The Australian Prudential Regulation Authority (APRA) recently issued a revised draft of a new standard dedicated solely to remuneration, updating requirements with a more principles-based approach. This article highlights key updates and what actions firms should take now.

The Australian Prudential Regulation Authority (APRA) issued a revised draft [1] of prudential standard CPS 511 Remuneration on 12 November 2020, seeking to lift the minimum standards of practices across all APRA regulated entities [2] in response to the Financial Services Royal Commission. APRA describes the revised proposal as strengthening “market practice through more principles-based minimum requirements” relative to the initial version released in July 2019. The new approach is risk-based and proportionate, outlining more comprehensive requirements for regulated entities classified as Significant Financial Institutions [3](SFIs) and an earlier adoption date as part of a phased implementation timeline.

The prudential standard will operate alongside the Financial Accountability Regime (FAR) proposed by The Treasury in January of 2020 (read our past article, New Regulatory Requirements for Insurers Post Financial Services Royal Commission), which extends the Banking Executive Accountability Regime (BEAR) to all APRA regulated entities. And while there has been no update from The Treasury on the expected timeline for implementation, APRA has stated that it will continue to work to ensure appropriate alignment and review if changes are required upon finalisation of the legislation.

Overall, we expect firms will react positively to the revised draft, particularly the lifting of prescriptive requirements relating to financial measures in incentive design. We also anticipate firms to welcome the delay from the initial proposed implementation date of 1 July 2021.

Industry consultation on the standard closes on 12 February 2021, with APRA stating its intent to “finalise CPS 511 in the second quarter of 2021.

This article provides an overview of the proposed requirements and what actions firms should take now. Over the coming months, we will release a series of articles addressing specific areas of focus by sub-industry.

APRA has stated the goal of the revised requirements is to lift the minimum standards of practices through:

- Enhancing board oversight (increased transparency driving stronger board accountability on remuneration outcomes);

- Increasing the use of non-financial measures in remuneration design (stronger incentive for individuals to manage non-financial risks); and

- Ensuring appropriate financial consequences for poor risk management (consequence management framework).

The core requirements that provide the foundation for CPS 511 are listed below.

