Using benchmarks to understand the size and cost of your firm’s functional areas is an invaluable tool to compare your spending against peers and determine how to use existing staff more efficiently.

Competitive and regulatory demands for the finance function of most organizations have increased considerably over the last 10 years, raising both the profile and importance of financial reporting and forecasting efforts. Since human capital costs are the biggest expense most companies have, finding synergies between financial forecasts and a firm’s HR function can result in significant cost savings and efficiencies. Historically, financial planning and analysis (FP&A) can be cumbersome and requires a significant amount of manual work in populating spreadsheets, producing PowerPoints and exchanging a high volume of emails.

Not only is this type of work inefficient, but it also prohibits colleagues from focusing on work that drives strategic value. However, when equipped with market benchmarks for the size and cost of finance staff, firms can identify opportunities to restructure headcount in areas where automation is possible. This results in new opportunities for existing colleagues and reinforces talent retention. Organizations can evaluate current resource requirements and ultimately make any necessary adjustments to improve existing business operations.

To solve for this need, Aon’s performance and analytics practice has partnered with Anaplan, a business planning software firm, to build a Size and Cost Benchmarking solution that streamlines financial reporting, forecasting and workforce planning. With 86 percent of HR leaders saying talent shortages are a top concern[1], this solution provides a better way to leverage the skills an organization already has through automation of the most manually intensive elements of the job, allowing employees to participate in more transformational work.

“As companies work to scale their business, it’s not just a matter of adding more talent, but creating more capacity with better tools and unlocking new capacity and cost savings you previously didn’t think possible,” says Chris Brown, chief operations officer for Aon’s human capital team in North America.

This article answers the most common questions we hear from clients regarding challenges around their FP&A processes and how a financial planning solution like Size and Cost Benchmarking can help.

1. What will Size and Cost Benchmarking do for my organization?

Using benchmarks provides the beat on what the market looks like for the labor associated with a firm’s finance function. It identifies where you need more capacity to get the job done, where you need less, what can be automated and how you can best use existing resources to help fill any gaps.

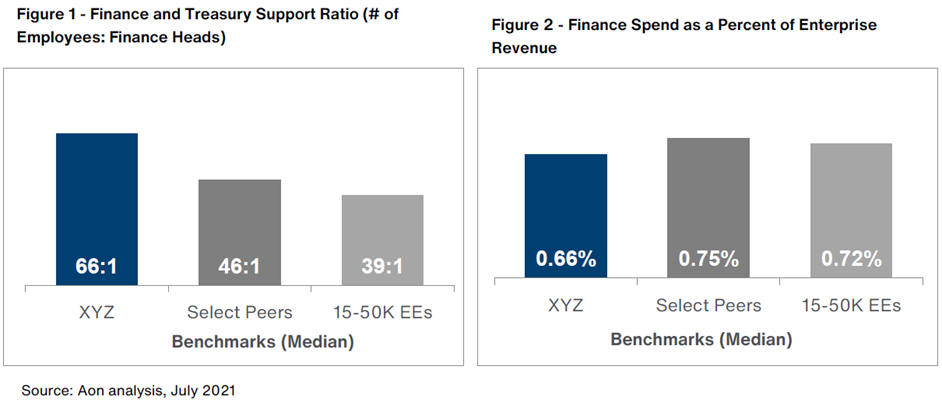

To put this into perspective, firms typically spend 0.5 to 3.0 percent of revenue on their finance function. For a business generating $5 billion in revenue, this equates to between $75 million and $125 million. FP&A comprises around 20 percent of the total finance function and is key to driving strategic plans. Therefore, having an agile solution for forecasting is beneficial from a cost efficiency standpoint and improves effectiveness of the function overall. Access to tangible data on spend and structure of a firm’s finance and FP&A process offers a holistic picture on cost. It also reveals how the function operates relative to peers and provides the necessary insights to make informed business decisions for the future.

The charts below offer a benchmarking example of a banking client (represented as XYZ in the charts ) we supported based on size (Figure 1) and cost (Figure 2).

Years of data and business partner interviews suggest cost efficiencies of up to 50 percent across the FP&A function when implementing a solution like Size and Cost Benchmarking. The process helps functional areas regain their capacity and ultimately improve overall business performance for the future. It targets opportunities and can diagnose whether automation is the most effective answer for your organization.

2. What can firms do to appropiately size their finance function after an M&A transaction?

After an M&A transaction, firms should assess the size of their finance function against the overall size of the firm and what the typical functional finance roles are for a company of that size. It’s also important to consider if the function is paid an appropriate percentage of overall firm production and what the mix of title levels is for senior leaders. Not only will this ensure accurate spend, but it will also boost morale and retention within the workforce knowing that their roles are meaningful and properly valued.

