From differentiating equity grants for scientific-based talent to paying a premium for new hires, we highlight the top five biggest equity trends in the life sciences sector.

Developing competitive long-term incentive plans that evolve and scale as your life sciences company grows is a critical element of any compensation strategy, but not an easy task. For one, defining what is competitive in the marketplace is ever-changing, particularly in this red-hot labor market. Secondly, the skills and technical expertise needed for life sciences organizations to thrive are in high demand from all types of industries who are looking to hire talent with the type of analytical expertise that life sciences firms have long sought.

Life sciences companies need to offer a motivating and competitive total rewards package that has equity as an essential component to compete in this market. That’s why we developed the 2018 Radford Long-Term Incentive Practices Report for Life Sciences Companies.

We highlight five trends in the development of long-term incentive plans we’re observing. The data is based the 2018 Radford Long-Term Incentive Practices Report for Life Sciences Companies where we looked at LTI practices at 169 pre-commercial and 109 commercial companies across the globe. Click here to learn more about the report.

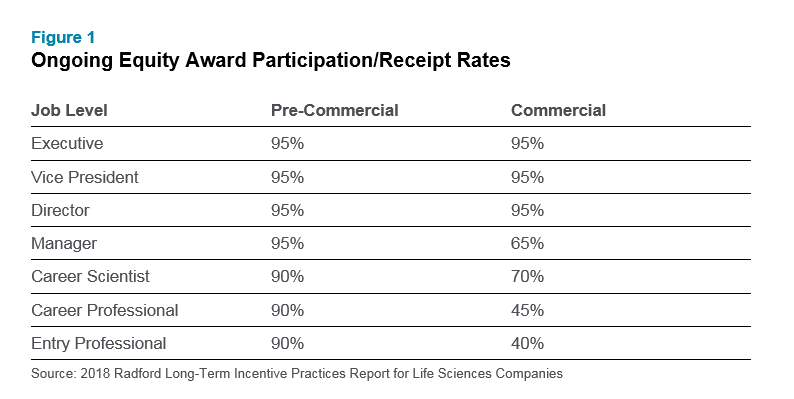

#1: Pre-commercial companies have a more broad-based approach to equity eligibility.

Compared to pre-commercial companies, commercial life sciences firms can expand their cash program and have a greater need to conserve shares given larger headcounts and concern over share dilution.

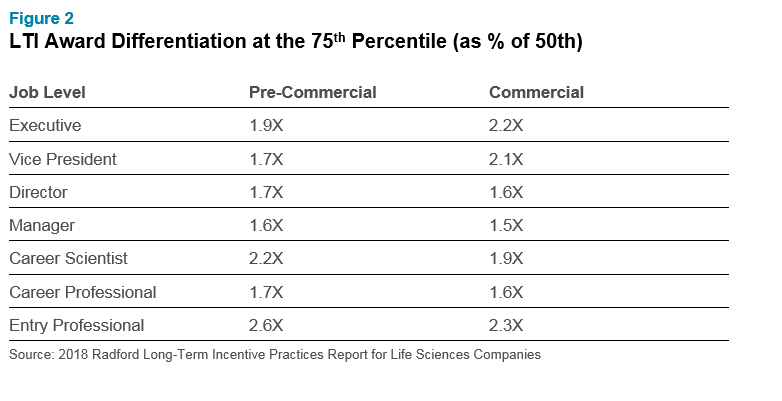

#2: Life sciences companies focus on differentiating awards based upon performance and impact.

For both commercial and pre-commercial companies, the 75th percentile is roughly 2 times the market median and the 90th percentile is roughly 3 times the median. This suggests there is a significant level of performance differentiation across all companies. A differentiated equity program becomes even more important as companies grow in order to conserve shares and reward top performers. We recommend all organizations think about implementing or fine-tuning a differentiated equity program.

