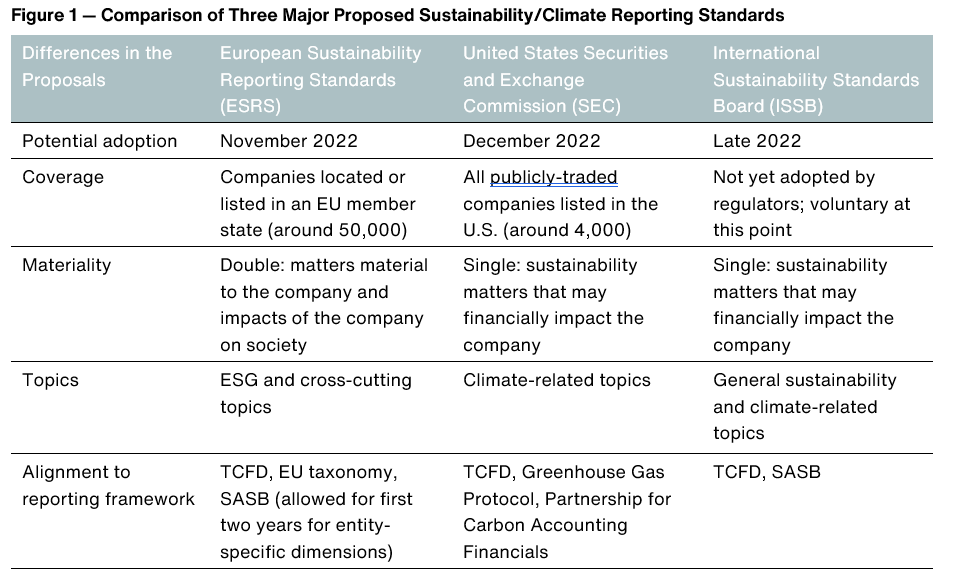

A draft of new European sustainability standards is the latest in a series of proposed climate and sustainability disclosures in Europe and the United States. We compare the proposals and what companies can do to prepare.

A recent draft of the European Sustainability Reporting Standards (ESRS) — the first set of reporting standards that will be required for companies that fall under the Corporate Sustainability Reporting Directive (CSRD) — goes well beyond climate reporting. The proposed reporting standards are expected to be finalized in November 2022 and cover a full range of environmental, social, and governance (ESG) issues including climate change, pollution, water and marine resources, biodiversity, resource use, workers in the value chain, governance, risk management, business conduct and more.

The draft ESRS are more rigorous than other reporting proposals and would apply to a large contingent of companies, including all large companies (defined as meeting two out three of the criteria: €40 million in net turnover, €20 million on the balance sheet, and/or at least 250 employees) governed by or established in a European Union (EU) member state and all European stock exchange-listed companies. This increases the scope to about 50,000 companies and will greatly increase reporting requirements for companies based in the U.S. that have large subsidiaries in the EU.

These proposals may evolve (ISSB has already noted plans to expand reporting requirements beyond climate), but for now, ESRS remains the most comprehensive proposal to date.

As much as U.S. and EU regulators have worked to harmonize these newly proposed standards with global frameworks, the distinctive differences in the ESRS, SEC, and ISSB proposals outlined above mean that global companies required to comply with multiple sets of standards face a significant reporting hurdle. This will no doubt be further complicated with the UK’s expected adoption of ISSB standards, which as of now, remain voluntary. The UK government has not committed to a specific date.

With implementation dates on the horizon, global companies should evaluate their preparedness and timelines to align with new regulations.

Next Steps

The comment period for the draft ESRS is August 8. The comment periods for the SEC and ISSB proposals close on June 17 and July 29, respectively. Implementation dates may vary depending on the volume of comments received, but all three are expected to be finalized by the end of 2022.

We help our clients navigate these proposed standards by mapping current sustainability disclosures to expected requirements to determine which areas companies need to focus on to bring their reporting into compliance.

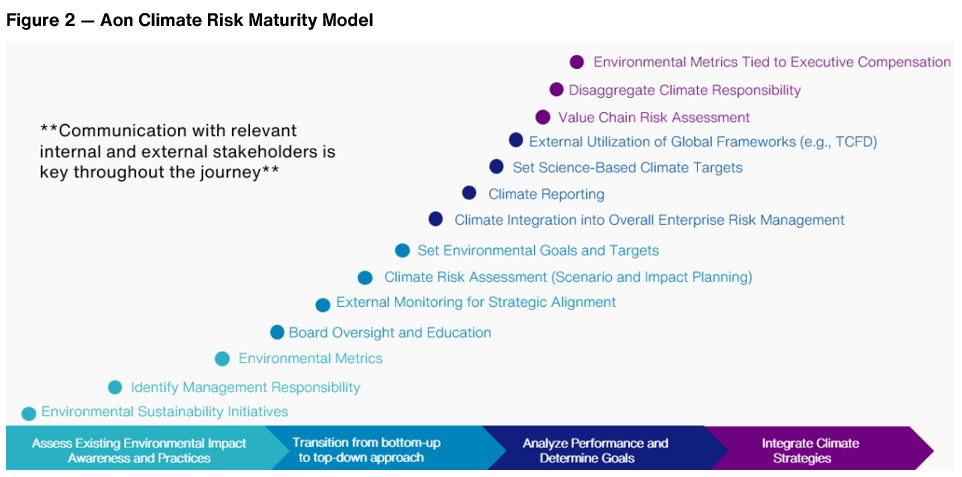

U.S.-based companies, which will be subject to climate reporting requirements for the first time, will likely need to take a comprehensive view of their progress along a climate maturity curve (see Figure 2) to determine next steps as they prepare to comply with pending SEC climate rules. EU companies will also need to undertake a similar gap analysis to advise where enhanced disclosure is needed as they transition from current reporting to the more robust ESRS.

If you’d like to speak with one of our ESG experts about these developments and how we can help, please write to humancapital@aon.com.