The percentage of sales organizations that have car allowance policies has decreased, but they still remain common in some regions. We explain where the plans remain popular and why.

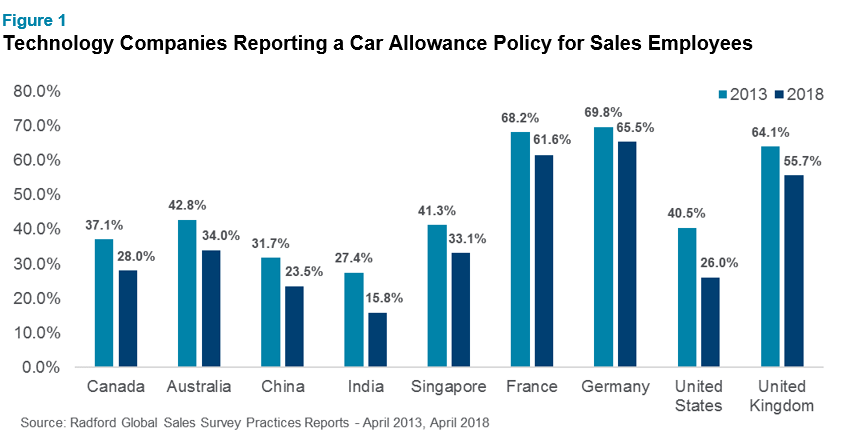

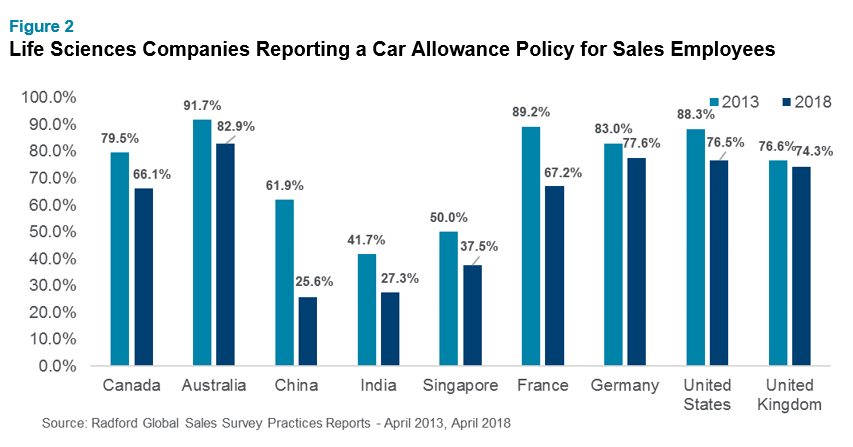

Car allowance policies for sales roles at technology and life sciences companies are falling out of favor among employers. In the past five years, there has been a decline in the prevalence of companies with car allowances in every market we studied across the globe for field sales jobs and applications/systems engineering roles. Car allowance benefits come in several forms, including access to a company car for business and personal use, or as cash allowances that can be applied toward a car.

Among technology companies, car allowance plans have dropped off dramatically in the United States (US) followed by India and Canada, as seen in Figure 1. The life sciences markets with the biggest drop in car allowance plans include China, France, Singapore and Canada, shown in Figure 2.

Companies cite a host of reasons for abandoning car allowance programs, including:

- Institutional investors and proxy advisory firms continue to question the practice,

- Employees without access to car allowances have expressed internal pay equity concerns,

- Administering programs can be expensive, and importantly,

- Some companies question whether car allowances are a motivating benefit or if money would be better spent on different types of rewards

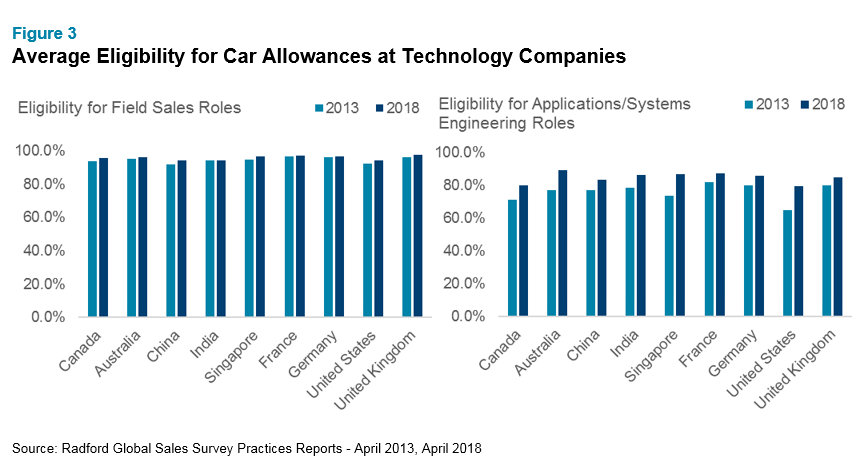

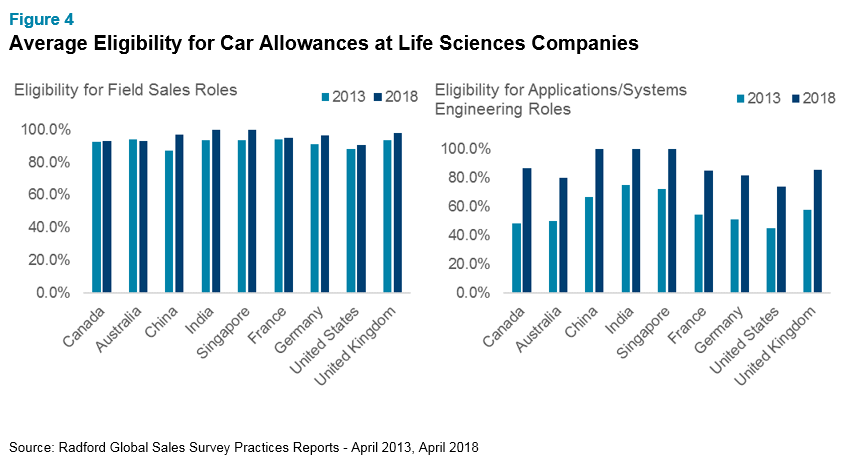

While fewer companies are offering car allowances to their sales employees, companies that have kept the plans are increasing eligibility for sales employees on average— particularly among employees in applications/systems engineering roles. Figures 3 and 4 show average eligibility rates for all job levels (individual contributors, managers and executives) for either or both field sales roles and systems application engineers at sales organizations in 2013 and 2018. We note there is little difference in eligibility among job levels for both sectors across all regions.

Next Steps

Even while declining in popularity, car allowance plans are still a majority practice in many markets, particularly in Europe, partly because they are a legacy perk that long-tenured employees have come to expect. Furthermore, when companies end the plans they often replace them with a salary adjustment to offset the loss of the benefit, which companies may want to avoid because it can be a larger financial commitment in the long run. Finally, in some countries, companies receive tax benefits for offering car allowances.

The need for sales organizations to benchmark car allowance plans regularly is clear: practices are changing rapidly, and the prevalence of car allowances varies widely by region and sector. While car allowance plans are a minority practice among technology sales forces outside of Europe and a declining practice among life sciences companies in Asia, they are still popular in many other regions. Making a widespread decision on car allowance policies for sales people across the organization— particularly companies with sales employees in multiple global locations— could have negative repercussions if you don’t study and understand common practices and culture norms in local markets.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our sales force effectiveness practice, please write to consulting@radford.com. For more information about the design of car allowance policies in Europe, we invite you to participate in the Aon European Car Benefit, Transportation & Generation Survey 2018/2019 by clicking here.

Related Articles