The retail banking scandal has exposed the perilous link between the actions of the sales workforce and corporate culture, as well as the laissez-faire attitude towards mis-selling that led to those actions. Are banks across the GCC region at risk, too?

One year ago, the U.S. Department of Justice issued subpoenas over Wells Fargo’s fake accounts scandal. Including the most recent announcement, Wells Fargo has discovered 3.5 million potentially fake bank and credit card accounts. This has since raised a number of questions among banks globally.

Over the last few years, the GCC region has remained a dominant market, experiencing steady increases in disposable income and, in return, a ripe opportunity for the sale of investment and pension products. However, such an opportunity also brings its share of risks.

Below, we identify reasons for the increased risk of mis-selling and how GCC banks can mitigate such risks by undertaking suitable course correction.

Why has there been an increased risk of mis-selling within banks?

There are several factors.

- Due to macroeconomic reasons, credit has remained fairly tepid. In conjunction with higher average cost of funds, this has kept the Net Interest Margins under pressure. In response, banks have enhanced their focus on Non-Funded Income (NFI), which, unless balanced appropriately, significantly increases the risk of product mis-selling. This is particularly pertinent to the priority and private banking segments, where the fee generated per client is significantly higher.

- Regional banks have begun to move away from large product portfolios to rather narrow ones in order to highlight their most profitable segments. In some cases, Bancassurance sales have become the key contributor of a bank’s segmental income. Such a narrow focus on just a few products increases the risk of mis-selling to customers.

- Banks have inherited a rather aggressive sales culture that is driven top-down by senior management, which leads to a dysfunctional set-up of individual sales targets. In order to support this high sales growth environment, the design of sales incentive schemes and underlying key performance indicators often have no control mechanisms that mitigate the potential risk of mis-selling. In other words, customer service quality standards are being neglected and the motto remains: Sell, sell, sell...

The three-pronged solution

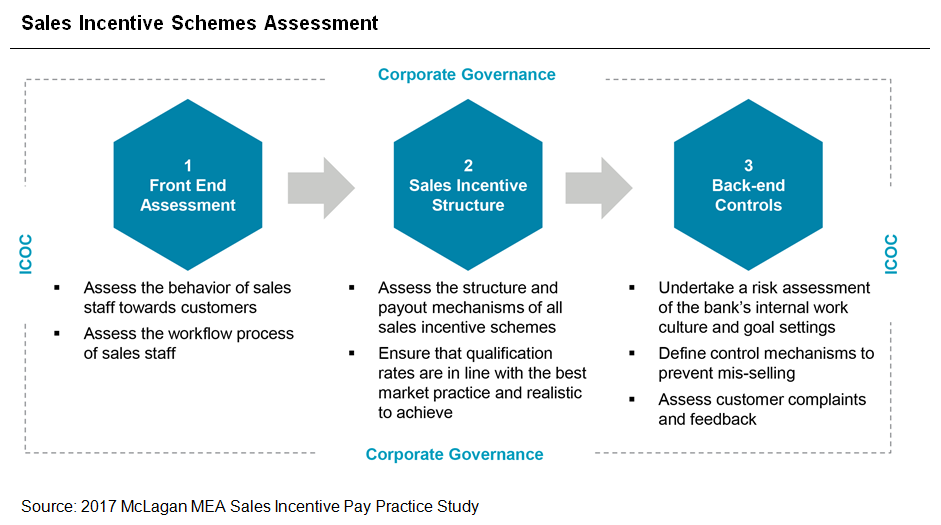

Measure sales staff behaviors: Banks should undertake a Front-End Assessment in order to gauge the behaviors of their sales staff towards customers. This entails a rigorous review of the core processes around sales and operations by internal or external assessment specialists. The next level reviews the procedure for the closure of business transactions. This dual-layered assessment approach is pivotal to mitigate any forms of misbehavior, and addresses several questions around the sales process, as well as customer communication. Are customers being informed about the type of products and their potential related risks?

