Retention bonuses are still common at technology companies, but our latest survey shows a decline in use in the US and several other key markets. We explore why.

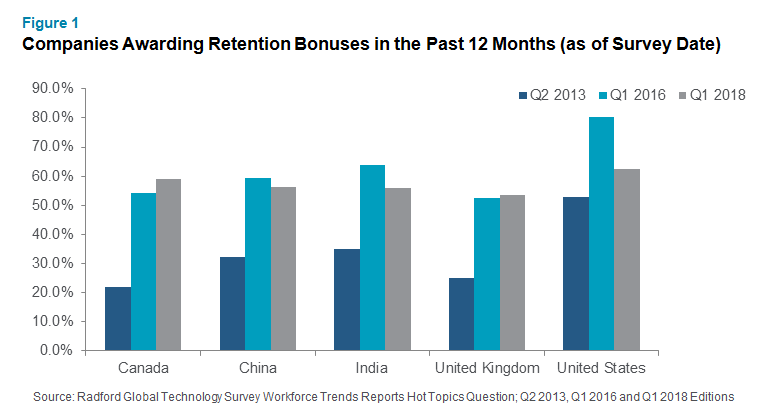

Periodically, we use our quarterly “hot topics” survey to check-in with clients on their use of retention bonuses. Between our first retention bonus survey in Q2 2013 and our second survey in Q1 2016, the prevalence of technology companies in key economies reporting the use of retention bonuses jumped dramatically― reaching as high as 80% of firms in the United States (US). As we began to compile the results of our Q1 2018 hot topics survey on retention bonuses, we expected to see a similarly robust trend given the intensity of the talent market today. However, as Figure 1 illustrates, with the exception of Canada and the United Kingdom (UK), the use of retention bonuses is down in China, India and the US.

So why has the use of retention bonuses declined at technology companies? We think there are two driving forces. For one, stock market dynamics were much different two years ago when we last surveyed companies on their retention bonus practices. Secondly, companies are evolving in their approach to retaining talent. Cash is still important, but focusing on creating an employee value proposition that goes beyond pay is increasingly important in today’s fierce technology talent market. Let’s dive into both of these issues in greater detail.

Our last retention bonus survey in Q1 2016 came at a time when the stock market was beginning to show high volatility (in fact, January 2016 had one of the worst stock performances to start any new year). Looking at equity award values on a 12-month trailing basis ending in May 2016, US software and hardware stocks declined by an average 14.5%, while the Russell 3000 dropped by only 4.5%. As a result, employee equity holdings during this period decreased in value by a meaningful amount. This made employees feel less secure in their current roles, and simultaneously easier to poach with new-hire grants. We saw many companies pursue a strategy of retention bonuses to combat underwater stock options and/or stock awards that had dropped in value. These payments, which can include one-time or multi-payment options and clawback provisions, provide immediate liquidity, and typically don't carry performance restrictions, which is important for industries experiencing downward pressure on their stock performance as tech stock were back then. More recently, when the stock market was reaching all-time highs, employees had enough unvested equity they had less incentive to look elsewhere.

The other reason for the decline in retention bonuses is likely due to companies spending more time aligning their talent and rewards programs to have a bigger impact on engagement and retention. HR leaders realize that to compete for skilled technical talent they need to not only offer a competitive rewards package but also a compelling workplace culture. Employees value career opportunities that might include working cross functionally, workplace flexibility, opportunities for mentorship and training and much more. Oftentimes, when companies see their key talent leave there is a bigger issue at play that money alone can’t fix. Furthermore, many companies are stretching themselves to offer competitive starting pay packages; one-off awards like retention bonuses simply may not be in the compensation budget for many tech companies.

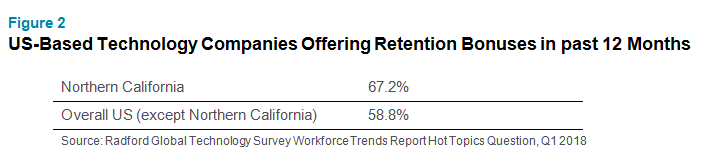

While the US saw the largest drop in retention bonuses over the past two years (an 18 percentage point decline), prevalence rates are still higher than all other countries we surveyed. Those figures are driven by a higher concentration of tech companies in Northern California that are still relying fairly heavily on retention bonuses in the competitive job market.

Technology companies in Northern California may find it unsustainable to compete for talent on rewards alone. Retention bonuses are more common in Northern California but they are also unsustainable for many budget-conscious organizations as a long-term solution. Click here to read our article on talent strategies companies should consider that cost little to no money.

Next Steps

When considering whether retention bonuses are the right strategy for your company, you should weigh the merits of bonuses against other options, such as increasing long-term equity awards, increasing base salary to ensure competitiveness and strengthening talent programs (e.g., improving working conditions that differentiate your firm, communicating a clear path for future professional development and job growth, etc.).

Retention bonuses can also be tricky because, by design, they are temporary. Even with a one-year clawback provision, the impact of a retention bonus is shorter term, so being mindful of ways to engage employees requires vigilance. The competitive hiring landscape among technology companies means retention will continue to be a concern for technology companies, which must be addressed with a longer-term strategy. Retention bonuses are absolutely necessary in some circumstances, such as uncertainty surrounding a merger or acquisition, but they should be limited to special circumstances and not part of large scale and sustainable retention strategy.

For more information on retention bonus design and values, please consult the Radford Global Technology Survey Q1 2018 Workforce Trends Report.

To learn more about participating in a Radford survey, please contact our team. Or to speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles