Using new data from Aon’s Salary Increase and Turnover Survey, as well as observations from our client engagements, we examine trends to see which industries are most impacted by turnover and where employers need to focus efforts to attract and retain talent.

The news is everywhere: As many organizations recover and reshape their business, they are actively growing headcount and taking extreme measures to do so with incentives and different approaches to total rewards. Meanwhile, remote working has opened new talent pools while employees have been evaluating what they want out of life and their career. These trends have combined to create a phenomenon known as “The Great Resignation” — a mass exodus of workers leaving their jobs for new opportunities.

But is the perception of greater job mobility actually translating to higher employee turnover? And what can employers do to proactively retain talent and grow their business as they face competition in the job market? In this article, we examine these questions using the latest public and proprietary data, as well as observations from our experts who have worked with hundreds of clients in the past year to manage their talent and rewards strategy.

Are Employees Quitting in Record Numbers?

A recent Microsoft survey found that 41% of workers around the world are thinking about quitting their jobs. But thinking and acting can be two very different things. Indeed, in the United States, workers are quitting in higher numbers. Nearly 3.98 million workers quit their jobs this July, an increase from 3.87 million in June, based on the Bureau of Labor Statistics' Job Openings and Labor Turnover Summary. That number is a slight dip from April, where a record-setting 3.99 million workers quit their job. At the same time, job openings increased to 10.9 million in July, also a record-setting figure.

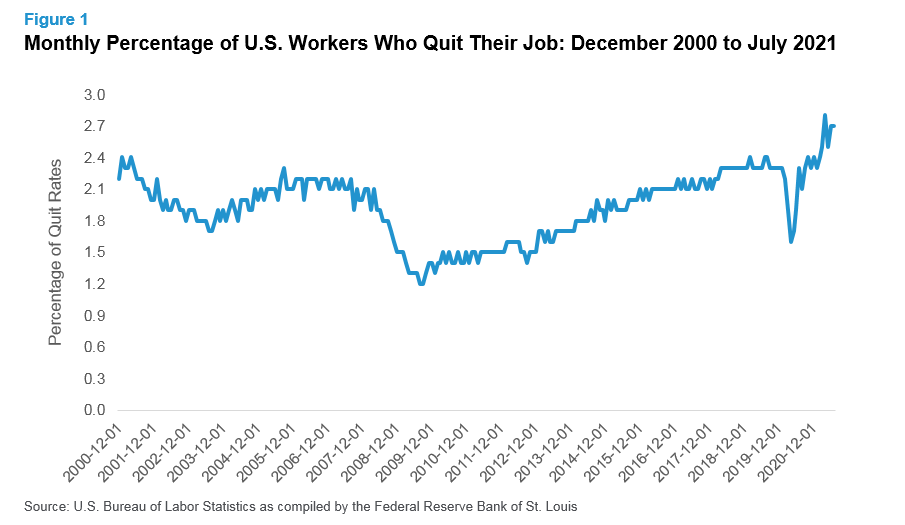

A longer view of employee turnover rates shows the number tends to closely track economic activity — rising when the economy is doing well with a spike immediately following a downturn. So, while it’s clear the U.S. is experiencing a record-high quit rate since the government has tracked this number for the past two decades, Figure 1 shows that turnover rates always creep up when there is an economic rebound.

“The moment the fog lifts and things free up again, turnover goes up and tenure goes down,” Stefan Gaertner, a partner at Aon’s human capital business who has studied employee turnover, told Aon’s The One Brief. “Part of what we’re seeing right now you could think of as pent-up demand for a new job, because people were not really changing jobs last year.”

There are also other factors that can explain higher turnover in the past year. This includes individuals leaving their jobs out of health concerns, a lack of childcare, burnout (an acute problem in the healthcare industry) or remote work providing new opportunities that weren’t previously available (see our article “Talent Recruitment Has Changed: What it Means for Peer Groups, Benchmarking and Employee Experience” to learn more.).

A Shorter View of Turnover Reveals a Different Story

To get a sense of how turnover has changed more recently before the pandemic to today, we examined data from the second edition of Aon’s Salary Increase and Turnover Study. The data represents around 2,500 companies across 43 countries.

What we find is that turnover has not increased across the board from June 2019 to June 2021. Throughout both year-long periods, the COVID-19 pandemic and business uncertainty likely had an impact, resulting in spotty turnover trends. If we focus on key industries globally (see Figure 2), we find turnover is more robust in certain industries that remained strong or grew during the pandemic, including life sciences and manufacturing. In these industries employees were more likely to have abundant job opportunities. Other industries like media and entertainment saw a decline in turnover over the two-year period.

