This article takes a look back at the year and a look forward, highlighting profits and losses, as well as adjustments property-casualty insurance firms should make to their human capital strategies to successfully embrace agility and the future of work.

The property-casualty insurance industry in the United States (U.S.) faced various challenges in 2020 from not only the global COVID-19 pandemic and civil unrest, but also significant losses from catastrophic events and lower premium production. Despite all this, the sector remains financially strong with a solid foundation for the future. There’s no doubt that 2021 will be a transitional year for companies as they continue to return to the workplace and adapt to new working models that embrace more flexibility and workforce agility for remote opportunities.

Industry Overview

Past strategies paved the way for strong performance and the future of the property-casualty insurance industry. Last year started on a high note for most companies, as they entered 2020 with favorable financial results from the prior year. However, the global pandemic, paired with historic catastrophic activity such as wildfires and storms, left a negative impact on industry profitability.

The industry’s operating model has been rapidly changing for the past several years, with an increased focus on technology investments in core systems, analytics and product and price sophistication. These investments, along with innovation in remote work capabilities, created a near seamless transition to a virtual environment as the pandemic swept the globe.

The continuous development of mobile and online tools to improve the agent and customer experience proved to be extremely beneficial. These robust sets of tools enabled carriers to communicate easily and effectively with customers, while also maintaining productivity and service levels.