Furthermore, if only one product is being offered, do the sales or relationship managers fill out customer application forms without consent to check boxes for additional products?

Review sales incentive schemes: Banks should undertake a detailed review of their current and planned incentive scheme structures to gauge the risk of mis-selling. The following questions should be leveraged when approving sales incentive schemes:

- What customer centric performance measures exist within the program and what weighting do these measures have?

- Are the schemes capped or un-capped?

- Do the schemes have any gates and / or modifiers to ensure that all relevant products are being sold?

- Do schemes pay out even if the team and / or departmental revenue goals have not been met?

- Are there any thresholds in place or are staff members being incentivized on the first dollar earned?

- Are the schemes designed in a way that also ensures the quality of sale?

- Are the schemes designed to incentivize staff for target growth of liabilities as opposed to relative growth?

- Are the schemes comprised of a healthy mix of qualitative and quantitative measures?

- Are there any (short-term) deferral mechanisms applied to the schemes?

- Are the schemes aligned with the latest market practice and the bank’s overall corporate strategy?

- Do the individuals that oversee the incentive plan, e.g., set performance goals, review results, make exceptions to the plan, also participate in the plan?

Understand your work culture: Banks should undertake a risk assessment of their internal work culture and goal setting processes. Sales behaviors are directly correlated to the attitude and environment promulgated by senior management. Understanding the bank’s culture and its impact on the design of sales incentive schemes is pivotal to help drive the right behaviors within an organization. Naturally, if a firm’s overall goals involve aggressive revenue growth year on year, sales staff will react differently towards customers compared to those employees whose goals are balanced by qualitative measures, such as Customer Satisfaction Scoring (CSS).

Furthermore, banks should establish effective oversight and governance protocols around sales processes and incentive design. After all, it is crucial for banks to put the right control mechanisms in place, e.g., call backs, customer feedback, and audit checks. Staff assessment on sales quality could potentially limit negative behavior, and ensure the proper distribution of products to customers. As such, the reputation of the bank is protected and the related cost of effort is kept at a minimum, too. Though completely eliminating fraudulent activity will be extremely challenging, good governance allows for reduced upfront risks and more transparent tracking, monitoring, and resolution when issues arise.

For many banks, HR often plays a subservient role around sales incentives, which continue to be driven and managed by businesses. This is a clear conflict of interest, as without the necessary feedback mechanisms and risk mitigation protocols, plan designs can quickly spiral out of control. Incentive plan governance should be a definitive mandate by the Remuneration Committee and the Board. Therefore, banks should consider implementing a committee to provide oversight of the entire sales incentive scheme governance process, and assist in risk management. The committee should include representatives from the business, HR, and risk and finance.

In order to ensure consistency of approach, banks must commit to a singular organization-wide framework for incentive plan designs. Incentive plan management is often secluded within a business that does not allow for adequate central oversight.

The easiest way to ensure the continuance of good practices is by hiring the right people. When it comes to sales, many banks tend to hire for ability to sell rather than the ability to sell right. A good recruitment screening setup should be multifaceted and not just focused on past sales performance.

Looking forward

Over the last twelve months, the banking world has seen a number of cases similar to the Wells Fargo incident. This should raise a red flag amongst those who have not yet reacted and assessed their internal culture and processes.

Markets that are not greatly regulated are technically exposed to a risk of substantial mis-selling. Therefore, it is highly recommended that HR, in conjunction with Senior Management, embarks on a journey of constant review to ensure that Wells Fargo’s scandal is not replicated across the GCC region. The only way to safeguard the integrity of the overall incentive architecture is to adopt frequent proactive reviews as opposed to more reactionary redesign mechanisms.

After all, it is important to realize that risk is not ancillary to the financial industry, nor is it a mere by-product; it sits at the core of all business processes. The key to success lies in keeping any additional operational risk on account of mis-selling to a minimum.

Related Articles