With a more remote workforce, European life sciences firms are seeing an increase in talent moving within countries. As such, organisations face pay-related questions, including analysing cost of living, market pay, tax and accounting-related laws in local jurisdictions.

As more employees transition into longer term or permanent remote working conditions, an increasing number of workers are moving to new locations. For countries in Europe, that often means employees are able to move across country, which can have significant implications for pay management.

From an organizational and individual perspective, cross-border talent is in many respects a positive: It widens the talent pool for employers and increases career growth and opportunities for employees. But it also can give rewards professionals a bit of a headache due to pay differentials across locations, as well as different local regulations on benefits and taxes. (For specific information about implementing geographic pay differentials, see our article: As European Technology Firms Consider a More Virtual Workforce, They Must Decide How Location Factors Into Pay.)

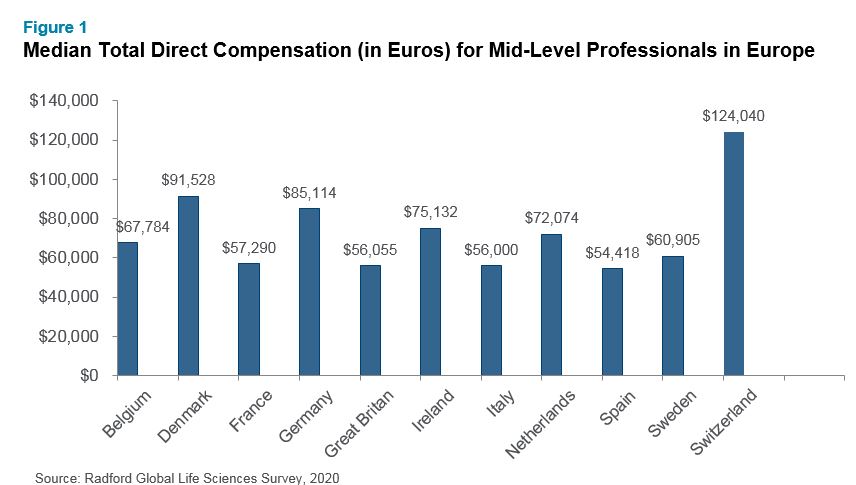

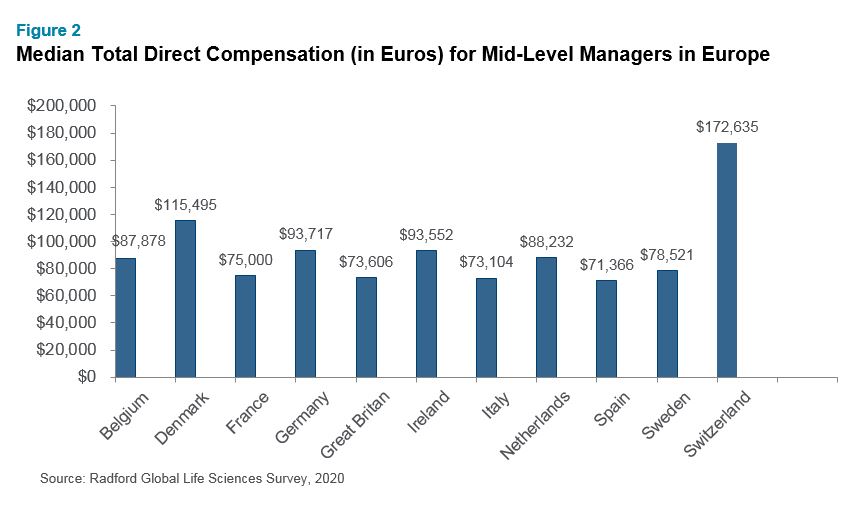

We wanted to examine some of these compensation and accounting differences in the life sciences sector, as we’ve had many clients asking for assistance with the cross-border movement of their people. Using Radford’s life sciences data, we found significant pay differences among the countries where there is a concentration of life sciences talent. Switzerland, for example, pays consistently more than other locations for equivalent roles, while the United Kingdom typically pays less. Meanwhile, southern Europe generally has lower wages than northern Europe.

The following charts show the difference in pay for career professionals (P3) and first-line managers (M2). The trend is reflected across company size and subsector.

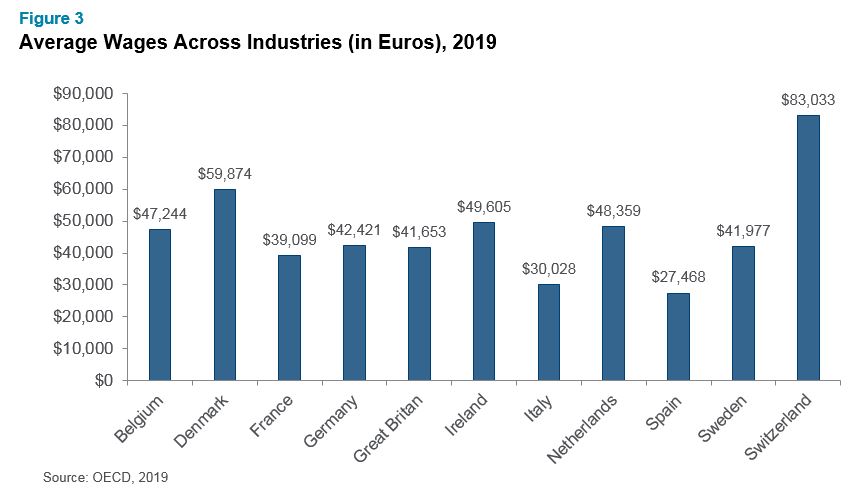

The differences in wages aren’t just among life sciences companies. Data from the Organisation for Economic Co-operation and Development (OECD) for 2019 shows a similar situation for average annual wages across industries. (Average wages are obtained by dividing the national-accounts-based total wage bill by the average number of employees in the total economy, which is then multiplied by the ratio of the average usual weekly hours per full-time employee and the average usual weekly hours for all employees.)