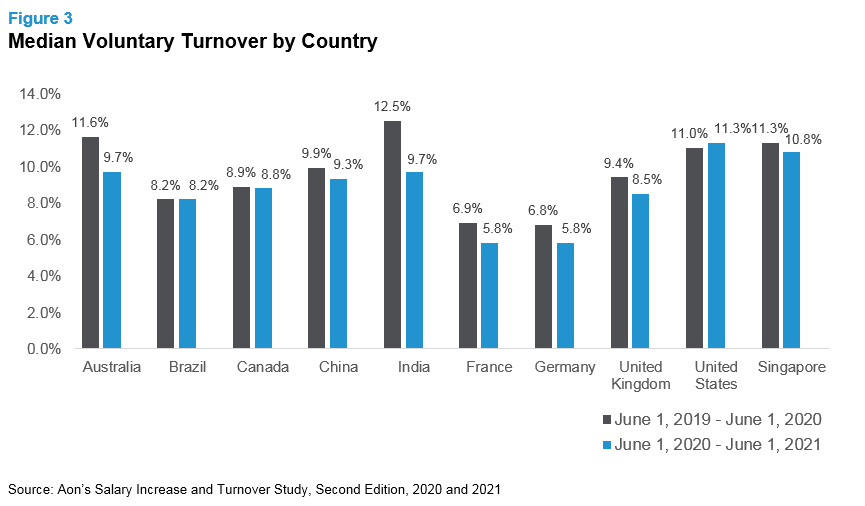

Taking a global view agnostic of industry, we also observe mostly flat or declining turnover (see Figure 3). From June 1, 2019 to June 1, 2020, there were only a couple months where most countries were grappling with the pandemic. However, during June 1, 2020 through June 1, 2021, countries were in various stages of battling surges of the virus and enacted different mitigation measures like lockdowns. In the past year, the U.S. experienced a modest increase in turnover while Australia, China, India, France, Germany and Singapore experienced declining turnover. Other countries were mostly flat.

We should note that it is quite possible, even likely, that turnover will rise in more industries and countries in the next edition of the survey that will capture June 1, 2021 to June 1, 2022. In fact, based on our work with clients in recent months, we have observed a recent surge in hiring and turnover activity as companies continue to reshape their business following more than a year of business disruption. In the U.S., 31% of the 2,414 companies in our Salary Increase and Turnover Study say they are aggressively hiring. Other countries report more modest headcount growth plans as of June 2021. However, as with turnover data, in this case the reported information may be lagging real-time conditions from the past few months.

Aon Partner Martin McGuigan, who is based in the United Arab Emirates, described the current environment in the Middle East as “The Great Re-Hire” instead of “The Great Resignation.” And in the United Kingdom, where 12% of companies report aggressive hiring, a shortage of delivery drivers and other jobs has made headline news across the world.

Attracting and Retaining Talent in a Competitive Environment

Even if a company isn’t experiencing record-setting turnover among its staff at this point in time, new job openings have increased based on government and Aon data. With hiring activity increasing and many employees re-evaluating what they want from their job and career, every employer needs to double down on efforts to retain and attract talent.

Companies are responding in a variety of ways that include — but also go beyond — base pay compensation. One strategy is to really focus on providing additional pay through short- and long-term incentives. “Every retailer is trying to beat out everyone else on the base pay front. Ensuring that their incentive plans are highly effective allows them to better manage fixed cost, drive the right behaviors, and attract and retain the type of employee who thrives in this environment,” says Kelly Voss, a partner in Aon’s human capital business who leads the retail practice.

Meanwhile, salary increases have remained fairly stable from 2020 to 2021, according to Aon’s Salary Increase and Turnover Study. “Budgets for merit increases, promotions and general increases have not moved much in the past year, even among the highest-paying companies,” says Tim Brown, a partner in Aon’s human capital practice who leads the study.

There is one interesting standout in the data: The highest-paying companies have increased overall budgeted spend, and that trend is more pronounced among technology companies.

“That suggests to me the salary increase budget is being set aside to be used later in an uncommitted purpose,” Brown says. This could include internal and external equity concerns, counter offers or needing to respond to rapid movement in salary ranges for certain jobs.

“It’s no surprise we’re seeing this more among technology companies where the competition for digital talent is particularly fierce,” Brown adds.

Simply continuing to target above-market pay for new hires or offering higher salary increases or incentives to tenured employees may be a good short-term measure, but it isn’t a sustainable solution for most companies in the long run. Aside from creating internal pay equity concerns, it puts more pressure on operating margins and may prevent employers from investing in other critical areas of total rewards.

“Retaining talent with counteroffers is a worst-case-scenario, which is why we are seeing more companies giving one-time recognition bonuses to all employees, out of cycle equity grants, and across-the-board salary increases to take the edge off the pull of the market to employees,” says Brooke Green, a partner in Aon’s human capital business.

More cost-effective and sustainable solutions include:

- adding flexibility to where and how work gets done,

- providing better manager training (particularly when in a remote working environment),

- getting better at targeting high potentials with differentiated pay, and

- providing compelling career paths and opportunities for development.

These initiatives map up to a more compelling employee value proposition. Before a company takes any major action, they should also seek employee feedback about what they value. (You can learn more about Aon’s new total rewards approach in our video.)

As we evaluate whether the hype over “The Great Resignation” is warranted, the question really should shift to, “What is my organization doing to improve the employee experience?”, says Green. “Any level of turnover is painful, but most companies are worried about critical talent far more than their overall turnover figures,” she says.