Proportionate Approach

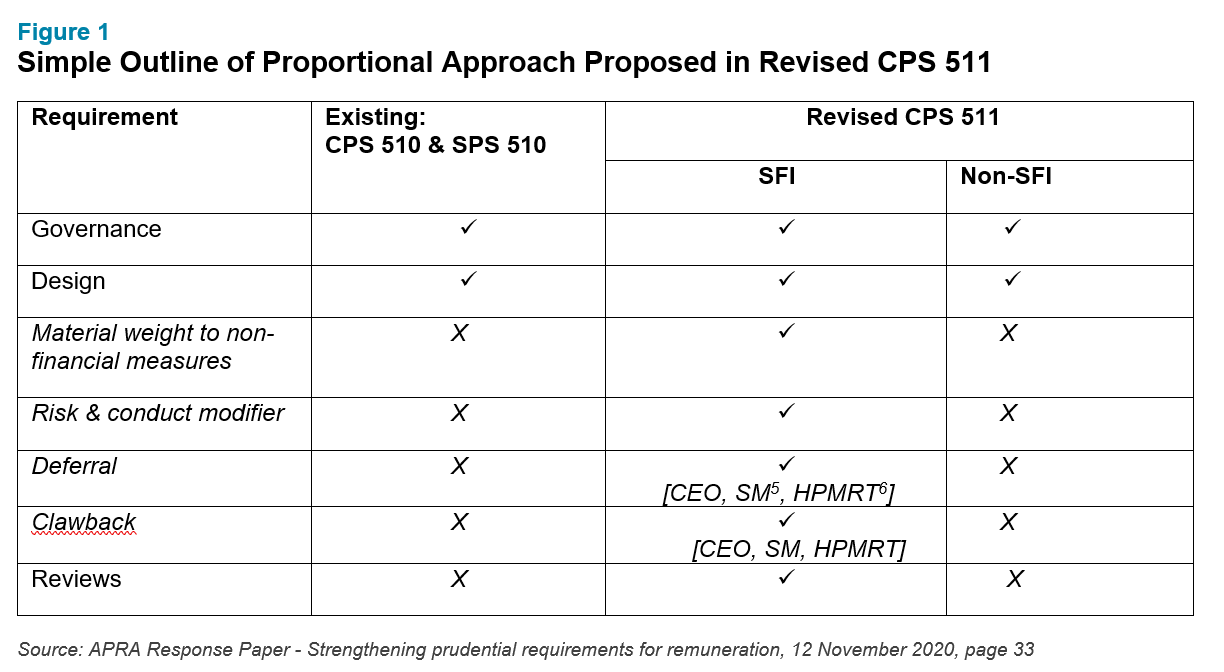

Consistent with the initial draft, APRA has adopted a proportionate approach, outlining more comprehensive requirements for regulated entities classified as Significant Financial Institutions [4]SFIs). It has further simplified requirements for non-SFIs in response to industry feedback on minimising compliance costs and ongoing regulatory burden, which, in certain areas, has resulted in less onerous requirements than for those in the existing standard.

The below table is an extract from APRA’s response paper, providing a simple outline of the differences in requirements based on entity status.

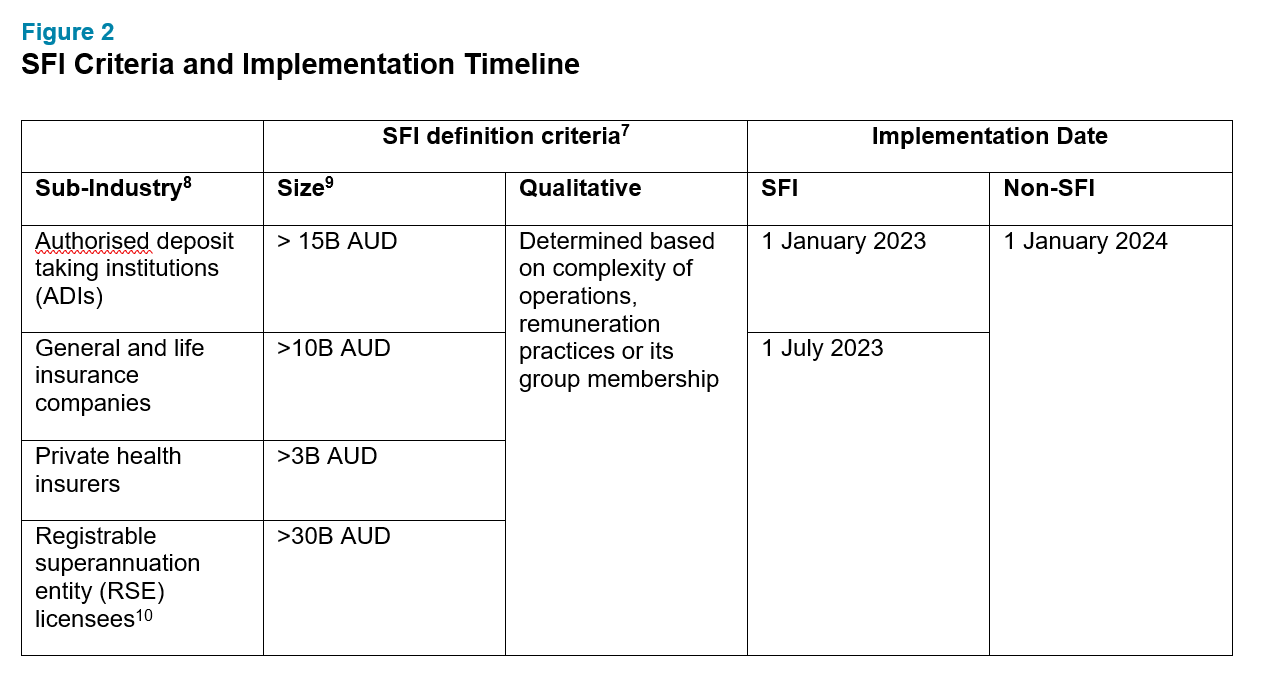

Given the additional requirements for SFIs, the first step firms should consider when undertaking an assessment is to determine their status. An entity only needs to meet the size or qualitative criteria under the standard.

