Corporate titles, such as EVP, SVP, VP, and AVP are widely used at both credit unions and banks. Historically, banks tend to make more extensive use of corporate titles across the employee population. As credit unions increasingly compete with banks for talent and business, their title structures and approach to title management may also need to change.

Corporate titles carry importance both internally and externally. Internally, they provide employees with a clearer understanding of hierarchy and seniority within the firm and help to define career paths. Additionally, titles offer human resources a way to define eligibility for certain programs or benefits and can be used as a tool for recognition and reward. Externally, corporate titles provide customers, industry associates, and other constituents with an implicit understanding of who they are interacting with, helping to build customer confidence. While practices vary from firm to firm on how to define and manage corporate titles, it’s important to have an understanding of how your firm compares to the industry—inclusive of banks and credit unions.

Approaches to Corporate Title Structures

Data from the McLagan Regional & Community Banking Compensation Survey reveals that there is a wide range of ways that firms use corporate titles. What is less clear from the data is the philosophy behind the structure decisions.

One approach is to use a formalized hierarchy surrounding corporate titles with specific meaning and criteria associated with each title. The structure may be linked to formal criteria such as a minimum salary grade, specific reporting relationship, or a particular functional role. This method provides a clear path to advancement with a certain level of objectivity; however, it can also be perceived as too rigid, hierarchical, or political.

Another more common approach involves defining a general set of criteria or loose framework around the use of titles. Maintaining discretion to apply specific title decisions based on this more general set of principles is crucial. A nomination-and-approval process may exist in both formal and informal management approaches. However, if principles aren’t followed or exceptions occur too frequently, the perceived value of the titles may diminish.

Corporate Titles in Credit Unions

Whichever way your firm chooses to approach corporate titles, it is important to remain relevant in the context of the market. Based on our compensation survey data, we are able to understand how compensation relates to specific organizational roles, levels, reporting relationships, functional titles, and corporate titles, giving a holistic view into how credit unions and banks utilize corporate titles.

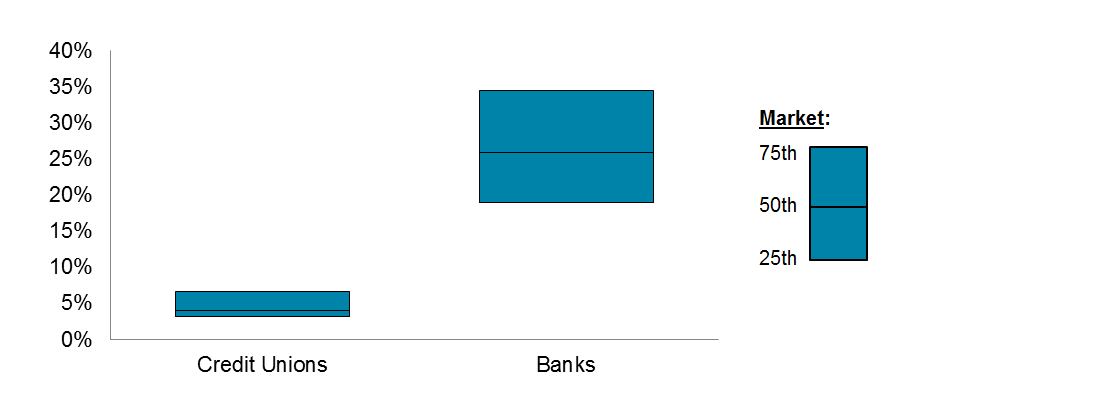

Data from our survey reveals that credit unions have far fewer employees with corporate titles than banks—about 4% receive corporate titles in credit unions at the median versus 26% at banks. Typically, employees with titles at credit unions are positioned higher in the organization. At the same time, titles do not extend as deep into the employee population.

In part, these differences are due to variations in business model and the associated staffing mix. For example, credit unions have not historically had a significant business lending function—an area where corporate titles are prevalent in the broader banking market. Business lending is also an area of growth, where credit unions are competing more directly with banks today compared to in the past. This is one reason why we are seeing renewed interest in corporate titles and an increased shift by some credit unions towards bank-like structures.

