How they are trending and what banks can do to control them

A decade since the credit crisis, the world’s major banks are still struggling to bring costs under control. Having gone through multiple cost reduction programmes post-2008, firms are under continued shareholder pressure to increase return on tangible equity.

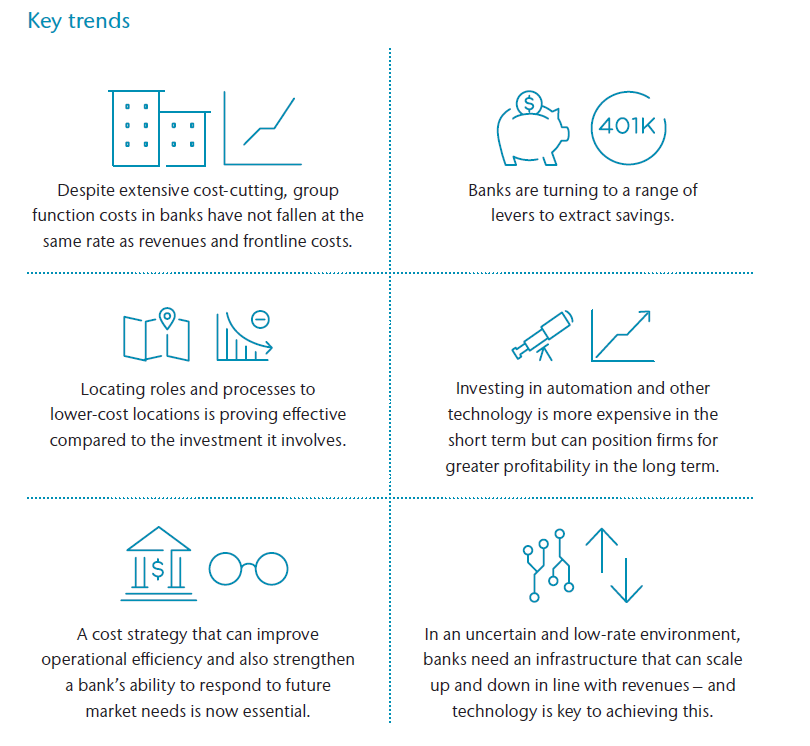

With revenues under pressure from a flatter yield curve and an uncertain outlook in many business areas, cutting group function costs remains key to improving ROTE. Here we look at function costs trends and assess the measures with the greatest potential to transform long-term costs.

To learn more about how banks are seeking to optimise their support function costs in the face of persistent revenue pressures, please download the full white paper here.

You can also reach out to Nicholas Yazdani at nicholas.yazdani@mclagan.com for further information and support.

Related Articles