It’s been more than a decade since the Great Financial Crisis (GFC) hit the global economy, forcing governments, regulators, and boards to rethink their respective roles in protecting the interests of various stakeholders. Soon after the GFC, technology disruption came along, challenging traditional business models and introducing new risks for financial services firms to consider. To tackle these risks and imperatives, which range from culture and conduct to digital, many countries adopted new or revised regulations. For instance, in Southeast Asia, the Malaysian Code on Corporate Governance (MCCG 2017) was updated to strengthen corporate culture and enhance accountability and transparency.

Below are additional key risks that are impacting financial services firms and resulting topics that are at the top of non-executive directors’ minds.

Key Trends in Corporate Governance 1,2

- Cyber risk - 42% of directors foresee cybersecurity threats as one of the greatest effects to companies in the next 12 months.

- Digital - 19% of new independent directors of S&P 500 boards had backgrounds in the technology or telecommunications industries.

- Culture and conduct - The financial crisis and recent events in the business world prompted increased attention towards culture and conduct.

- Gender diversity - 19% of directors are woman at board level.

- Disclosure and transparency - Information disclosure is key to good corporate governance.

These factors have also increased the responsibilities of board directors, who must now maintain the role of a strategic guide for management, as well as serve as a guardian of shareholder interests. Such added tasks place a distinct demand on the diversity of skills and experiences required among board members. Therefore, the question of remunerating non-executive directors (NEDs) for these skills, experiences, and very importantly, their time, has become more pertinent.

Cost of governance

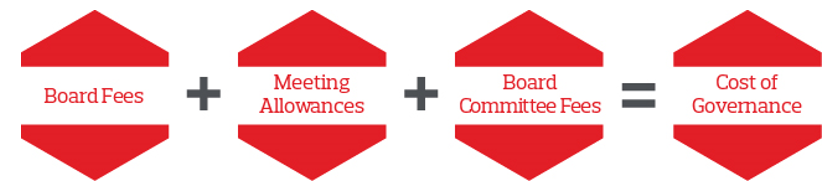

The most important question to a shareholder is the total cost of governance, which is subject to approval at annual general meetings (AGMs). The total cost of governance is the aggregated fees of individual directors, which comprise overall basic board fees (retainer fees), meeting allowances for each board or board committee meeting attended, and/or board committee fees for providing specific expertise to board committees, such as audit.

Besides the risks mentioned above, increasing regulation, disclosure requirements, as well as public interest in financial services have placed a distinct demand on directors’ time, hence increasing cost of governance.

In our experience, the two key issues influencing NED remuneration structure in emerging markets today are meeting allowances and board committee fees.

Meeting allowances

While countries such as the UK, Hong Kong, and Australia don’t often remunerate NEDs for each meeting attended, firms operating in Southeast Asia (except for Singapore, in which case more than half of companies do not pay meeting allowances) still have a significant amount of NED remuneration geared towards meeting allowances. In extreme cases, this amount can form as much as 80 to 85 percent of total fees for NEDs.

Board and board committee meetings are part of the ongoing performance oversight that NEDs are supposed to provide as a portion of their board service. Remunerating directors for individual meetings may encourage this board service to instead be viewed as a discrete series of meetings. With the advent of technology and telecommuting, the workplace is also expanding outside of formal boardrooms and meetings. Therefore, meetings are not the only proxy of time spent.

In other cases, where the board has convened multiple times per year, questions from shareholders may arise regarding the board’s productivity and the perception of excessive meeting allowances being paid.

Finally, the desire for simplicity and a clean fee structure builds the case for moving away from meeting allowances. Additionally, the total cost of governance becomes more predictable to the shareholders and less likely to vary significantly.

Board committee fees

The topic of committee fees is slightly more complex. There is a high prevalence of NEDs being remunerated for the strategic oversight provided to each board committee, which is often calculated or expressed as a ratio to the board retainer. The key questions that are being raised on this issue are:

- Is there a need for committee fees?

- What is the right remuneration for different committees?

The issues boards are facing are becoming more diverse and complex, ranging from succession to cyber risk. Instead of rushing through packed board agendas, some of these topics are being delegated to board committees to think through before recommending endorsement by the board. The NEDs sitting on these board committees bring specific skill sets to contribute to the agenda. They also devote additional time to discharge their duties and responsibilities. As such, there is an increasingly strong case for building in board committee fees.

The right remuneration for different committees should take into account the skills, amount of effort, and time required. In addition, audit and risk committees also take on more potential liabilities and therefore, are usually paid more. Board committees should base their fee frameworks on these factors to ensure that they are internally equitable, and also confirm that the total cost of governance is not excessive.

Complexity vs. simplicity

Increasing complexity and diversity in subject matters for board deliberation does not necessarily mean increased complexity in board remuneration structures. The foundational principles of remuneration, such as compensating incumbents for skills, experience, and time, as well as market benchmarking, still must be followed. Ideally, the fee structure should be robust enough to attract the right talent and skills, while also being able to stand up to the scrutiny of shareholders.

To learn more about executive compensation and governance in Southeast Asia and other regions across the globe, please contact our team. You can also read a version of this article and explore other regional Asia topics and content by visiting Aon’s Insights at Work blog here.

_________________________________________________________________________________________

1Source: Aon proprietary data and secondary research:

Uncertain Regulatory and Economic Climate Tops List of Corporate Directors’ Concerns for 2019

The Digital Boardroom: Industrial Boards Are Looking for More Tech-Savvy Directors

2Source: Aon Proprietary Data; Article: The Edge, Malaysia

Related Articles