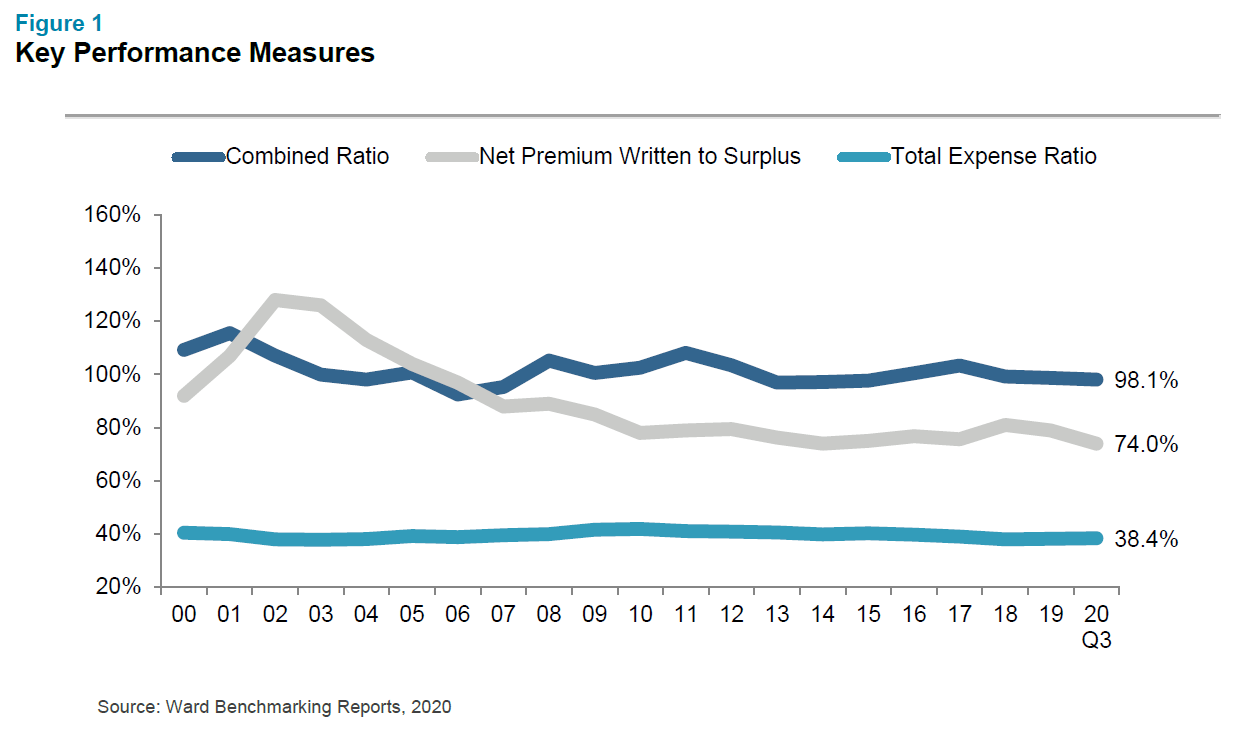

Low bond yields have kept the focus on achieving profitable underwriting results and are likely to continue for the foreseeable future. Premium growth through the third quarter of 2020 was 2.7%, which was 2.8 points lower than the corresponding timeframe in 2019. Premium decreases in workers’ compensation and premium refunds in personal auto had a notable impact on overall premium level. Despite lower premium growth, property-casualty insurance remained profitable for the first three quarters of 2020, making the industry financially well-positioned entering into 2021.

Net income dropped in the first three quarters of 2020 – $35.5 billion compared to $48.2 billion in 2019 – and policyholder surplus grew $24.4 billion (3.0%). As a result, the net premium written to surplus ratio improved to 74%. The total expense ratio, including underwriting and loss adjusting expense, increased slightly to 38.4%, up from 38.2% in 2019.

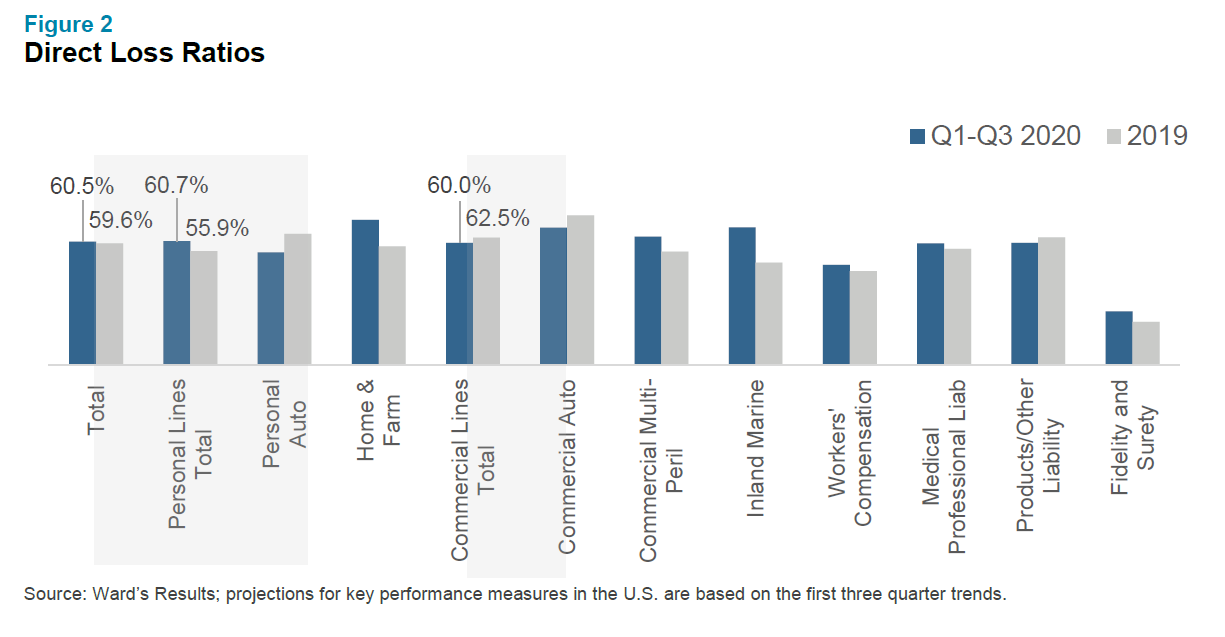

Direct loss ratios were mixed by line of business in 2020 (as seen in Figure 2), but most lines of business had higher loss ratios through the first three quarters of the year. The estimated $8 billion in wildfire losses in California, in addition to record storm landfalls and derecho events, all had a significant impact on property losses. However, the pandemic’s stay-at-home orders dramatically reduced miles driven and claim volume for auto lines, resulting in only a one percentage point increase year-over-year in total direct losses.