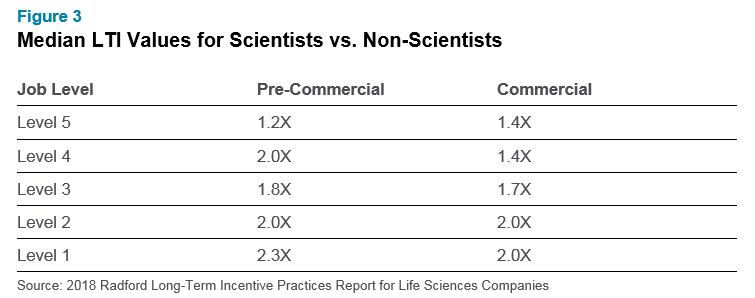

#3: Scientists receive substantially more equity across both pre-commercial and commercial companies.

Scientists carry a substantial equity premium in the market relative to non-scientists, which is slightly higher at pre-commercial companies due to the importance placed on research and development. The unique skillset of scientists is a key driver to the potential success of an organization. For this reason, they are often given differentiated rewards — not only through increased equity grant values (as shown in Figure 3) but also through differentiated program design. Oftentimes, they have entirely different grant schedules vs. non-scientific roles, and firms implement special programs designed to motivate and retain these key players in the R&D function.

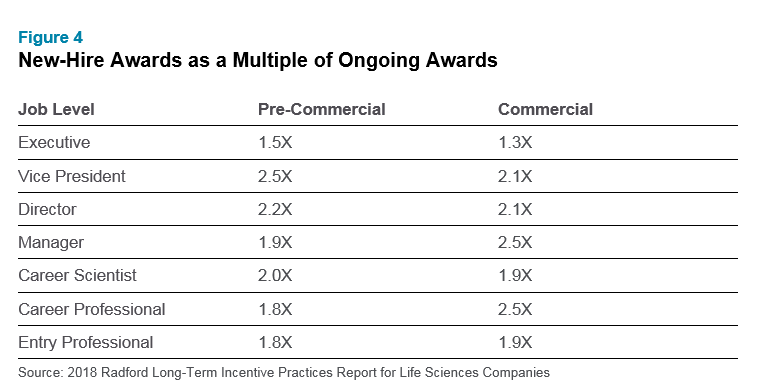

#4: Companies are paying a premium to attract new talent.

Life sciences companies are paying more to lure new hires from existing jobs, reflecting the competitive job market. New-hire awards are consistently higher than ongoing awards as shown in Figure 4.

We also find that new-hire premiums are highest in competitive life sciences hubs, such as Boston and San Francisco. This data emphasizes the need for companies to have a specific geographic location strategy to maximize the impact of their equity programs and remain competitive.

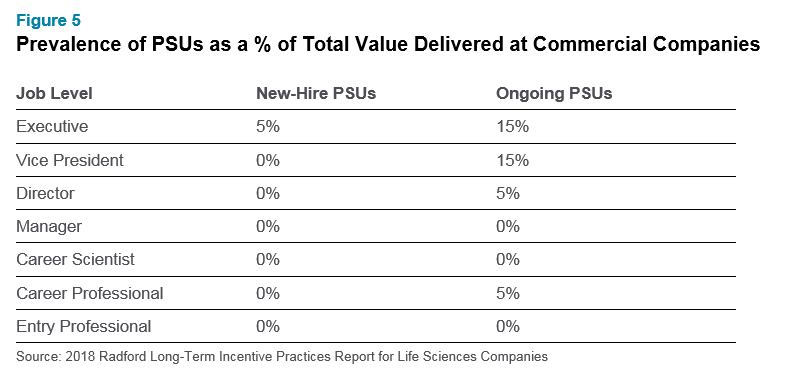

#5: Performance shares/units are an emerging practice at commercial firms.

While PSUs are still used sporadically as supplemental milestone-based programs at pre-commercial firms, they are a growing practice at commercial firms, especially at higher job levels.

Next Steps

Do you want more data and insights? The 2018 Radford Long-Term Incentive Practices Report for Life Sciences Companies is available for purchase here. If you have any questions about rewards design and want to speak with one of our experts, please write to consulting@radford.com.

Related Articles