European biotech firms looking to expand into the United States need to be prepared to meet employee expectations for larger equity awards.

Equity compensation is an important component of all total rewards programs at life sciences companies, but we continue to see significant cultural differences in how equity is used in Europe and the United States (US). Yet, in an environment where more and more life sciences companies are expanding globally, and sooner in their development cycles, it’s important for companies to understand equity practices and expectations around the world, and especially when they enter new markets.

To examine how equity usage differs between Europe and the US, and specifically when a European-based company enters the US market, we examined burn rates and issued overhang among the following groups of life sciences companies using Radford’s burn rate and overhang database:

Figure 1

Scope of Companies Studied

| Type |

N count |

Market cap range |

| Public companies based in the US |

194 |

$5.5 to $990 million |

| Public European companies listed on the Nasdaq exchange |

9 |

$100 to $900 million |

| Public European companies not listed in the US |

26 |

$25 to $850 million |

Source: Radford Burn Rate and Overhang Database

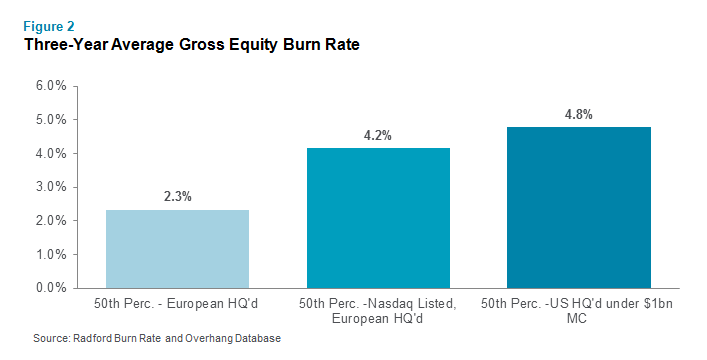

When it comes to burn rates, US companies are the most aggressive in the global market, burning through 4.8% of equity annually at the median, as seen in Figure 2. More interesting, European companies listed on the Nasdaq stock exchange operate with a similarly aggressive equity policy, burning through 4.2% of equity annually. This data supports the notion that the location of a company’s stock exchange listing has an impact on its equity philosophy as companies compete with local market competitors to attract and retain top talent through a competitive equity program. These companies also operate within the context of US governance models and investor expectations. Meanwhile, European companies not listed in the US only burn through 2.3% of their equity annually.

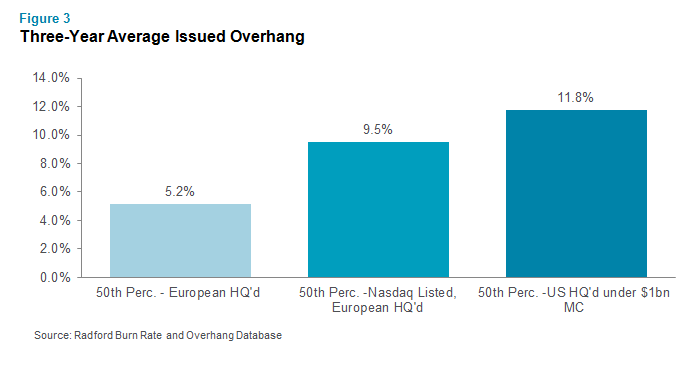

A similar picture unfolds when we look at issued equity overhang (calculated by adding options, warrants, unvested restricted stock and performance shares outstanding divided by basic total common shares issued and outstanding). Figure 3 shows that the US-headquartered companies have the highest issued overhang, declining slightly for European-headquartered companies listed in the US and then a much bigger drop-off for European-headquartered companies not listed on the Nasdaq.

Next Steps

European-headquartered biotech companies listed on Nasdaq are forging a new middle ground between Europe and the US when it comes to equity compensation practices. Over time, as this group grows larger, it will be interesting to see if they force more European biotech firms listed on local market exchanges to increase their overhang and burn rates closer to US levels. This could be an important tipping point that finally begins to level the equity playing field between the US and European markets.

In the meantime, however, it won’t be easy for European biotech companies to suddenly ramp up their equity usage. Equity grant pools are a limited resource and carefully guarded by shareholders, especially in the more conservative corporate governance environment of Europe. To get around this challenge, European companies need to look carefully at all of their equity grant practices to maximize equity resources. For example, should equity participation continue to be fully broad-based or perhaps limited to high-impact functions or geographies? Additionally, can heavier usage of full value shares accomplish retention goals while reducing burn rates? Another approach to consider is the use of dual equity pools for US and non-US employees, both falling under an overall equity usage range tolerated by investors. This type of model can help significantly with annual equity planning, but isn’t a magic bullet that necessarily allows for larger equity awards in the US without some cuts to participation and/or European grant levels.

Overall, when you’re expanding into a new market with vastly different equity compensation practices, it’s important to find the right middle ground of adopting some new market practices for your talent in the region without going outside the range of what your company and investors are comfortable with.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles