With sustained high employee turnover, private companies should take a closer look at their equity refresh programs. In this article, published in partnership with Sequoia Capital, we examine using Aon’s data how equity refresh programs are evolving, and ways companies can maximize their programs.

Whether we classify the last couple of years as the Great Resignation, Reset or Reorganization, it has rarely been this difficult to attract and retain great talent. While no company has it easy, startups and other private companies are struggling with constrained cash budgets while competing against the significant equity usage of public companies, especially on an annual basis.

To be successful, founders must foster a culture of building value — and equity plays a key role in bringing that story to life with employees. In this article in collaboration with Sequoia Capital, we examine the latest trends in equity refresh programs and how to ensure programs are designed in a way that maximizes their effectiveness.

How are equity refresh programs evolving?

Equity refreshes are additional grants issued to existing employees who receive new-hire grants. The purpose is to reward and recognize the employee’s contribution to-date, while aligning the individual with the company’s success and value growth going forward. Ensuring that employees hold long-term equity and share in the future success of an organization can be a significant factor in retaining key talent and aligning employees around important long-term goals.

We’re seeing a number of trends in the development of equity refresh programs, including:

- Earlier: Companies are considering refresh programs earlier in both the company and employee lifecycle. This ensures compensation is competitive in the current talent environment and creates further retention and alignment with the future value of the organization.

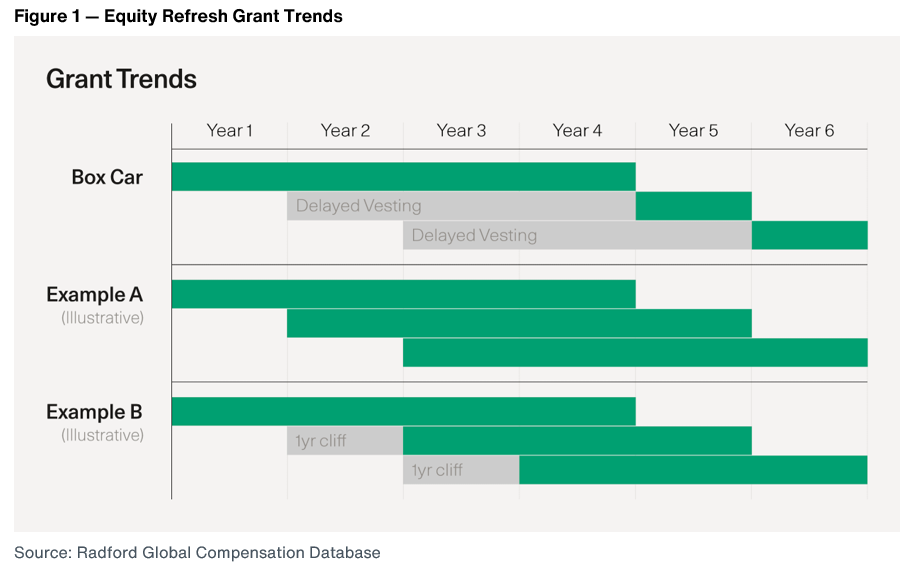

- Frequent: More frequent, smaller grants have become increasingly favorable. This is a marked shift away from the “Box Car” method, which emerged out of the Great Recession in 2009 (see examples in Figure 1).

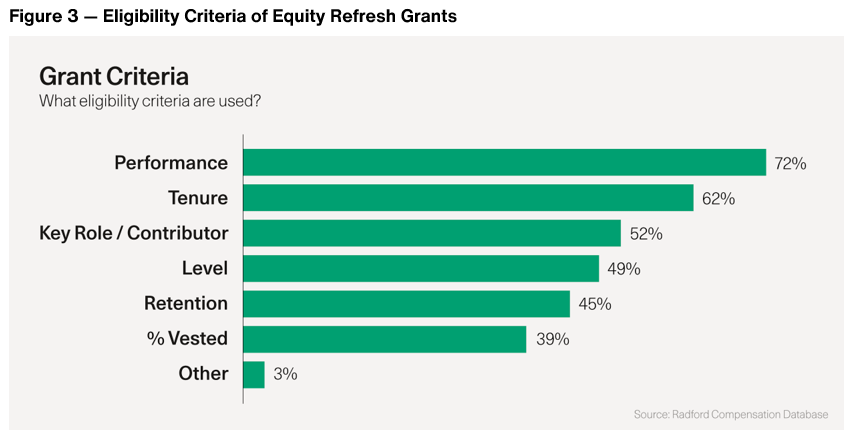

- Selective: While criteria may vary, refresh programs are focused and weighted toward top performers in critical functions.

