The International Sustainability Standards Board (ISSB) released two proposed standards addressing General Requirements and Climate-Related Disclosures. Here’s what companies should know as they navigate global reporting standards and prepare for their own disclosure.

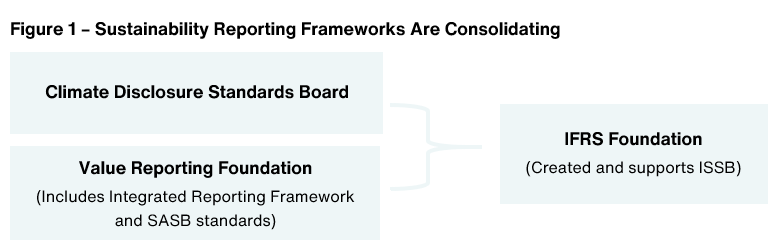

When the International Sustainability Standards Board (ISSB) was established at the COP26 conference in November 2021 by the International Financial Reporting Standards (IFRS) Foundation, one of its first priorities was to streamline the complex sustainability reporting landscape.

In June 2022 the ISSB will enter a new stage in its development when the Climate Disclosure Standards Board, an initiative of CDP, and the Value Reporting Foundation, which houses the Integrated Reporting Framework and SASB standards, will consolidate into the IFRS Foundation.

Before the consolidation takes place, the ISSB took an important step in its mission to develop global sustainability disclosure standards to meet investor needs when it released two proposed standards on March 31, 2022. In this article, we’ll describe what the standards will do and how companies and investors can prepare.

Overview of the General Standard and Climate-Related Proposals by ISSB

The proposed General Sustainability-Related Disclosures Requirements Standard lays out ISSB’s requirement for entities to report material information about sustainability-related risks and opportunities. Key points from the general standard proposal are shown below.

Figure 2 – Highlights from ISSB’s General Standard Proposal

| Materiality |

Geared toward an investor audience, materiality includes any information necessary to assess enterprise value. In utilizing this definition, the standard clearly departs from requiring double-materiality disclosures, which is proposed under the European Union’s (E.U.) Corporate Sustainability Reporting Directive. |

| Topics covered |

Companies can consider disclosure topics from a variety of sources, including but not limited to IFRS Sustainability Disclosure Standards, SASB and Climate Disclosure Standards Board. |

| Reporting pillars |

Entities are required to disclose sustainability-related financial information using the same pillars as the Task Force on Climate-Related Financial Disclosures (TCFD) framework. (Read more about the TCFD framework in our article.) Under the proposed standard, TCFD’s four pillars — governance, strategy, risk management, and metrics and targets — would apply to reporting material sustainability issues beyond climate-related topics (e.g., human capital, cybersecurity risks). |

| Where to disclose |

Sustainability disclosures may live in financial statements and other sustainability-related financial information, providing flexibility in where companies choose to report this information. |

The proposed Climate-Related Disclosures Standard requires entities to disclose information about their exposure to significant climate-related risks and opportunities. The key takeaways include the following:

Figure 3 – Highlights from the Climate-Related Proposal

| TCFD alignment |

The climate standard proposal is well-aligned with the TCFD pillars (governance, strategy, risk management, metrics and targets), but requires additional metrics and detailed disclosure, including sector-specific climate metrics drawn from SASB standards. |

| Scope 1, 2 and 3 reporting |

Similar to the SEC’s recently proposed climate disclosure rule in the United States (U.S.), the ISSB’s proposed climate standard requires entities to report Scope 1, 2, and 3 emissions, but in contrast, there is no requirement for third-party verification of any emissions data. |

Impact of ISSB’s Proposed Standards on Corporate Reporting

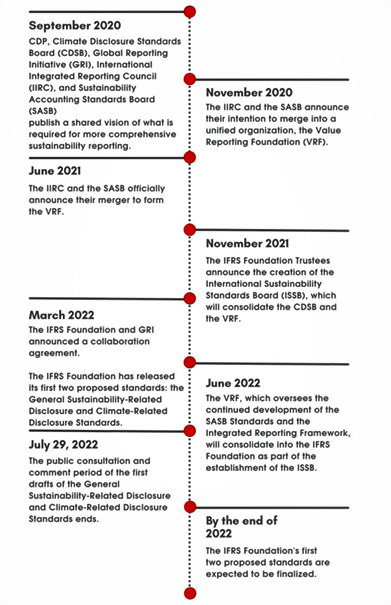

These first drafts of the general and climate-related disclosure standards are open for public comment until July 29, 2022. The standards are expected to be finalized in the second half of 2022.