Human Capital Trends

Employment Rates

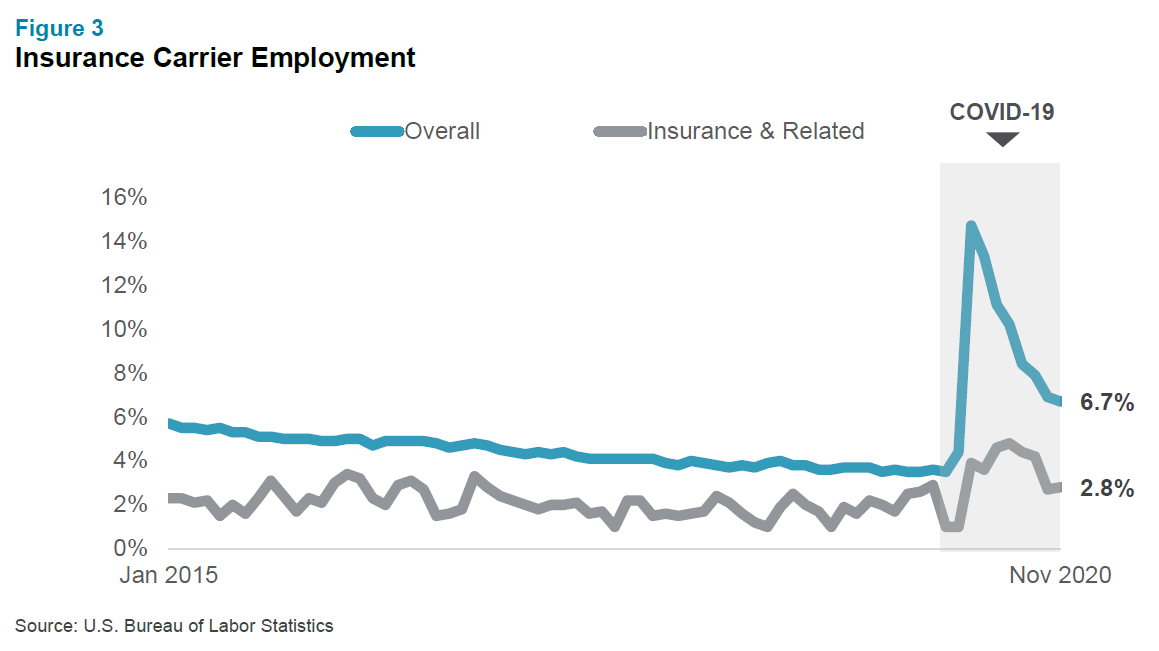

The insurance industry remains focused on human capital, with this past year demonstrating strong workforce resiliency. Unemployment remained low, with most companies able to leverage electronic and social distancing policies to retain and attract key talent. Entering the COVID-19 pandemic, the overall U.S. labor market was strong. The unemployment rate rested at 3.5%, and the insurance industry compared slightly lower at 1.0%. As unemployment spiked in the early months of the pandemic, the increase for insurance peaked at just 4.8% compared to 14.7% for the broader U.S economy.

