PVHs on equity compensation can carry significant value for companies and employees from tax treatments to positive equity expense savings. However, every operating country with employees comes with challenges – a global approach to equity is vital for risk and goal management.

A post-vest holding period (PVH) on executive equity awards is a powerful corporate governance tool that companies can use to not only improve the ties between business leader compensation and shareholder interests, but also generate a long list of compelling benefits for companies and employees alike (see our previous article for those benefits).

The use of holding periods for equity compensation by U.S. S&P 500 companies has steadily increased year over year recently and reached 11.49 percent in 2021, up from 8 percent in 2019.[1] Holding period use helps companies gain from tax benefits, favorable light from investors and proxy advisors and cost savings on equity expense. However, can organizations use PVHs for awards to non-U.S. employees?

In this article, we look at what PVHs mean for organizations distributing equity awards to non-U.S. employees. We also examine the global benefits of PVHs where applicable, and what organizations should think about as they consider the ties between their business leader and employee compensation and shareholder interests through a global lens.

How Do PVHs Work In Different Countries?

There are two main holding period structures: pre-settlement and post settlement..

A pre-settlement holding period is when a holding period applies after vest but before the shares are transferred to the employee (otherwise known as settlement). The shares themselves are generally no longer subject to forfeiture meaning the employees are entitled to receive them even if they leave the company and no longer provide service. However, they will not receive the shares until after the holding period ends. In some countries, the tax point will be at the end of the holding period (when the shares are settled) which provides for a deferral of taxation.

A post settlement holding period is when the holding period occurs after share ownership has been transferred to the employee. This is done so that the holding period restricts the sale or transfer of actions by the employee. During this holding period, the employee will typically have the same ownership rights as any other shareholder with the exception of the sales or transfer restrictions. The taxable event will depend on the country of operation as some countries do not have explicit legislation addressing specific features like this and might view a post settlement hold as a substantial restriction resulting in the tax being deferred or even reduced. In the U.S., the taxable event occurs at settlement, so the PVH restriction might require the restriction to be applied only to the net shares settled after taxes.

Tax and Accounting Implications of Holding Period Use Outside of the U.S.

Outside of the U.S., different countries will follow different accounting standards and rules. Some countries might follow international standards such as the International Financial Reporting Standard (IFRS) (e.g., European Union) or have their own accounting rules which might be converged with IFRS (e.g., Hong Kong). Given every country follows their own unique tax and accounting rules, it is important for companies to gain an understanding of how the tax and accounting treatment for equity compensation with holding periods differs from one country of operation to the next to ensure compliance with regulatory requirements and understand costs/benefits, administration challenges, etc.

Rules relating to equity compensation with a holding requirement might differ in clarity and vagueness depending on the country, and holding periods might impact the treatment or annual reporting obligations. For example, in the event a country views the taxable moment at settlement or transfer where there is a post-settlement hold, taxes might be due when the shares are transferred to the employee and not at the end of the holding period (upon when shares can be sold to cover the tax obligation). This can create challenges with the way withholding obligations are funded if the plan or award agreements are not carefully drafted.

Organizations should collaborate with their regional and executive leadership teams to assess the potential collective global impact of adding holding period provisions to equity awards in different countries of operation.

Tax and Accounting Benefits of Holding Period Use Outside of the U.S.

There are clear risks and potential tax implications for organizations that include a holding period on equity awards depending on the country of operation. However, there can also be many tax and governance benefits to reap by doing so, for example:

- A Reduction in Employee Taxable Value: There are some countries that might allow for a reduction in the taxable value of the equity income such as Canada, Hong Kong, Ireland, Luxembourg, Netherlands and Switzerland.

- A Capital Gains Tax Reduction: In some countries, employees might be able to reduce their capital gains for tax purposes such as Australia, Colombia, Czech Republic, India and Luxembourg

Organizations should collaborate with their regional and executive leadership teams to assess the potential collective global impact of adding holding period provisions to equity awards in different countries of operation.

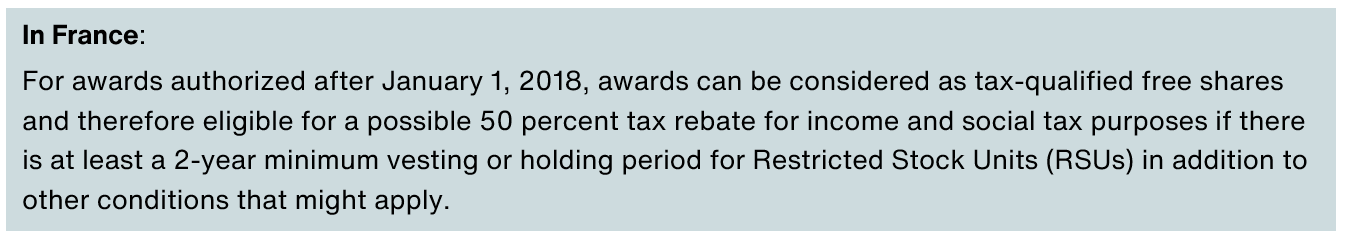

- Qualified Arrangements: It might be possible for the equity plan to be considered a qualified plan if a holding period is incorporated in countries such as Australia, Belgium, France, Israel, Spain and the UK.

Next Steps

Proper due diligence is critical for any organization considering whether or not to incorporate a holding period on equity awards and the implementation process in any country.

It’s critical that organizations consider the differing holding periods rules and limitations in every country of operation so as to build a global playbook that takes advantage of all available tax and accounting benefits globally while also reducing risks and implications based on a unified and cohesive strategy.

We recommend organizations think through the following questions when trying to determine if and how PVHs would help achieve compensation, shareholder and governance goals:

- Is it more beneficial to have a pre-settlement hold or a post-settlement hold?

- How will this impact the accounting treatment in the countries we grant equity in?

- Does our plan allow for the type of tax withholding provisions that lend themselves to the type of holding period we are looking to have?

- Are there any tax implications associated with having a holding period? Will the equity be eligible for any tax qualified treatment?

- Will there be any additional securities, foreign exchange or tax compliance requirements (e.g., seeking approval from local authorities)?

- What additional regulatory reporting obligations will there be?

- Are our global teams able to handle any additional administrative processes that might occur?

- What capabilities will our broker/stock plan administrator have to help ease any administrative burdens?

- What additional language or documentation needs to be prepared?

- What is the best way to communicate this to our employees?

At Aon, we have a dedicated global equity compliance team that helps companies navigate through global due diligence, complex LTI design, expense and discount modelling and equity compensation design.

Please write to us at equityleaders@aon.com with any questions you might have or if you would like to speak with one of our experts.

[1] “Aon, “Post Vest Holding database,” last accessed July 21, 2022.