- Value Communication: An emphasis on transparency around equity value is paramount to ensuring employees truly appreciate their holdings and understand how they may financially benefit with the company’s growth.

Who receives refresh equity?

There’s a wide variance in program eligibility between companies, and the decision of who’s eligible should be rooted in your company’s compensation philosophy. Most criteria around eligibility for such a program is centered around tenure with the organization (in driving its value historically) and performance.

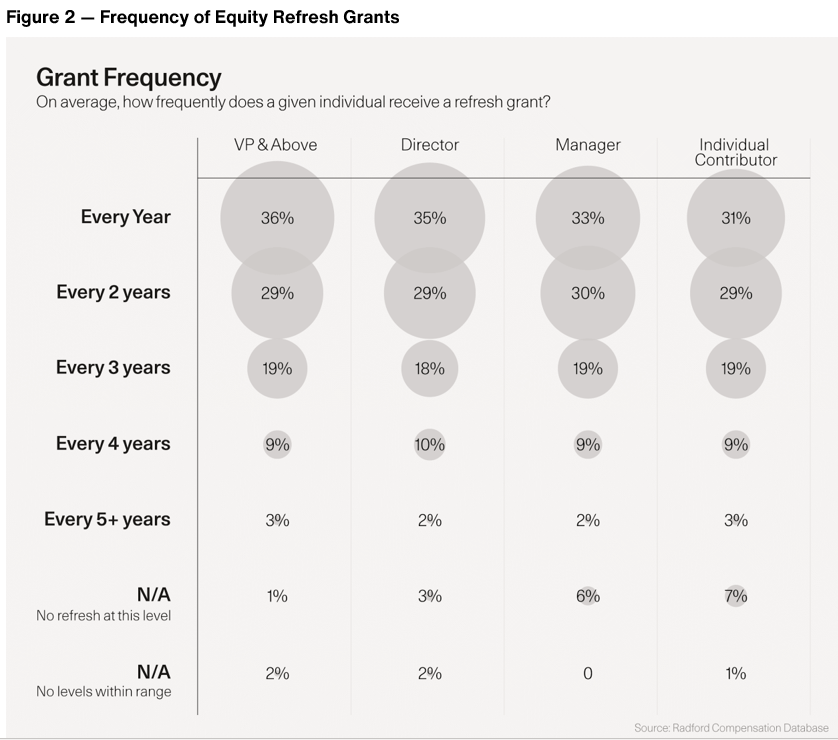

Often, equity refreshes are reserved and weighted toward the company’s top performers within critical talent functions that are considered “growth engines” in the business. Generally speaking, we observe that more frequent equity grants are made to the senior levels of the organization. This may be partially due to employees being hired as individual contributors and then promoted to managerial roles.

What is the typical size of a refresh grant?