Hiring and Headcount Updates

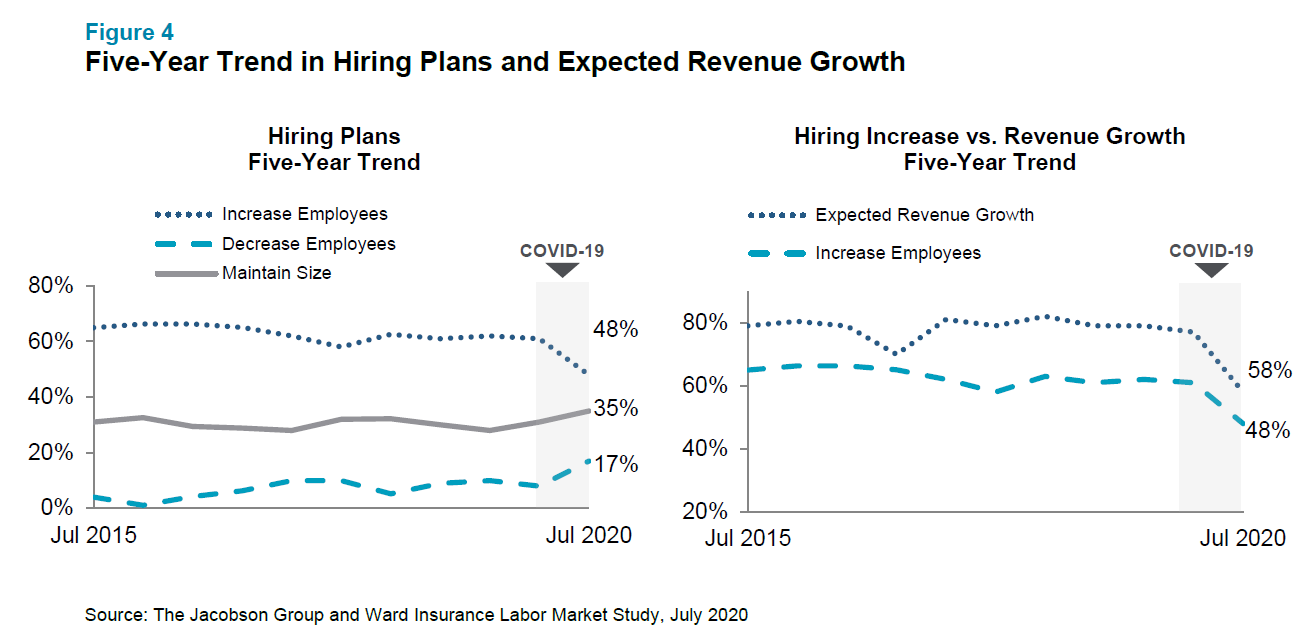

Hiring increases slowed in 2020, as companies evaluated the impact of COVID-19 on business demands. The semi-annual Insurance Labor Market Study, conducted in partnership with the Ward benchmarking practice at Aon and The Jacobson Group, showed that 58% of companies expected an increase in revenue in July 2020 – which was down 19 points from the January survey – while 35% of companies expected flat premium growth in 2020, up 13 points from January. Unsurprisingly, hiring expectations followed suit, with more companies anticipating either maintaining or reducing their employees. The number of firms increasing employees dropped by nearly 12%.

Over the past five years, the property-casualty industry has seen an approximate 5% increase in total headcount. However, back office general support and claims support functions have experienced slight decreases. Other corporate support functions, including finance, human resources and billing, remained relatively flat. Information technology increases continue to outpace overall headcount growth, with the use of both internal headcount and third-party contractors. Front-line adjusting and appraising headcount grew by 10%. Job roles related to analytics continue to grow, with more specialization in specific areas like sales and marketing, pricing and product development, and claims. Commercial lines also rose significantly, as companies continue to invest in new products and better price sophistication.

Employee Turnover

Employee turnover has remained relatively unchanged over the past year, especially in executive, field sales and corporate roles. About 35% of companies reported a decrease in employee turnover and only 5% of companies reported a slight increase in turnover. A likely key factor is economic uncertainty, which placed a temporary pause on recruiting and new job searches from prospects for most companies.

Recruiting challenges are expected to continue in the short term, since companies often find it challenging to recruit candidates that are willing to change jobs given the continued uncertain economic conditions. Making hiring decisions without in-person meetings only adds to this challenge, although virtual interviews have helped to lessen the impact. As companies develop their employee value propositions to help attract talent, increased flexibility for the workforce will be front and center.

