We discuss the pros and cons of holding terms and how to value them in your ESPP.

Mandatory post-vest holding periods have become increasingly popular for many types of equity awards. Holding periods limit the ability of an award holder to sell shares for a specified amount of time after vesting, even upon separation of service. The shares are not forfeitable during the holding period (as shares are already vested), but award holders cannot sell and realize value until the holding restriction lapses. Post-vest holding provisions are commonly found with restricted shares or units granted to top executives, but also are a feature in some broad-based employee stock purchase plans (ESPPs). According to the 2017 NASPP Domestic Stock Plan Survey, 22% of qualified ESPPs and 31% of non-qualified ESPPs have a required holding period, often ranging from six months to two years.

There are numerous reasons why a company might choose to add a holding period to ESPPs, such as:

- To prevent employees from “flipping” their shares or selling them quickly after the purchase

- To encourage employees to participate in the longer-term growth of the company

- To improve tax treatment of shares: Any shares of stock held for one year or longer are taxed as long-term capital gains or losses upon a sale; generally, long-term capital gains are taxed at a lower rate and are more beneficial to employees

- To reduce compensation expense under ASC Topic 718

That said, many companies choose not to put a holding requirement on ESPPs because the broader employee population may not have the risk tolerance required to hold shares.

ESPPs with holding periods tend to have lower participation rates, according to our research. Employees tend to prefer liquidity and flexibility in ESPPs for short-term cash needs. Furthermore, some of the key governance aspects of mandatory post-vest holding periods — to help meet share ownership guidelines, provide a pathway to clawback compensation and more — are most beneficial to executives and upper management. ESPPs are aimed toward rank-and-file employees, where these issues are less of a concern.

Despite these drawbacks, some companies have expressed an interest in adopting holding periods because it gives them the ability to apply a discount for illiquidity to the fair value of the ESPP. While ASC Topic 718 prohibits considering the non-exercisability of an award during the vesting period in the valuation of an award, any feature — such as a mandatory post-vest hold period — that limits the exercisability of an award after vesting can be considered when estimating the fair value. To meet the ASC Topic 718 requirements to apply an illiquidity discount, the required holding period must be specific to the security and be in effect for a specified period of time, even upon separation of service. (Please see our article Mandatory Post-Vest Holding Requirements: A New Approach for Mitigating Your Company’s Equity Compensation Expense for more details on the technical considerations for holding periods).

In this article, we’ll examine how to estimate the fair value for an ESPP with a mandatory holding period.

Calculating Discounts for Holding Periods

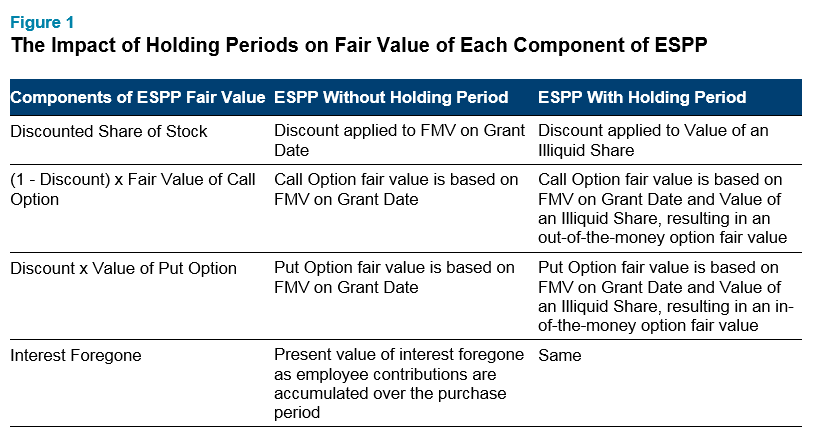

ESPPs are valued as the sum of its separate components based on the plan’s features. The fair value of an ESPP award can have up to four components. The chart below illustrates the impact of a holding period on each component of an ESPP’s fair value.

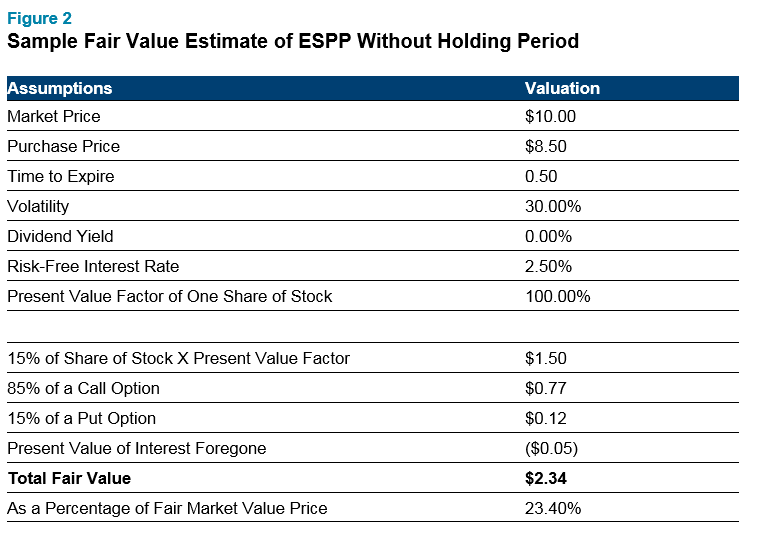

Figure 2 shows an example of a typical ESPP fair value estimate (with no holding period), for an ESPP with a six-month purchase period with a 15% discount and a look-back.