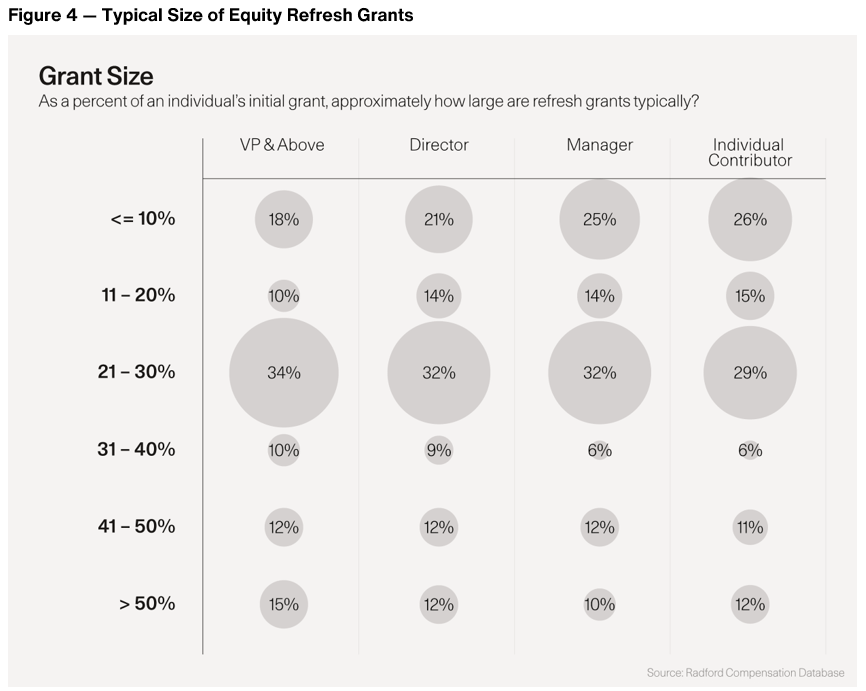

The size of grants can vary based on a company’s compensation philosophy and the acceptable dilution levels to the broader organization. However, most companies aim for a refresh value of 30 percent or lower (25 percent is the industry norm) of a current new-hire grant for the same role and level. Size of grant can vary based on level as seen in Figure 4, but most companies are simply adding a portion of equity to the existing holdings to help drive the right incentives and alignment while not overly diluting the organization.

What is the timing of refresh grants?

Timing is critical and there are two components: when an employee is first eligible, and the frequency of refresh grants. Employees are typically eligible for refresh programs once an initial grant is 50 to 75 percent vested. Budgeting and allocating shares for a refresh program is key, and planning should start in the budgeting cycle just before the first group of employees’ grants reach 50 percent vested. This is often year two of the company and/or the individual’s employment.

In terms of frequency, refresh programs are generally considered on an annual basis for top performers in critical functions. You may want to consider differentiation based on how critical a given job is to the organization’s success. It’s important to note that private companies that are very close to going public will typically issue equity on an annual basis to better align with the compensation structure within public companies, especially at senior levels.

Which equity vehicles are typically used?

Equity types will vary based on the company’s philosophy and goals; however, most equity tends to be granted in the form of stock options. This allows the company to incentivize growth, create long-term shareholder alignment and better control taxation and liquidity. Companies may use full-value shares to avoid the potential of underwater options and maximize retention, especially for the broader population.

In the past couple of years, we have observed a few performance-based equity programs. These grants do not vest until specific performance criteria are met, such as key milestones for the company or even specific revenue or earnings requirements. Several companies have considered such a program lately to create even more direct incentives for employees driving towards long-term growth for the company.

Do employees truly value their equity programs?

One of the most common challenges companies face with the use of equity compensation is helping employees understand the value that they hold. With a more consistent use of equity through refresh programs, companies should also consider robust communication plans to ensure employees truly understand and appreciate the value associated with these programs.

We recommend preparing a robust communication strategy around your annual refresh program to ensure employees understand the value of the stock, when the stock is earned, and how that can benefit them over time. Usually, companies who emphasize the education of equity compensation also tend to be higher performing companies with more retention.

Next steps for re-evaluating your refresh program

After working with hundreds of companies on their equity refresh programs, we observe five ways to maximize their effectiveness.

- Ask what the equity refresh grant is solving for. Identify which problem(s) you’re solving for or aiming to prevent. Equity refresh programs are essential to rewarding and retaining top talent, but maintenance, budgeting and planning are required.

- Start the planning process early. Year two of employee’s tenure and/or the company’s tenure is a key milestone for both parties and the company should start planning early in thinking about refresh grants.

- Prepare in advance of the program’s launch. Program eligibility can be tricky for first-time managers. Remaining unbiased and consistent when identifying critical functions and talent is essential. The more prepared you are for growth and scale in the use of equity, the more the company will easily adapt as you grow as an organization.

- Communicate proactively and transparently with employees. Be comfortable with your company’s equity value proposition for both hire-on and refresh grants. Be as transparent as you can and empower employees with the tools to better appreciate their programs.

- Don’t forget about cash. Cash and equity are the two main levers when attracting and retaining talent. Consider and plan how each will shift as the company matures.