The Impact of COVID-19 on the Future of Work

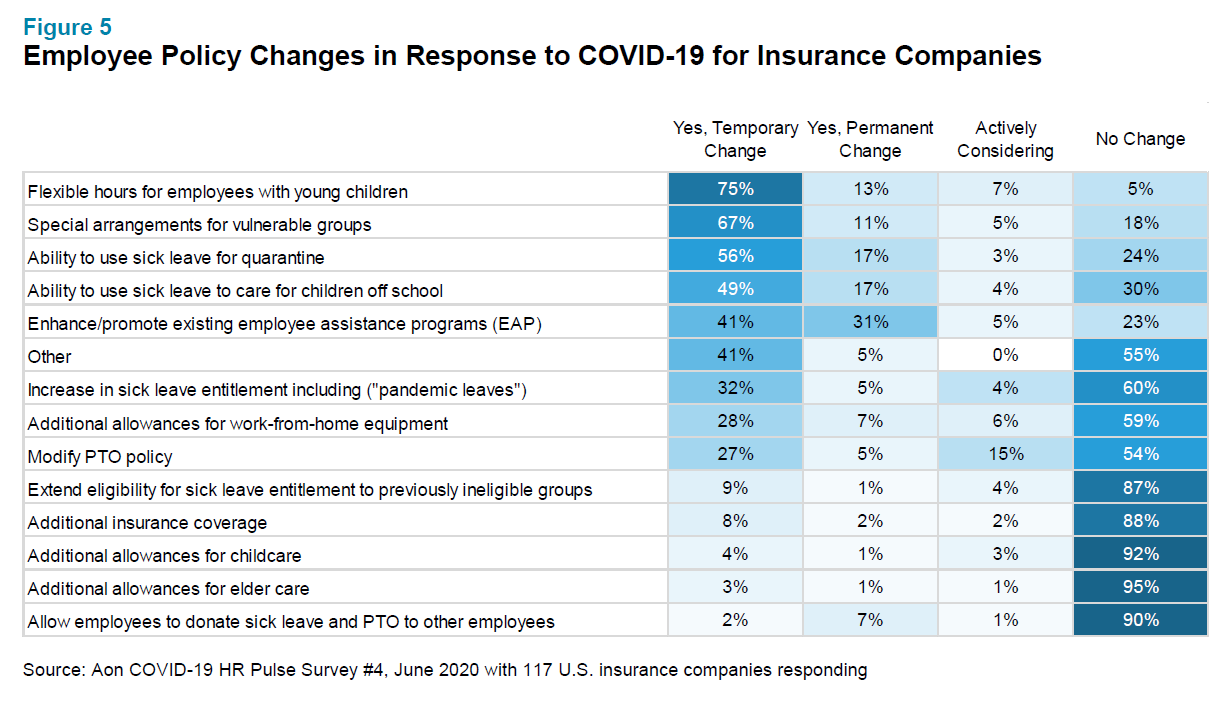

Shifting from in-person to remote work during the pandemic did come with some obstacles, especially for working families. As a result, many companies adapted their policies to allow for flexible working schedules for both on-site and virtual employees. Most of these policy changes are anticipated to be temporary. One notable employee program update involves enhancing employee assistance programs. Nearly one-third of companies reported making these changes permanent. Figure 5 shares other employee policy changes firms have made or are considering on a temporary and permanent basis.