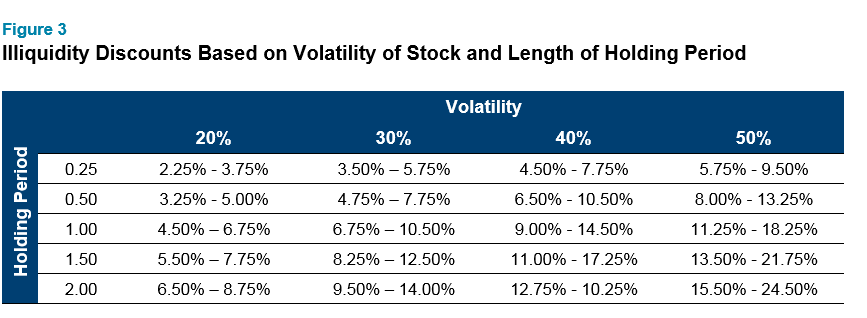

In order to value an ESPP award with a holding period, the value of an illiquid share of stock must be known. Several theoretical valuation models can be used to estimate the impact that illiquidity periods have on a share of stock’s value. The most prominent techniques are the Chaffe and Finnerty models, both of which conclude that mandatory holding periods lower the value of a share of stock. The two main drivers of the magnitude of the discount are the volatility of the underlying stock and the length of the holding period. Figure 3 shows estimated illiquidity discounts by varying lengths and volatilities.

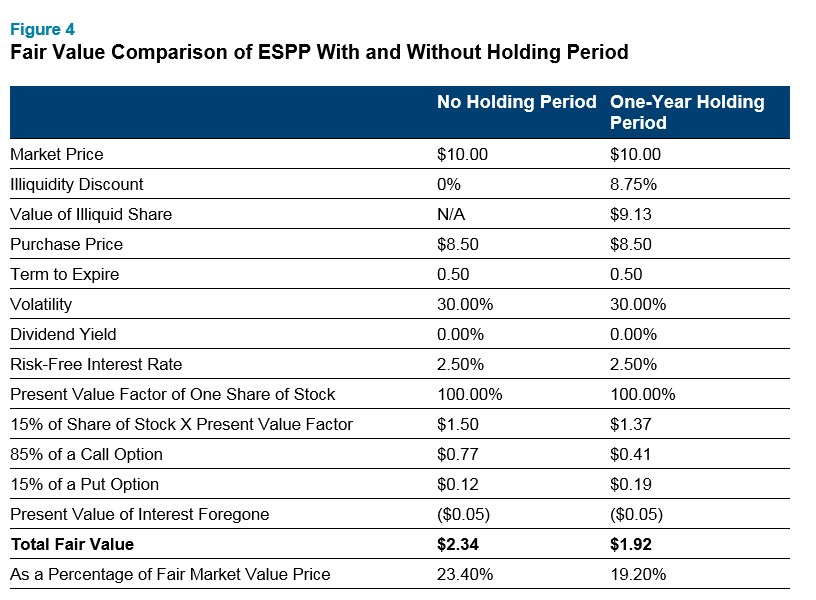

The value of an illiquid share of stock is simply the current share price multiplied by the discount. Continuing with the example above and assuming a one-year post-purchase hold period, we estimate a discount of 8.75%. The valuation would now follow Figure 4, which compares the valuation of an ESPP with no holding period to an ESPP with a one-year post-purchase holding period.

The value of the share and the call option has decreased, while the value of the put option has increased. Overall, the fair value decreased from $2.34 to $1.92. This is an absolute decrease of 17.95%, or 4.2% of the stock price at valuation.

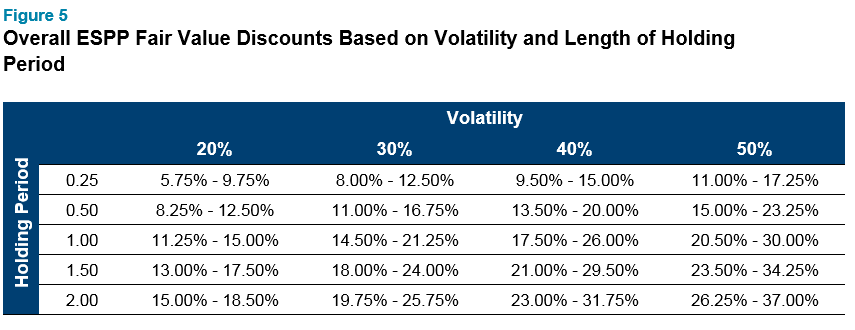

Figure 5 summarizes the estimated discounts on an absolute basis for various levels of volatility and lengths of holding period, assuming a six-month purchase period with a 15% discount and a look-back.

Next Steps

Mandatory post-vest holding periods have grown in popularity among equity awards, but questions remain about whether employees will view holding periods as a disadvantage and opt out of the plan. A company should consider its goals for an ESPP when contemplating a mandatory holding period — balancing the impact to participation rates, shareholder perspective and compensation cost. An illiquidity discount could be allowed to flow through to the income statement as savings to the company, or companies could try to increase its appeal to employees to increase participation (with a greater discount, look-back feature, etc.) while keeping compensation expense (per award) constant. Holding periods on ESPPs may not be ideal for every company, but are certainly a feature worth understanding, especially for companies that have holding periods and have not considered applying an illiquidity discount.

If you have questions about whether this valuation technique can be used to reduce your ESPP compensation cost, contact us at consulting@radford.com or visit us at radford.aon.com/valuation/.

Related Articles