As the Chinese technology market matures, using overly-simplistic discount factors to set pay between cities isn’t working as well as it once did. It’s time to dig deeper.

The technology sector in China is maturing rapidly— from the ongoing expansion of the local semiconductor industry to the transformation of manufacturing by robotics to the digitization of almost every business process in every business sector. This is leading to dramatic changes in how and where companies operate. Importantly, as these forces accelerate, greater differentiation in compensation practices, from city to city and region to region, is on the rise.

Traditionally, rewards professionals working on pay in China have focused most of their attention on China’s four “Tier 1” cities, which include Beijing, Shanghai, Guangzhou and Shenzhen. These cities are all densely populated economically developed areas on the east coast of China that rank highest on the government’s list of development priorities. In terms of scale, these cities all have gross domestic products of more than US $300 billion and populations in excess of 15 million people.

Using detailed benchmark data from Tier 1 cities as a starting point, it is still not uncommon for rewards professionals to apply standard discount factors to estimate pay in “Tier 2” and “Tier 3” cities. For example, after salary ranges are created based on Tier 1 city data, pay in every Tier 2 city might be universally set to 85% of those levels. However, it’s time to question this approach, especially within the technology sector.

Thanks to more government support and robust growth in the technology sector, Tier 2 and Tier 3 cities are all attracting more investment and companies. Businesses in these cities include both local startups and outposts for larger firms expanding their operations to take advantage of new customers, lower operating costs, lower living costs and strong local universities.

Yet, not all Tier 2 and Tier 3 cities are maturing at the same rate. Unlike Tier 1 cities, Tier 2 and Tier 3 cities are spread across all of China and, therefore, represent a much wider diversity of geographic situations and economic, infrastructure and talent development levels. In sum, talent and rewards practices in these cities are no longer moving in lock-step.

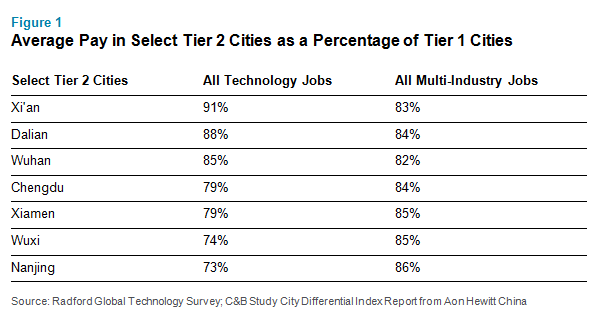

To test this notion, we used the latest results from the Radford Global Technology Survey, which can report data on specific compensation levels in more than 40 Chinese cities. Unsurprisingly, as Figure 1 below illustrates, our analysis found that pay levels range widely from city to city in China for technology jobs.

Per Figure 1, average pay for technology jobs in the Tier 2 city of Xi’an is already at 91% of Tier 1 cities, but in Nanjing, average pay levels are only 73% of Tier 1 cities. As a result, while a general discount factor of 85% is still largely accurate for general industry jobs, using a generic approach could lead a company to wildly under- or over-pay for key technical talent.

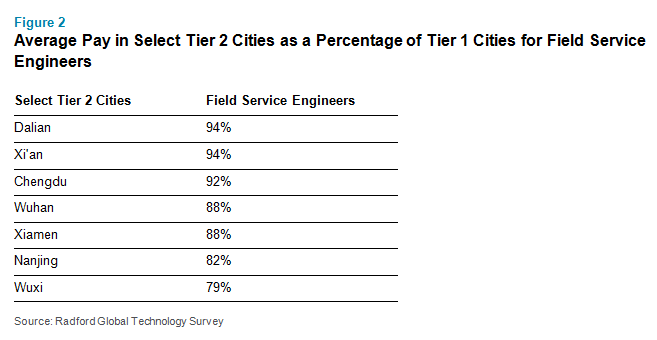

Digging deeper, geographic pay differentials can also differ within job families depending on factors like local talent availability and demand. What’s more, differentials within job families don’t necessarily follow the same general patterns observed across all technology jobs. Figure 2 demonstrates this point.

Another way to view geographic pay differentials is by job level. For example, average pay for management jobs in the Tier 2 city of Dalian are 92% of Tier 1 cities. Yet, for individual contributor job roles in Dalian, average pay drops to 78% of Tier 1 cities. Across cities, jobs types and job levels, detailed benchmarking reveals a startling array of geographic pay differentials that cannot possibly be fairly represented by a universal discount factor. As a result, there is only one conclusion to draw: rewards professionals need to consider taking a more detailed approach to benchmarking in China’s Tier 2 and Tier 3 cities.

Next Steps

Until very recently, avoiding regional benchmarking in China was a viable strategy. Most companies either had operations in only one location (usually a major market) or found that data sources were too limited across both major and minor labor markets to provide for useful analysis. The growth of the technology sector in China is changing this. As companies expand their geographic footprint in the country and competitive pressures increase, it is increasingly advantageous to take a more city-focused view toward benchmarking pay. And companies that adopt this approach sooner rather than later will enjoy a competitive advantage.

As a result, we no longer recommend applying a blanket pay differential factor between cities or regions in China whenever truly local data can be used. Looking at pay differentials through a variety of lenses, including job roles, job levels and between specific cities will help companies set pay in far more accurate manner.

To speak with a member of our compensation consulting group about benchmarking strategies, please write to consulting@radford.com. To learn about participating in a Radford survey, please contact our team.

Related Articles