The following table details the criteria and corresponding implementation timeline proposed.

APRA will advise entities of their status with relevant reasoning by Q3 2021, following the release of the final standard.

APRA will advise entities of their status with relevant reasoning by Q3 2021, following the release of the final standard.

Governance

Boards will need to demonstrate that they “bring rigour and challenge” in their oversight of the remuneration framework, decisions and outcomes, having not been sufficiently engaged in the past, according to APRA. The documented Remuneration Policy is required to set out the systems and processes supporting implementation of the entity’s remuneration arrangement, including the assessment of performance, conduct and consequences, formalising the processes associated with how remuneration outcomes reflect risk outcomes in the business.

Boards are set to approve remuneration outcomes at:

- the individual level for CEOs, Senior Managers and executive directors, and aggregate level for HPMRTs and MRTs.

- aggregate level for HPMRTs and MRTs

Additionally, SFIs will be required to:

- establish a board remuneration committee

- undertake an annual compliance review of the framework and a triennial review by “operationally independent, appropriately experienced and competent persons,” with management to document and report the results to the BRC or “relevant oversight function.

APRA will provide guidance on examples of better practices in the CPG 511 accompanying practice guide, to be released Q4 2021.

Remuneration Design

The revised standard:

- covers remuneration arrangements for all employees;

- for third-party service providers, refocuses the policy intent, clarifying that entities are required to make an overall assessment of a service provider’s remuneration arrangements. It also provides discretion on this process;

- extends the definition of variable remuneration to include service period requirements capturing sign-on awards; and

- specifies remuneration adjustments to include in period adjustments, in addition to malus and clawback

The following remuneration design requirements are specific to SFIs:

Material weight to non-financial measures

Material weight must be given to non-financial measures when determining each component of a person’s variable remuneration that is performance related.

The term “material” has not been defined in the standard. APRA acknowledges that it “carefully considered industry concerns” in proposing a hard limit on the use of financial measures in the initial draft, referring to Commissioner Hayne’s comments that the “optimal balance will be a process of trial and error and, as such, different for each organisation and at each staff level.”

APRA will again provide further guidance in CPG 511 on establishing both a framework to determine appropriate non-financial measures and the definition of “financial measures.”

Risk & Conduct modifier

Firms are required to have a mechanism to potentially adjust variable remuneration outcomes to nil in order to reflect known risk and conduct incidents based on clearly identified criteria, which, in APRA’s view, will reinforce a material weight to non-financial measures within a person’s variable remuneration. This is expected to take the form of a risk and conduct modifier, as outlined in the response paper.

Practically, these two requirements will represent the most significant change. Firms will need to review their remuneration framework and all existing incentive plans, both short- and long-term, to ensure these two design components are met.