While these standards are important developments that companies should consider as they develop their own sustainability disclosures, it’s important to note they are voluntary. Regulators would need to adopt them to be mandatory, and their integration into required regulations may be slowed by the fact that there are proposed sustainability rules already well underway in both the E.U. and the U.S.

In the near term, regulators may continue to utilize the existing frameworks and standards that are forming the basis of ISSB’s proposals rather than the newly proposed standards themselves. TCFD, in particular, is gaining regulatory traction in parts of the world. In the U.S., the SEC’s proposed climate rules identified TCFD as one of the three frameworks considered in the development of its rules. Meanwhile, the Singapore Exchange requires all listed firms to comply with TCFD reporting, and in Australia, mandatory TCFD disclosures are expected in 2023.

In contrast, European countries have signalled a more robust sustainability reporting approach. The United Kingdom has indicated that it plans to incorporate ISSB standards in current reporting requirements, while in the E.U. the Corporate Sustainability Reporting Directive legislation is poised to be more rigorous in its requirements than what ISSB has proposed.

Given these regional differences, companies need to pay close attention to the types of frameworks and reporting standards followed in the region(s) they are filing disclosures in. Below is a timeline of the development and consolidation of sustainability standards.

Figure 4 — Timeline of Climate Disclosure Standards

Preparing for ISSB’s Proposed Standards and Other Developments

As expected, the ISSB’s two proposed standards demonstrate their commitment to leveraging the TCFD framework and SASB standards going forward with some importation distinctions as detailed in Figures 2 and 3.

Companies should consider internal alignment with TCFD and SASB to prepare for future reporting requirements. Consider the following steps as you develop a sustainability reporting strategy to evolving standards and expectations in the market and from regulators.

- Step 1 — Evaluate the TCFD framework: As regulatory authorities continue to fold TCFD into their proposed rules and institutional investors like BlackRock, Vanguard and State Street Global Advisors communicate expectations around TCFD alignment, companies need to prioritize this reporting framework. If your firm is not using the TCFD framework, we recommend starting to compile and organize your climate-related governance, strategy, risk management practices, and metrics and targets internally, as well as taking into consideration sector-specific guidance.

- Step 2 — Undertake a gap analysis: Once all your company’s climate-related information is organized accordingly to the TCFD framework, conduct a gap analysis to determine the maturity of your disclosure by primarily answering the question: Is your company able to provide limited, moderate or full disclosure in each of the framework’s four pillars? Through this analysis of each element of the TCFD recommendations, your company can learn how to provide a fuller or more comprehensive response in advance of any regulatory requirement to disclose.

- Step 3 — Stay current on SASB standards that major investors are tracking: While not as pressing from a regulatory standpoint, SASB standards can be utilized to cross-check materiality and corresponding metrics internally to create baseline data and track progress. We may see more pressure from investors to disclose along the SASB standards before regulators consider their adoption. Currently, BlackRock and Vanguard both expect SASB-aligned disclosures, and State Street Global Advisors consider SASB alignment in the context of climate-related shareholder proposals for carbon-intensive sectors. Beginning to accurately monitor SASB metrics will help your company monitor your material issues and stay ahead of disclosure pressures and/or requirements.

How Aon Can Help

The expertise of Aon’s Global Corporate Governance and ESG Advisory Group can help your company navigate this dynamic sustainability reporting environment by identifying gaps between your current ESG reporting, the TCFD framework and SASB standards. Our full suite of solutions includes ESG benchmarking, ESG strategy and narrative development, stakeholder engagement and analysis, proxy advisory and regulatory policy application and trends, among others.

For questions about these proposed standards or other climate-related inquiries, please reach out to our team of experts by writing to humancapital@aon.com.