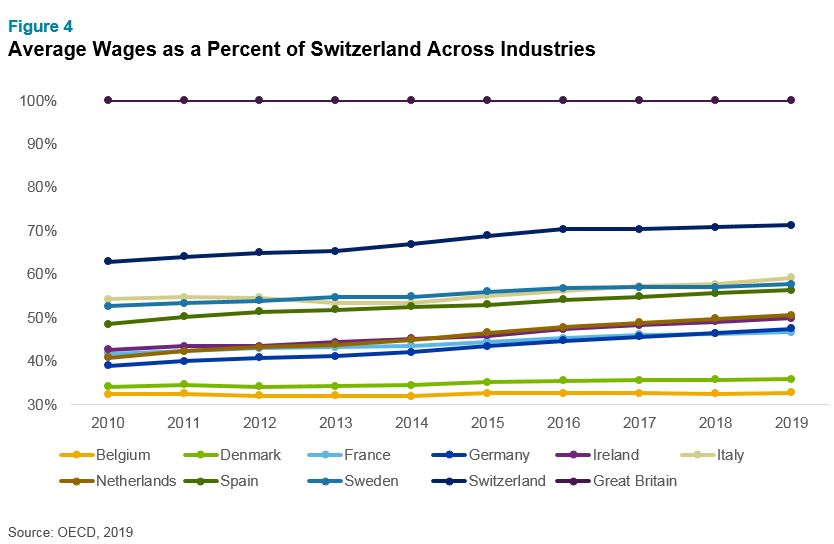

The differences in wages between countries and across industries are also consistent through time. The gap for Switzerland is closing, but only slowly, as shown in Figure 4.

Impact of Cost of Living and Taxes on Pay Management

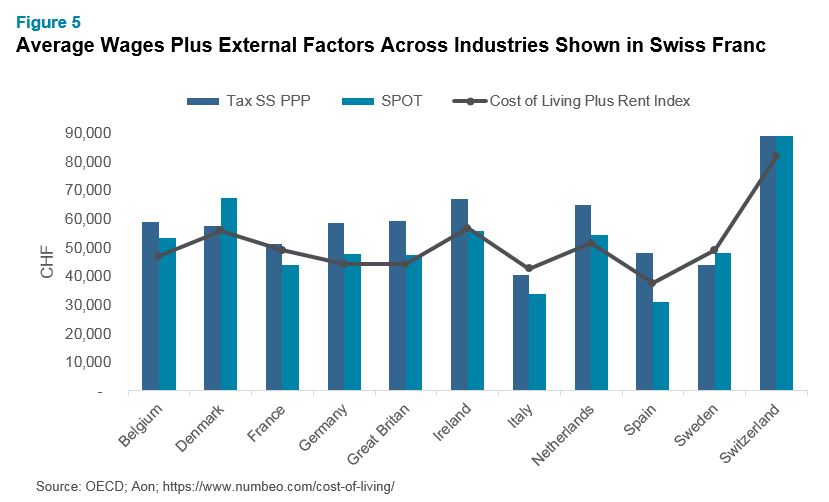

Looking at variances in wages across Europe only tells part of the story, though. The differences in cash compensation can be moderated or exacerbated by differences in cost of living and tax regimes. This adds to the complexity of managing pay differentials. Figure 5 shows OECD data reflected across countries using both Aon's cross-border methodology (which takes into account income tax, social security and purchasing power parity) and the SPOT FX Exchange rate, alongside the cost of living plus rent index.

Comparing Figures 5 and 3, we can see that the differences in wages are not as big between Switzerland and many of the other European countries when accounting for income tax, social security and purchasing power parity (i.e., Aon's cross-border methodology). However, wage differences between Switzerland and other countries are more pronounced when using the SPOT FX Exchange rate. This reinforces the need to review pay differentials between countries from a variety of perspectives.

Next Steps

There are clear benefits for a more mobile workforce in Europe, including opening new talent pools. In the life sciences sector, talent is scarce in some areas and the location of many major players is concentrated in key sites. But it’s also important to be aware of the pay implications that can accompany a cross-border move. When an employee asks to be based in a different country from that in which they were originally hired, or a company hires a new employee in a new market, here are some considerations to think about:

- Be clear on the market data you use to benchmark pay. What is the data telling you and what other elements should you consider (e.g., local market talent pressures, tax regimes, benefits considerations)?

- Study all elements of a new-hire offer; pay is only one lens with which to approach this issue. The flexibility of remote work appeals to many employees, but there may be job requirements or restrictions in the offer. Costs of living in different locations will also play a part (albeit, sometimes a minor part) in perceived value of any offer.

- Develop a clear and consistent policy for managing cross-border talent. Define how you approach the pay market and the overall offer and create a well-thought out governance approach to ensure the application of compensation is fair.

To learn more about participating in a survey or to speak with our experts, please contact one of the authors or write to rewards-solutions@aon.com.

Related Articles