The number of life sciences companies with CIC and not-for-cause severance policies has fallen and wide variation remains in how plans are designed, according to our new survey.

Severance and change-in-control agreements can be an uncomfortable topic for companies to discuss with their employees, but it’s an area of heightened interest due, in part, to fervent M&A activity in the life sciences sector. As such, it’s an important housekeeping item for HR professionals to stay on top of.

In 2017, Radford surveyed 108 US-based life sciences companies on their practices for severance, change-in-control (CIC) programs and equity treatment upon retirement. A majority of the respondents are pre-commercial and commercial biopharma companies and medical device companies. Nearly three-quarters of the respondents are publicly traded companies.

Unlike severance policies for the C-suite, which are required to be disclosed in the company proxy, practices below the C-suite are much less known. Our 2017 survey follows up on similar surveys we conducted in 2014 and 2011.

Below we highlight five important discoveries from the Radford 2017 US Severance & Change-in-Control Practices Survey at technology companies.

Trend #1: Most companies have not-for-cause and change-in-control severance policies, but adoption rates are lower.

While more than half of life sciences companies have a not-for-cause or involuntary termination severance policy for employees, the prevalence rate is lower in 2017 compared to the 109 life sciences companies we surveyed in 2014: 56.5% vs. 64.0%. The same is true for CIC severance policies with 65.4% of life sciences firms reporting they have a policy in 2017 vs. 72.0% in 2014.

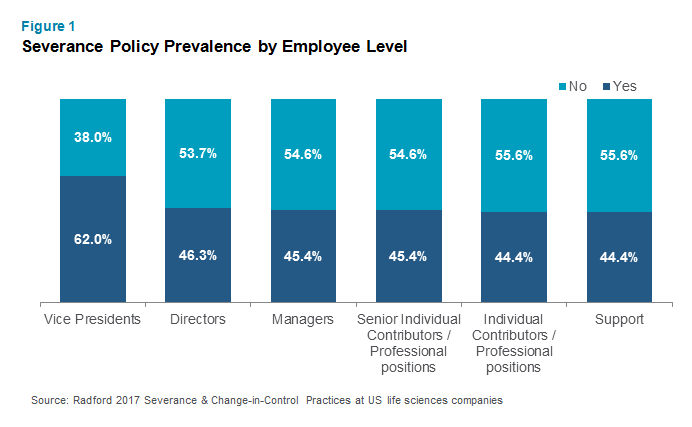

Trend #2: Vice presidents are more likely to have a severance policy, but prevalence rates are nearly the same at all job levels below VP.

Perhaps not surprisingly, vice presidents are the most likely of all job levels to have a not-for-cause severance policy in place. However, at all job levels below the VP— from directors to support staff — the prevalence of severance policies is nearly the same as illustrated in Figure 1.

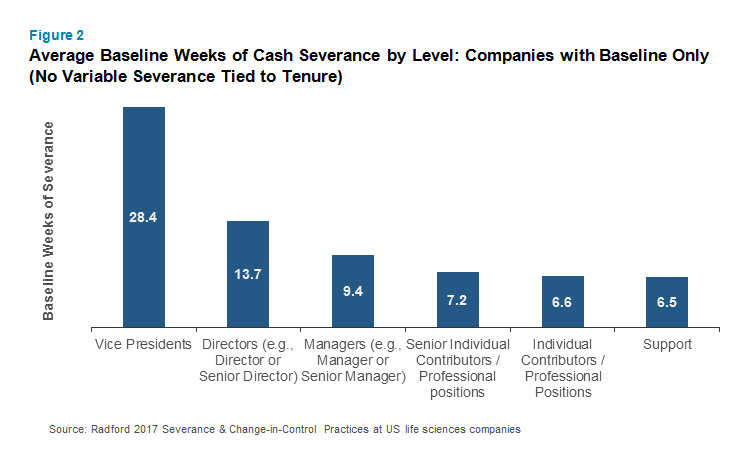

Trend #3: The percentage of companies offering cash severance is consistent across job levels below VP, but there is wide variation in the amount of cash offered.

Companies that provide cash severance in not-for-cause situations tend to provide it for all job levels. However, there is a wide variation in the number of baseline weeks used to calculate the amount of cash severance as seen in Figure 2.

Trend #4: Fewer companies are putting a cap on the maximum weeks of severance allowable.

While more than half of companies have a maximum limit on the number of weeks of severance paid out, the number of companies reporting a cap declined from 59.0% in 2014 to 53.3% in 2017.

Trend #5: Most companies calculate cash severance for a change-in-control through job level rather than tenure.

Fifty-seven percent of life sciences companies use only job level when calculating the amount of cash severance in the event of a change-in-control. That compares to 7% that use a tenure-based formula and 12% that use a combination of level and tenure. An additional 24% reported that they did not have a CIC severance policy. In our 2014 survey, a higher percentage of companies (26%) reported using a formula that combined level and tenure.

Figure 3

How is Your CIC Cash Policy Determined?

| Employee Levels |

Percent of Companies |

| Level-based: our rate of severance is tied to the level of the job |

57% |

| Level- and tenure-based: our rate of severance establishes a minimum based on level, then additional amounts are determined based on years of service |

12% |

| Tenure-based: our rate of severance is tied to the number of years of service |

7% |

| No policy |

24% |

Source: Radford 2017 Severance & Change-in-Control Practices at US life sciences companies

*****

To learn more about and purchase results for the Radford US Severance and Change-in-Control Practices survey, please click here.

Related Articles