% of Employees with Corporate Titles

Source: McLagan Regional & Community Banking Compensation Survey

Source: McLagan Regional & Community Banking Compensation Survey

Industry Trends

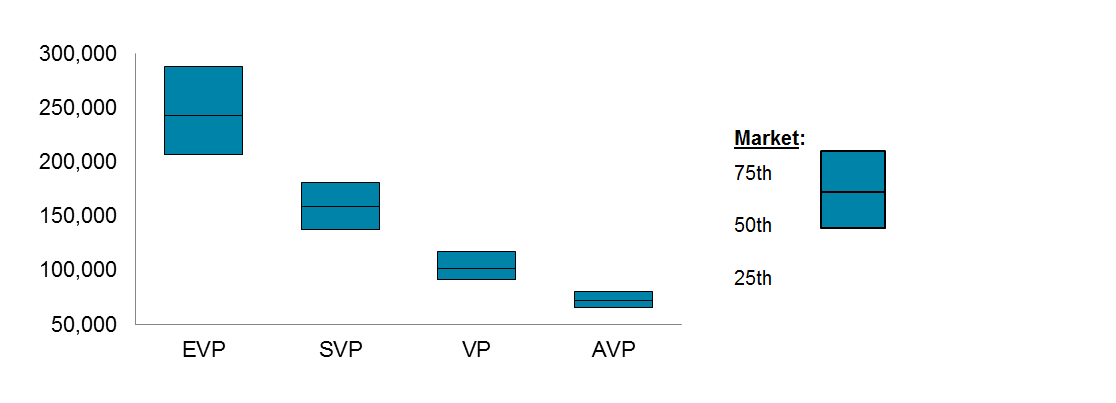

Within the McLagan compensation survey data, we cover Corporate title data from banks and credit unions generally under $30 billion in assets. In the market as a whole, combining both banks and credit unions, VP and AVP titles are used most frequently, while EVP and SVP titles are given to far fewer employees. Salary grades are sometimes incorporated into the criteria for specific titles, alongside other factors such as position impact, knowledge / skills, and management responsibilities. Regardless of whether an individual’s salary grade assignment is a factor in the determination of title, we do see a correlation between the two. Credit unions typically have much higher salary levels for VP and AVP positions compared to banks, due to the fact that corporate titles are not extended as deep into the organization.

Salary by Corporate Titles (Banks and Credit Unions)

Source: McLagan Regional & Community Banking Compensation Survey

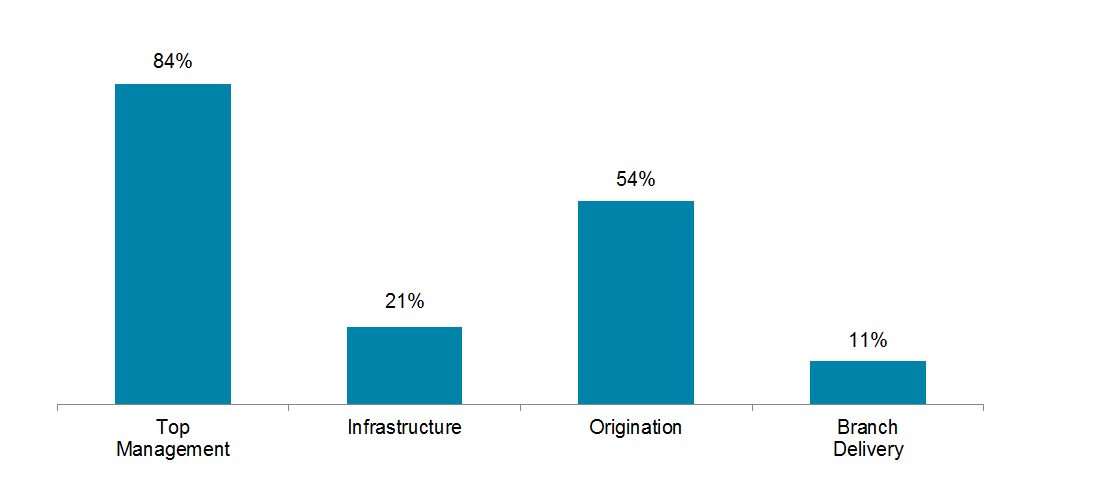

At the median, 84% of employees categorized as top management have corporate titles. Similarly, 54% of employees in lending or other origination positions have corporate titles. Top management staff and origination positions regularly interact with high-value customers and other constituents, necessitating recognition of the employee’s seniority and experience. Corporate titles contribute greatly towards the accomplishment of this goal.

% of Employees with Corporate Titles by Group (Median Values Across Credit Unions and Banks)

Source: McLagan Regional & Community Banking Compensation Survey

While credit unions continue to compete with banks for talent, transforming longstanding methods and staying up-to-date on current market trends in relation to corporate titles is imperative. Credit unions must consider mirroring bank tactics and models to effectively carry titles further down the hierarchy and reach deeper into the employee population. As a full-service consulting firm serving credit unions and banks, McLagan operates the largest and most comprehensive industry-specific compensation survey. We are available to assist in the evaluation of your corporate title structure, drawing comparisons to a select peer group and offering guidance to help your firm leverage the use of corporate titles.

For more information about a corporate title market analysis or how to create guidelines or policy around this topic, please contact Katrina Gerenz at 952.886.8247 or katrina.gerenz@mclagan.com.