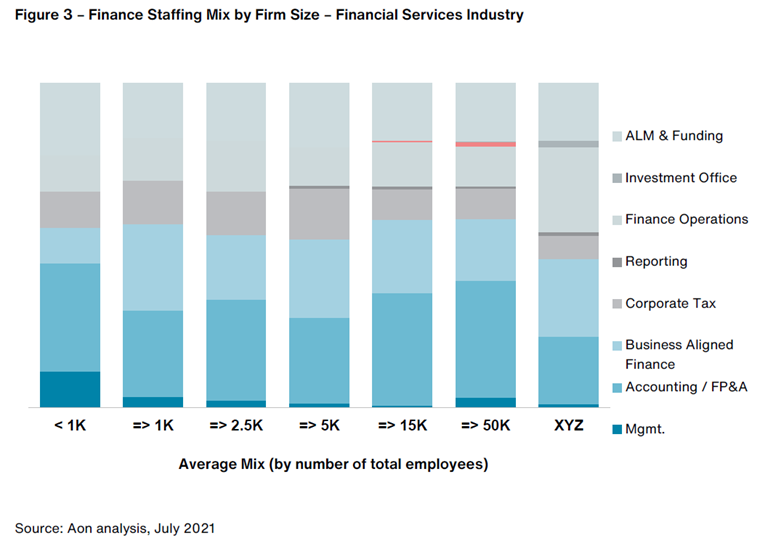

Lastly, don’t forget to ensure that your newly merged organization has a finance function that is appropriately sized to support its client-facing population. When two smaller firms merge to create a much larger entity, what does the finance function now look like at that level? To illustrate how the composition of the finance function changes with size, see Figure 3, which analyzes our banking client against various firm sizes.

3. How can your business unlock existing capacity within the finance function?

By automating the manual effort associated with a typical FP&A process (budgeting, forecasting, management reports, dashboards), the finance team is able spend more time partnering with other parts of the business and is better positioned to efficiently scale the function to accommodate growth. Through connected planning and forecasting, Anaplan allows firms to ingest source data into the platform through scripts or APIs and integrate with algorithms that essentially perform the most time-consuming FP&A tasks. Gone are the days of onerous models, labor-intensive variance analysis, scenario analysis and management reporting.

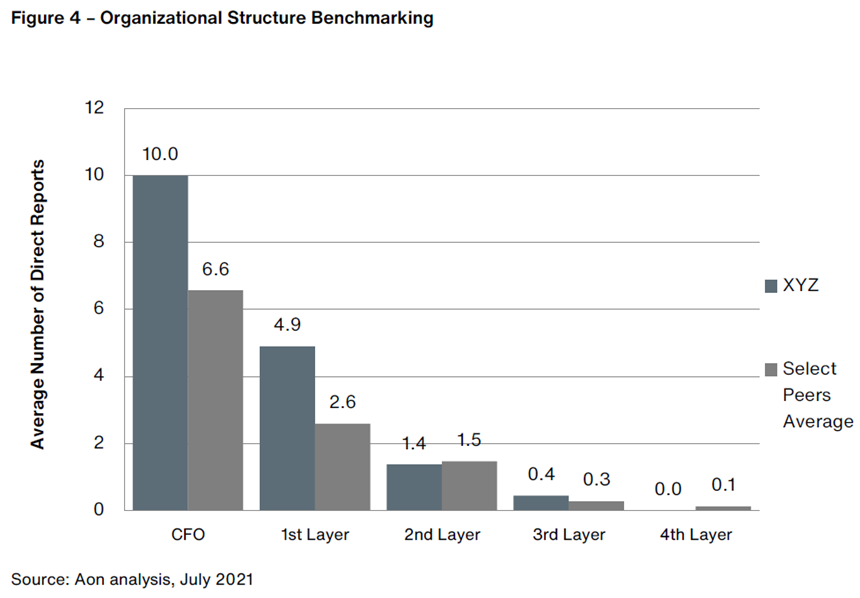

Benchmarking the shape and structure of your function by applying these proposed tools can make the organizational structure of finance more efficient. (e.g., less direct reports for managers so they can focus on value-adding activities).

4. In addition to finance, how does this solution help the HR function with strategic workforce planning?

A solution such as Size and Cost Benchmarking enables a seamless connection between HR and finance data. This then delivers improved and timely visibility of workforce trends to functional leaders. Given historical trends and current market conditions, is your firm positioned to support future demands for talent? A thorough assessment of your existing functional data can help answer this question.

Finding the right finance talent in the right places to ensure location-based efficiencies is also a challenge many firms face — especially with growing economies and acute talent shortages occurring around the world. However, with the right benchmarks and solutions, rethinking your approach to location strategy and other pressing workforce changes becomes that much easier.

For more information on our partnership with Anaplan and how we can help your finance function operate more efficiently, please contact chris.brown.3@aon.com, dsmith@aon.com or nicholas.yazdani@aon.com.

[1] Aon Global HR Pulse Survey, December 2021 - January 2022.