In the ramp up to going public, it’s becoming critical that companies create a plan to address and disclose environmental, social and governance strategies, risks and opportunities. Failure to do so can lead to unsolicited scrutiny and an opportunity for others to craft your narrative.

The growing focus by stakeholders on how companies are evaluating environmental, social and governance (ESG) considerations is driving management and boards to evaluate their existing strategy for disclosure and the pressing need for board-related oversight of ESG. This type of evaluation is not just happening among large-cap organizations — mid-stage private to public-ready ones are also increasingly realizing the need to be prepared for the expectations of their future investors and other critical stakeholders.

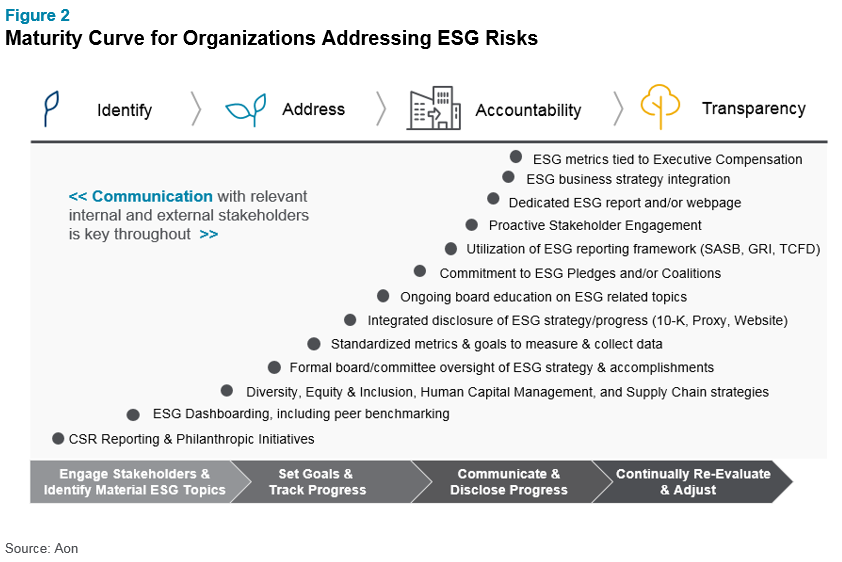

Companies are at different stages of their ESG journey and there is no one-size-fits-all approach. Industry, geography and maturity should all be key considerations in determining how to prioritize actions (see Figure 2 for activities that typically occur at different stages of company development). For private companies considering a more traditional IPO, direct listing or merging with a special purpose acquisition company (SPAC) on the horizon, investor expectations will likely be centered around:

- Governance Practices: Is there a dedicated board committee responsible for ESG oversight or is it written into the charter? Does the management and board know and understand what the ESG priorities are for the business and is a process in place for regular review? Is the company aligned with peers and the industry overall from an ESG perspective?

- People Risk: How is the company defining and driving the human capital management strategy? In particular, how does a firm attract, develop and retain talent? How is diversity and inclusion addressed from the board level through the wider company?

- Board and C-Suite Readiness: Are executive management and the board ready for the scrutiny — which is only increasing — that comes from regulators and shareholders once a company is publicly traded?

Three Steps for Taking Action Early

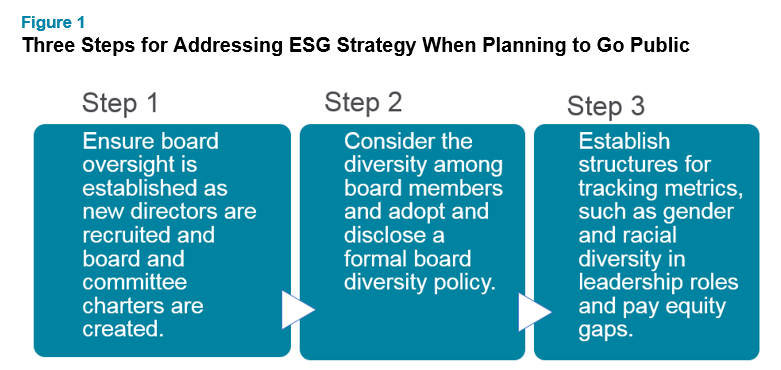

There are three primary ways companies planning to go public should begin addressing ESG issues as they relate to governance practices, people risk and board/C-suite readiness (outlined in Figure 1 and discussed in more detail below).

The first step is ensuring board oversight is established as new directors are recruited and board and committee charters are created. In our work with clients, we see directors manage oversight at either the entire board level or within a specific committee. Either way can be effective, but it should be disclosed in the relevant charter so that investors are aware. As part of this oversight, executive management and the board should establish a cadence for providing education opportunities and business updates on the ESG topics of interest to the entire board.

Next, consider the diversity among board members. Ask directors to self-identify their diversity characteristics (e.g., gender, ethnicity, race, background) to disclose in the proxy statement and company website and consider adding photos and relevant expertise to director biographies. Additionally, adopt and disclose a formal board diversity policy. A growing number of public companies are doing this, and we consider it an easy way to show shareholders that directors are committed to maintaining a diverse board. Of course, actions speak louder than words, so ensure the diversity policy is being fulfilled.

Finally, track important human capital management activities internally. Even if the company is small, establishing structures for tracking metrics, such as gender and racial diversity in leadership roles and pay equity gaps, can create sustainable processes and goals for companies as they scale. This is particularly important because starting in 2021, public companies are required to disclose human capital management in the annual 10-K filing (see more information in our article: U.S. Companies Focus on Four Areas of Human Capital Management Disclosure).

Next Steps

Once a company becomes public and develops a broader ESG strategy, we recommend reaching out to investors to better understand their expectations and concerns so those can be addressed. In some cases, an ESG reporting framework can be utilized as a guide — and there are many. See our article, ESG Groups Form Partnership to Create Framework for Corporate Disclosure of Sustainability Metrics, for new developments on different ESG ratings.

No matter where a company is on its ESG journey, it’s never too early to begin engaging with stakeholders and preparing for future risks. Figure 2 shows the activities companies will typically undertake as they progress on their journey to addressing ESG risks.

Aon has global ESG services to help companies of all sizes and industries address these issues at any stage of development. Our team of more than 50 governance advisors and analysts globally support over 1,000 clients annually on a broad range of ESG matters. We provide companies with shareholder perspectives to help prioritize issues that matter most to key stakeholders and can mitigate risk for companies, while balancing the unique needs of individual firms and industry and competitor practices.

To learn more about how Aon can help you meet your ESG goals, please contact one of the authors or write to humancapital.aon.com.