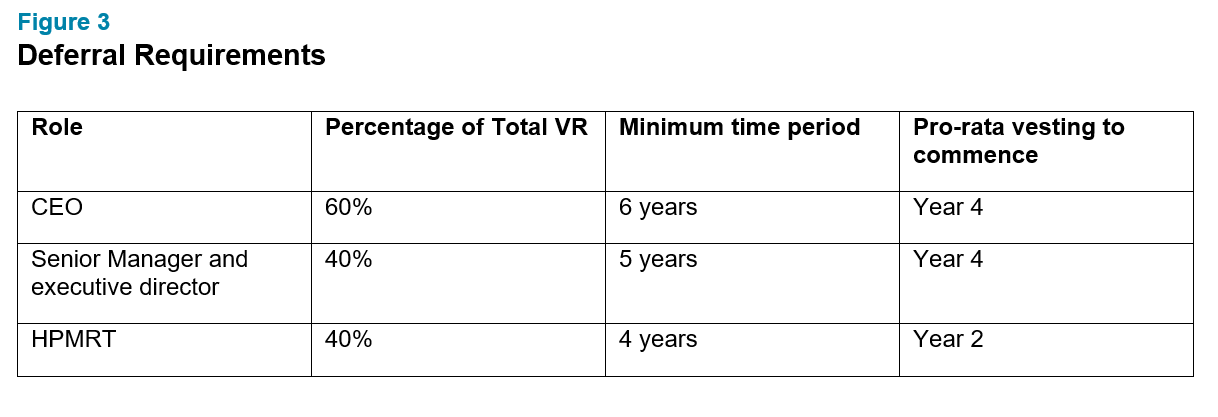

Deferral

Deferral periods will apply to specific roles only when deferred variable remuneration (VR) exceeds $50,000 AUD in a financial year.

The table below outlines the requirements. A reduction in time period from the initial proposal now includes the period over which performance is assessed if measures are forward-looking.

Firms should note the deferral threshold aligns with BEAR and The Treasury’s proposal under FAR. Additionally, with the definition of variable remuneration extended to include service period requirements capturing sign-on awards, APRA has indicated that it will once again outline better practices in CPG511.

Clawback

For specified roles,[11]variable remuneration will be subject to clawback arrangements for a minimum period of two years post payment or vesting, regardless of whether the person remains employed or engaged.

APRA has clarified in the response paper that the policy intent is for the application of clawback to only be considered in exceptional circumstances and narrowed the criteria for its use, now aligning it with the criteria for malus in the standard.

Disclosures

With increased transparency[12]identified by the APRA Chairman as a key component of the proposal, APRA has stated that entities should expect significantly enhanced reporting and disclosure requirements and will need to demonstrate publicly how they are incentivising staff to manage risks. They will also be expected to hold staff accountable for adverse risk and conduct outcomes, given the more principles-based minimum standard approach.

Requirements are yet to be determined, with APRA planning to consult on the topic by late 2021 and finalise by late 2022.

What should firms be doing to prepare?

It’s important to note that this consultation period will close on 12 February 2021, with the intention to finalise the standard in the second quarter of 2021.

While the final standard may be slightly altered from the proposed principles stated above and the timeline for implementation appears generous (at least 18 months from release of final standard to first implementation date), we recommend that your firm take stock of its existing incentive plan and remuneration policies and practices as soon as possible. Given the additional requirements for SFIs, the first step to consider when undertaking an assessment is evaluating and confirming your status. This will help determine the extent to which your firm currently aligns to Australia’s regulatory direction and help prepare for any change that lies ahead. Don’t underestimate that amount of work involved in this process.

Remuneration arrangements will need to be compliant with the standard if the opportunity to earn variable pay occurs at or post the relevant commencement date, therefore covering performance years beginning on or after the applicable implementation date.

Firms classified as SFIs should also be aware that post release of the final standard, APRA expects businesses to undertake a self-assessment and develop an implementation plan, which may need to be shared with its supervisory teams.

In taking deliberate action to prepare your organisation, be sure to avoid knee-jerk reactions that could potentially put your firm into a compliance straight jacket. As the financial services sector operates in a shifting governance and competitive landscape, Standard CPS 511 presents an opportunity to ensure that policies, systems, processes and practices are fit for purpose, as well as aligned to stronger standards of governance.

If you’d like to learn more about the new APRA Prudential Standard and how to ensure your firm’s remuneration framework, policies and practices are ready for evolving regulation, please contact our team.

Related Articles