The effects of the COVID-19 pandemic are bringing about new compensation challenges for banks in Europe, further highlighting the importance of data to make informed decisions.

Now that we are well into the second half of 2020, it’s quite apparent that we will reflect on this year as one that has been unlike any we’ve ever seen before. As countries attempt to kick-start their economies and tentatively emerge from lockdowns around the world, the financial services industry (and banking industry especially), faces its own unique set of challenges as a result of the COVID-19 pandemic.

This article takes a closer look at what is happening across banks in Europe in the current economic landscape, offering insights and advice for how to use data to make informed pay decisions for a stronger year ahead.

A Different Kind of Financial Crisis

Whilst the impact of COVID-19 has the potential to create a financial fallout far worse than the most recent crisis in 2007, the situation is very different. For starters, this time around it is not of the banks own making. At that time, Wall Street’s crisis became Main Streets’ crisis, too.

In response to the current environment, banks have acted with greater social responsibility and have thus far not made large cuts to headcount — which could, of course, change down the road. Furthermore, they have maintained lending, granted payment holidays to customers and acted to ensure liquidity stays within the system. Accordingly, it is likely that these improved approaches will help to restore some reputational damage suffered by the industry during the financial crisis.

Many banks’ first half results for 2020 were significantly buoyed by strong trading revenues. But, what happens if and/or when volatility fades away? JPMorgan Chase was one such beneficiary of favourable market conditions, however, it’s important to not become complacent. The company’s CEO, Jamie Dimon, has already warned investors to expect a tougher second half of the year.

Again, although this feels different from 2007, banks will likely experience the real impact of this unforeseen circumstance when the knock-on effect resulting from the three-month shutdown of the global economy begins to manifest. GDP and economic growth indicators reveal signs that things are already in sharp reverse, with widespread unemployment predicted and many large-scale corporate failures expected to follow.

Banks are sitting on massive loan losses. One leading consultant has even predicted that provisions for loan losses (with a second spike in the pandemic) could run to €800bn for Eurozone banks alone over the next three years — and this is on top of many weak and debt-heavy balance sheets. In the United States (U.S.), banks are better positioned from a capital strength standpoint, but the scale and size of the losses will inevitably impact all lenders.

What Does This Mean for HR and Pay?

The picture halfway through the year is certainly complicated. Many firms have been booking outsized trading revenues on the back of volatile markets caused by COVID-19, bringing certain considerations to the forefront:

- Should key banking and capital markets staff expect bumper bonus payouts this year?

- Have favourable trading conditions led to this outperformance, allowing all banks with scale in their trading businesses to benefit (should firms therefore think carefully and not over pay?

- Should the increase in revenues instead be used to cross-subsidise lower performing areas of the bank? Or maybe these gains will be needed to offset the provisions for potential loan losses?

- Rather than going to staff, could the additional revenue be used to fund share buybacks or to increase dividends paid to shareholders?

These are tricky decisions and banks will be wary of attracting bad headlines and over paying across the board (whilst still allowing for some hyper differentiation in pay to certain staff) when large numbers of people in the broader economy are struggling or losing their jobs.

Using Data to Make Better Decisions

In these unusual and uncertain circumstances, using third party data is now even more crucial. By combining granular HR and financial data with the expertise of our performance and rewards consultants, our team is uniquely positioned to assist clients in addressing their bonus considerations, including a scenario-modelled view of year-end pay.

We apply data from our proprietary financial benchmarking product, Gauge, to create detailed payout rates (both backward and forward looking). This view enables HR to measure and calibrate compensation in line with financial performance. Clients can then use these ratios to ensure the size of the bonus pool is right and stress test current decision making around the level of bonus pool funding.

These ratios can be created both at the macro business unit level and the micro product level. Below is a simple example to see how this would work.

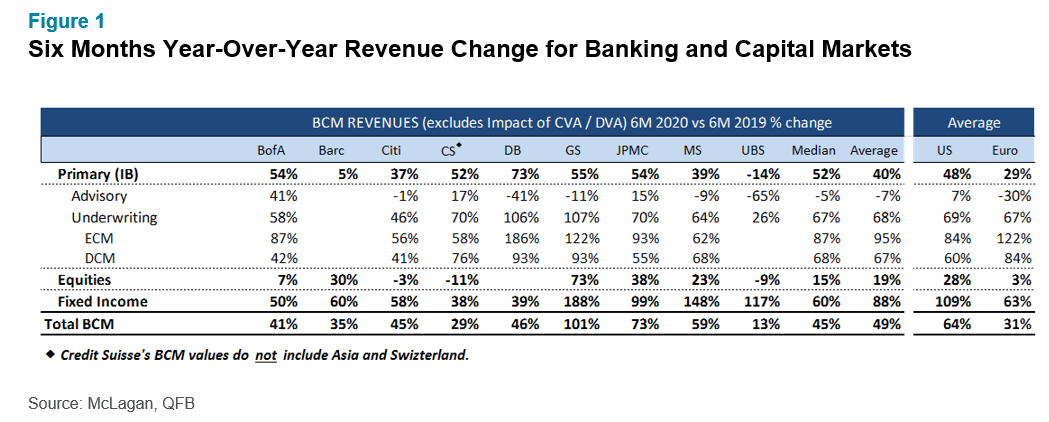

Figure 1 depicts the latest earnings numbers published by the leading investment banks. At the mid-year point for this group, fixed income median revenues are up two thirds on the same point of last year. Firms will have increased accruals to track this outperformance. But a key question remains: What should the final pool be for fixed income and how much of this additional revenue should be paid out in incentives?

Next Steps

With the proper combination of rich compensation and performance information, your firm will benefit from a full range of bespoke payout ratios. Unlike using public data, leveraging tools like this will even factor in the impact of things like capital to show a risk-adjusted product view.

Balancing the expectations of staff, shareholders and regulators is required to successfully navigate whatever lies ahead. To achieve this, it starts with getting pay decisions right — and doing so this year, of all the years, is the most critical.

For more information about McLagan’s Performance & Reward (P&R) analytics tools and capabilities, please contact Sean Carney at scarney@mclagan.com or your relationship manager. To learn more about participating in a survey or to speak with a member of our rewards consulting group, please write to rewards-solutions@aon.com.

To read more articles on how rewards professionals can respond to the COVID-19 pandemic, please click here.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles