broader HR systems should reward good financial performance and good behavior. Good behavior was defined as actions that safeguard the interests of the customer, as well as the long-term health of the AI.

- Assessment and Feedback Mechanisms: AIs should put in place tools to monitor behaviors of businesses and employees, including policies around escalation and whistleblowing. Results from assessment and feedback mechanisms must be reported to the senior management and the relevant board committee.

The circular has further details on how these guidelines should be implemented and shared with all board directors, in the case of AIs that are locally incorporated, and regional / head offices in charge of governance function for overseas incorporated AI.

Implications for Human Resources

The circular has significant implications for HR for AIs in Hong Kong, as well as the overseas entities of AIs, which are incorporated in Hong Kong. Unlike many of its predecessors, which confined their recommendations to the design and implementation of policies, the creation of new roles, and the setting of appropriate penalties in various circumstances, Als requires guidelines for a reformed culture with provided evidence for doing so.

The circular defines culture as a set of professional and ethical values, which defines attitude and behaviors as pursued and observed by the banks shareholders, board members, and staff. While the HR profession has always struggled to assess and measure intangibles like culture, it must find a way to combat this challenge. The circular directs firms to use formal feedback channels, such as staff surveys and qualitative feedback, to assess and monitor the institutions’ cultures, paying particularly close attention to instrument design to ensure that there is no scope for bias.

Some of the more tangible implications for human resources are listed below. These are by no means exhaustive, but could be used as a starting point for AIs in Hong Kong.

- Performance Management: Since the beginning of this decade, nonfinancial and qualitative performance assessments have been gaining prominence. Many of the largest firms now have documented performance evaluations that include behaviors. These will need to be enhanced to ensure that all elements adhere to the organization’s culture and behavioral standards. Performance expectations will also need to reflect culture and behavioral standards, and clear and appropriate consequences must be established.

- Career Management and Assessment: Assessment on behaviors and non-financial performance indicators have played an important role in promotion and career decisions for quite some time now. These will need to be assessed and possibly modified to ensure that all aspects of culture are captured. Assessment of external candidates against cultural traits is also possible and must be supplemented by thorough background and reference checks. Additionally, firms are encouraged to use skill measurement and psychometric assessment tools for making more robust talent decisions.

- Incentive Pay: Incentive pay programs will require significant modification to ensure that aspects of behavior and culture are included in the mechanism used to calculate payout. In countries like the UK where banking culture reform already exists, formulaic incentives and commissions plans are being phased out and replaced with plans that run on scorecards. The 2016 McLagan UK Retail Banking Market Practices Study found that almost all firms have scorecards / categories of performance criteria. This method bases incentive payouts on multiple factors in addition to individual performance, including employee behaviors / values, customer feedback, and risk. The same study also found that banks have additional recognition programs targeted at rewarding employees who display excellence in terms of customer service, behavior, and / or compliance to the bank’s values.

- Training: Banks will have to invest heavily in defining their culture, designing training programs and delivering it consistently across the firm. Training programs are often used at firms to communicate risk, anti-money laundering, and compliance policies, but may need modification when applied to culture since culture reaches beyond merely understanding and complying with a set of rules. Even more, because there is a clear emphasis on setting the tone from the top firms will need to provide intensive training for top management. Their involvement in culture reform must be more proactive and more visible.

- Communication: Successfully implementing change in culture requires frequent and sustained communication. In addition to reinforcing messages at town halls, team meetings, and orientation programs, some firms have gone even further asking the CEO to publicly state phrases like “every dollar is not equal,” to emphasize the need to assess the risk of revenues earned and its impact on customers and the long-term health and reputation of the brand. Firms will need to pay attention to bottom-up feedback, collecting qualitative and quantitative feedback from employees on various aspects of culture, setting culture goals for aspects of culture that require reform, assessing performance against those goals, and creating additional avenues for ad-hoc feedback that can be used when an employee sees a violation of behavioral norms.

Aon’s Point of View on Culture

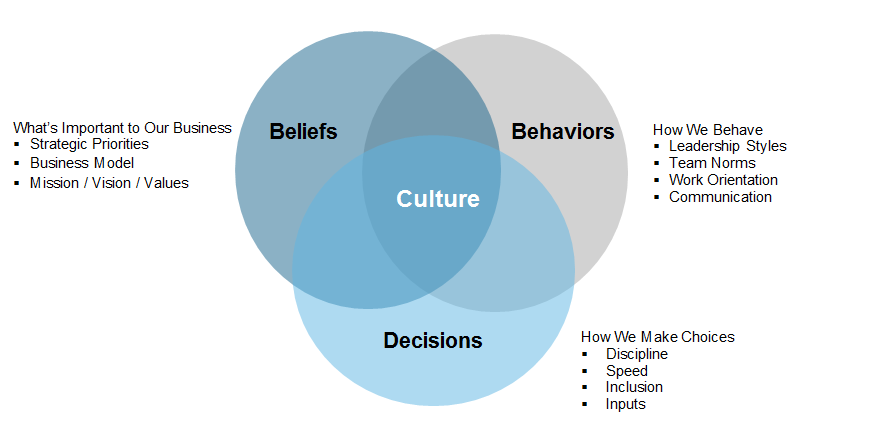

For several years, we have been partnering with firms to help them assess and improve their culture. Using proprietary assessment tools to measure various dimensions of culture, we collect employee feedback on culture across a number of organizations, helping them to reach their ultimate culture goals. Aon defines culture as the way work gets done. The diagram below illustrates the various components of culture:

Our research conclusively proves that aligning culture with business strategy pays dividends. In addition to higher engagement and an increase in value creating behaviors, companies with higher culture alignment had approximately 4 times higher sales (average CAGR for revenue over 3 years was 44% vs 10% for those with low alignment) and returns (average CAGR for EBITDA over 3 years was 40% vs 11% for those with low alignment) as compared to companies with low culture alignment.

Research including over 100,000 employees from over 60 companies across regions shows that high- performance cultures have traits in common, regardless of an organization’s strategy or business models. Employees in high performing organizations describe their company as more open / transparent, decisive, people-oriented, long-term oriented, and proactive; it is interesting to note that some of these like openness / transparency, long-term orientation, and proactivity align with those recommended by the regulator. Our research also conclusively proves that senior leadership has the highest relative impact on culture – as emphasized in the circular. That said, changing culture involves changing the way people behave in the organization, and oftentimes requires firms to change internal team members and employees.

In short, while culture transformation can be difficult, it is possible and a critical component for achieving long-term success in several major organizations. Remember “Who Says Elephants Can’t Dance?” by Lou Gerstner? Gerstner credited a major portion of the turnaround of IBM to their ability within their company’s culture.

In Conclusion

While more prescriptive than previous circulars, this one continues to talk about guidelines rather than rules. Additionally, it mentions that smaller and less complex organizations may apply the guidelines on a proportionate basis. In comparison, legislation in Europe is far more strict, with the regulator going so far as to say that for certain defined positions, which are classified as Certification Regime Staff, it is the firm’s responsibility to appoint individuals to meet its standards of competence, conduct, and culture. This needs to be reassessed annually. Personal liability, longer term LTI deferrals (up to 10 years), and stricter regulator reviews for senior management are the norm in Europe, but have not (yet!) come to Asia Pacific.