ISS’ decision to raise its scoring allocation towards the share pool duration factor and add a dilution threshold will likely lead to the most impactful changes for companies seeking shares in 2019.

Institutional Shareholder Services (ISS) published material changes to its Equity Plan Scorecard (EPSC) approach, which is used to determine whether it supports equity compensation plan proposals, on Dec. 19, 2018. Additionally, ISS published new burn rate benchmarks, broken out in tabular form by index and GICS categorization. These changes will go into effect for annual shareholder meetings beginning Feb. 1, 2019.

Of all the published changes to date, the higher scoring allocation towards the share pool duration factor will likely be the most impactful for companies seeking shares in 2019. Additionally, the standalone dilution deal-breaker thresholds could make it more difficult for companies with high overhang levels due to underwater stock options to receive ISS support for even modest share pool requests.

New Dilution Deal-Breaker

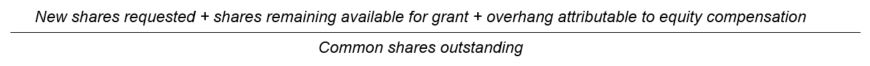

In addition to the requirement that a company must pass the applicable quantitative scoring threshold for the EPSC, firms now face a possible automatic negative recommendation from ISS if their “simple” dilution exceeds 20% for S&P 500 companies or 25% for Russell 3000 index companies. This new dilution threshold does not apply to non-Russell 3000 companies or special cases (i.e., recent IPOs, spin-offs, and companies emerging from bankruptcy with less than three full years of disclosed burn rate activity). Simple dilution is calculated as follows:

Companies making broad-based stock option grants throughout their organization may find themselves challenged by these new deal-breaker thresholds. This could disproportionally affect certain sectors that have higher burn rates, such as technology and life sciences companies. ISS says it won’t grant exceptions to the new policy. Note, this will not have a material impact on most financial services firms, as they do not use stock options as a primary equity vehicle.

While dilution is a critical input of many institutional investors’ voting policies, companies will still likely be able to obtain necessary shareholder support for limited share pool requests through enhanced proxy disclosure and proactive outreach efforts.

Increased Weighting of Share Pool Duration Factor

ISS has lost an opportunity to review equity plans every few years due to recent changes made to the IRC Section 162(m) tax rules. As such, ISS has increased the weighting attributable to the share pool duration factor in the “Grant Practices” pillar of the EPSC. Given this scoring methodology change, ISS is continuing to make it more difficult for companies to seek share pools in excess of five years.

Change in Control Input Clarification

ISS also clarified that for the change-in-control (CIC) vesting factor in the “Plan Features” pillar of the EPSC, the firm will rely solely on actual disclosures and plan document language as opposed to the actual vesting of awards. Full points will be earned if the plan discloses with specificity the CIC vesting treatment for both time- and performance-based awards. If the plan is silent on the CIC vesting treatment for either type of award, or if it provides for merely discretionary vesting for either type of award, then no points will be earned for this factor.

New Burn Rate Tables

In addition to the updates on its EPSC methodology changes, ISS released its new burn rate benchmarks, as shown below.

Figure 1

ISS 2019 Burn Rate Tables for S&P 500

| GICS Code |

Sector |

2019 Burn Rate Benchmark |

2018 Burn Rate Benchmark |

| 40 |

Financials |

3.04% |

3.24% |

| 60 |

Real Estate |

2.88% |

2.00% |

Source: ISS

Figure 2

ISS 2019 Burn Rate Tables for Russell 3000 (Excluding S&P 500)

| GICS Code |

Sector |

2019 Burn Rate Benchmark |

2018 Burn Rate Benchmark |

| 4010 |

Banks |

2.81% |

2.93% |

| 4020 |

Diversified Financials |

8.58% |

8.63% |

| 6010 |

Real Estate |

2.58% |

2.82% |

Source: ISS

As revealed in Figures 1 and 2, ISS burn rate thresholds did not materially change year-over-over for most sectors, although there were some increases and decreases across select sectors. Consistent with prior years, the burn rate factor continues to carry a high weighting in the overall scoring. As such, it is important for companies to monitor their burn rate usage relative to ISS benchmarks and methodologies as part of a regular annual equity usage review.

If you have any questions about ISS policies and want to speak with one of our experts, please write to info@mclagan.com.