As employers adapt their human capital strategies to address issues exposed by the COVID-19 pandemic, they should also examine how they manage emerging human capital risks during M&A. We explore areas of people risk that will drive the success of transactions.

One of the many realities that was reinforced during the COVID-19 pandemic is how vital a firm’s human capital strategy and management is to the business success of an organization. Organizations that were able to quickly pivot to remote working and equip managers with the tools to lead remote teams, for example, were better positioned to respond and recover from business disruption. This is one of the many reasons why shareholders are increasingly interested in companies’ human capital management (HCM). In the United States, that heightened interest is reflected in mandatory disclosure of HCM in companies’ annual reports beginning in 2021.

Companies now need to translate their focus on (and enhanced disclosure of) HCM to M&A transactions — the success of which is often hinged on the ability to effectively integrate human capital.

The complexity of managing corporate transactions has been often discussed. There is strong agreement among business leaders and practitioners that effectively integrating teams based on a sound due diligence process is the most important critical success factor of a transaction. With around half of all modern M&A deals deemed a failure, an examination of internal factors often points to missed synergies, inadequate due diligence process and a lack of cultural alignment.

In order to assess how to better integrate human capital, let’s look at the main purposes of M&A transactions. Deals normally are to drive financial capital (e.g., business bolt-on, product extensions) or brand capital (e.g., companies build platforms or enter adjacencies that they can sell to their existing client base). Rarely do firms consider the human capital they are acquiring until after the first two considerations have been satisfied. However, through our experience in advising clients during transactions, human capital is rightly becoming a bigger consideration and success factor. That’s partly because many recent deals are technology or intellectual property-driven transactions. For these deals, the acquirer is paying a premium for talent that is in high demand in the labor market. We expect to see more of these types of deals as companies develop workforce strategies to drive productivity and reshape their business for a post-pandemic future.

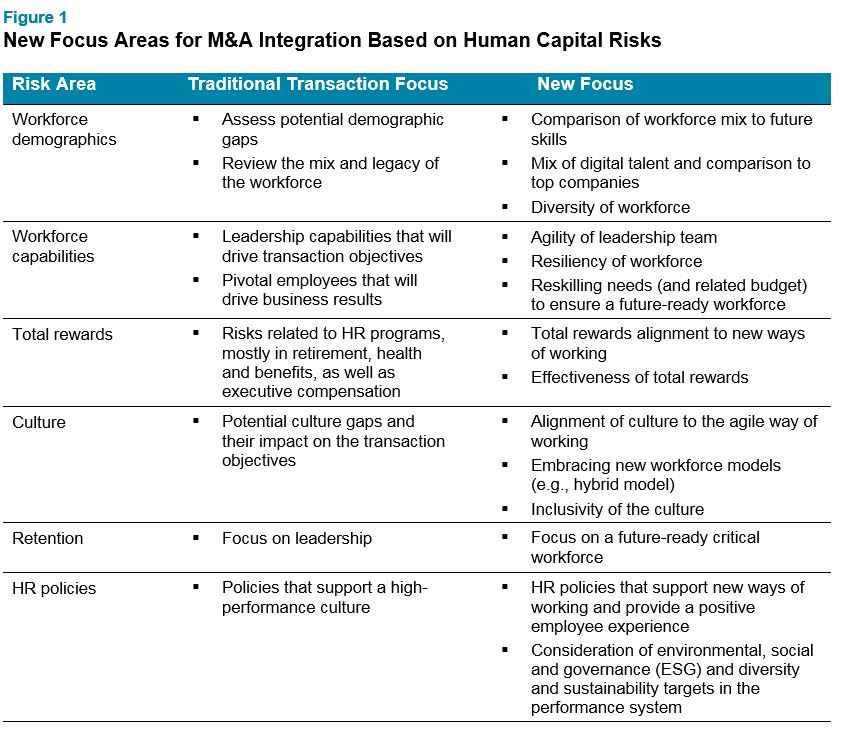

Below we suggest some new focus areas for businesses involved in transactions that are based upon emerging human capital risks. These considerations are intended to encourage companies to ask how “future-ready” the different workforces are that will be coming together.

Next Steps

Human capital is a complex risk that is becoming more influential during M&A transactions. With growing recognition that people-related risks can negatively impact both brand and financial capital if not properly managed, we encourage business leaders to ask the types of questions we lay out in the table above. The standard risk areas will remain valid in future transactions, but by adding a more future-orientated view of addressing these risks, companies are in a better position to address human capital integration early on.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.