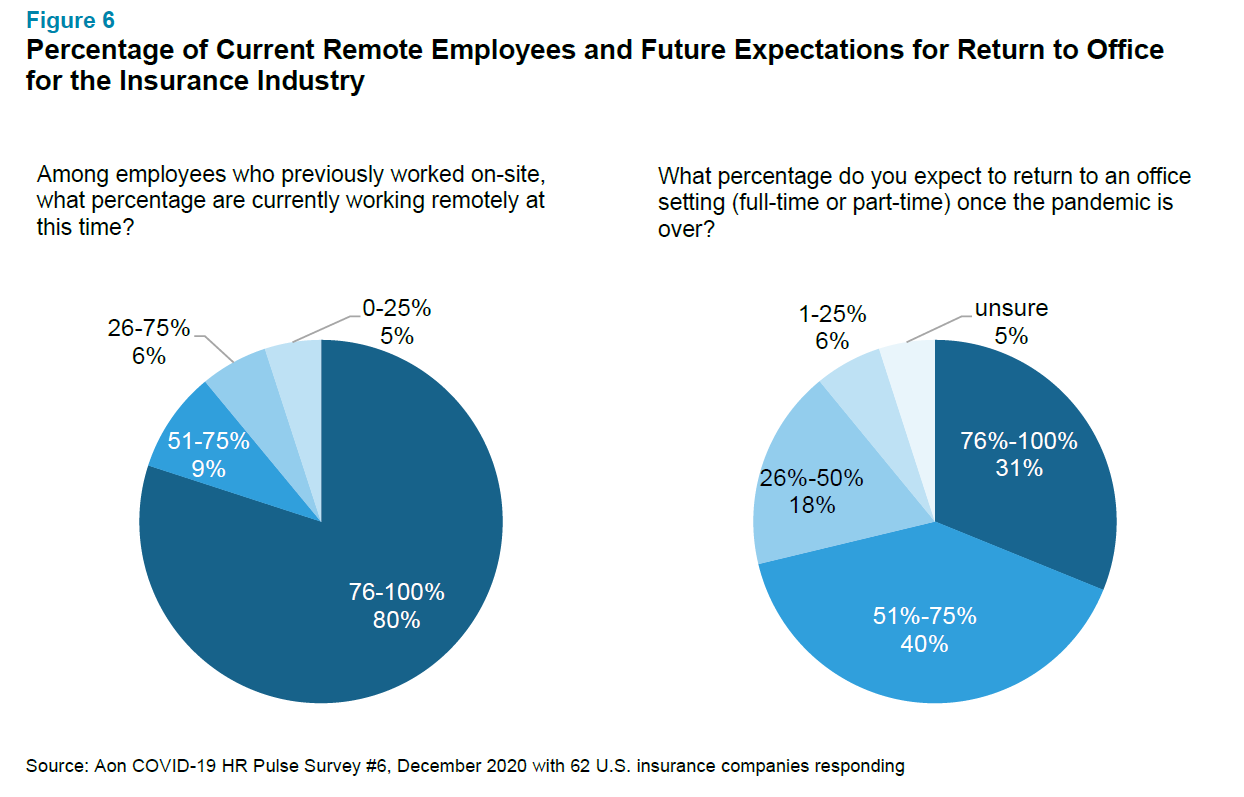

While there have generally not been significant changes to standard work schedules, 74% of companies have allowed flexible working hours for their employees. As of December 2020, 80% of companies reported that more than 75% of their workforce remained remote with no clear timeline for their return. It’s quite clear that the future working model may look very different. Only one-third of insurance companies anticipate that at least 76% of their positions will eventually return to an office setting, with another 40% anticipating between 50-75% of staff returning to the office (Figure 6). Even though many companies plan to reduce their physical presence in the future, a significant reduction in expenses is unlikely in the short term, since most companies are locked into space already owned or leased.

Next Steps

Despite the many challenges of the COVID-19 pandemic, civil unrest and elevated catastrophe activity, there is plenty of optimism for 2021. While year-end financials are still being evaluated, the property-casualty industry remains financially strong. Wise technology investments over the past several years have enabled firms to shift to remote work with minimal disruptions to productivity and service levels. Additionally, the adoption of digital customer interactions may further improve automation and performance.

Many companies are evaluating the future of work, embracing processes, technology and innovation that offer greater flexibility to business practices. Interactions that were once face-to-face have now become virtual and may remain that way in the future. Insurance companies must assess their current practices and strategies and make any necessary adjustments for work to seamlessly get done. And while this may look different – perhaps allowing for a mix of both work-from-home and office arrangements – the need to be agile and innovative is more important than ever before.

To learn more about current and future insurance industry trends for 2021 or to speak with a member of our rewards consulting group, please visit our website here or write to rewards-solutions@aon.com.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles