The new burn rate methodology could increase or decrease existing burn rate calculations depending on a company’s index and industry, which may impact shareholder support for an equity share plan proposal. We explain how companies can prepare.

Proxy advisory firm Institutional Shareholder Services (ISS) released new burn rate thresholds and a methodology change that goes into effect for the 2023 proxy season. ISS is adopting a “Value-Adjusted Burn Rate” (VABR)[1] approach to measuring the amount of shareholder wealth being granted in the form of equity compensation over an annual and three-year basis. This is similar to how ISS calculates its proprietary “Shareholder Value Transfer” dilution cost model.

For 2022 annual shareholder meetings, the VABR will be displayed for informational purposes only and will not affect ISS’ Equity Plan Scorecard (EPSC) evaluation or scoring. However, it is expected to replace the existing burn rate factor beginning with meetings on or after Feb. 1, 2023.

[1] In an FAQ, ISS sets out the VABR formula as follows: Annual Value-Adjusted Burn Rate = ((# of options * option’s dollar value using a Black-Scholes model) + (# of full-value awards * stock price)) / (Weighted average common shares * stock price).

Current Policy Application

ISS currently calculates burn rate benchmarks for specific industry groupings in three index categories: S&P 500, Russell 3000 (excluding S&P 500) and Non–Russell 3000. For each index, these benchmarks generally reflect each GICS industry group's three-year mean burn rate plus one standard deviation (with a floor for the benchmark of 2.00%).

Scoring under the EPSC for the heavily weighted “burn rate factor” is scaled according to the company's three- year average annual burn rate relative to its applicable index and industry benchmark. A company can receive maximum EPSC points for this factor when the company's three-year average adjusted burn rate is at or below 50% of the benchmark. A three-year average adjusted burn rate that is above the benchmark may result in negative points. Historically, negative scoring under the burn rate factor can be so high that it becomes nearly impossible to pass the EPSC, even if adopting all of ISS’ recommended practices in the plan features and grant practice pillars of the EPSC.

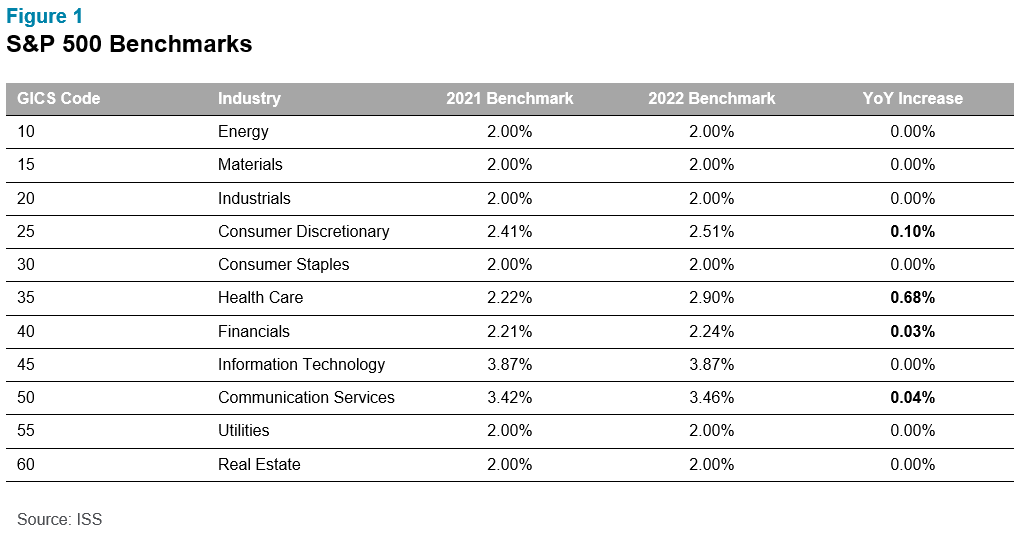

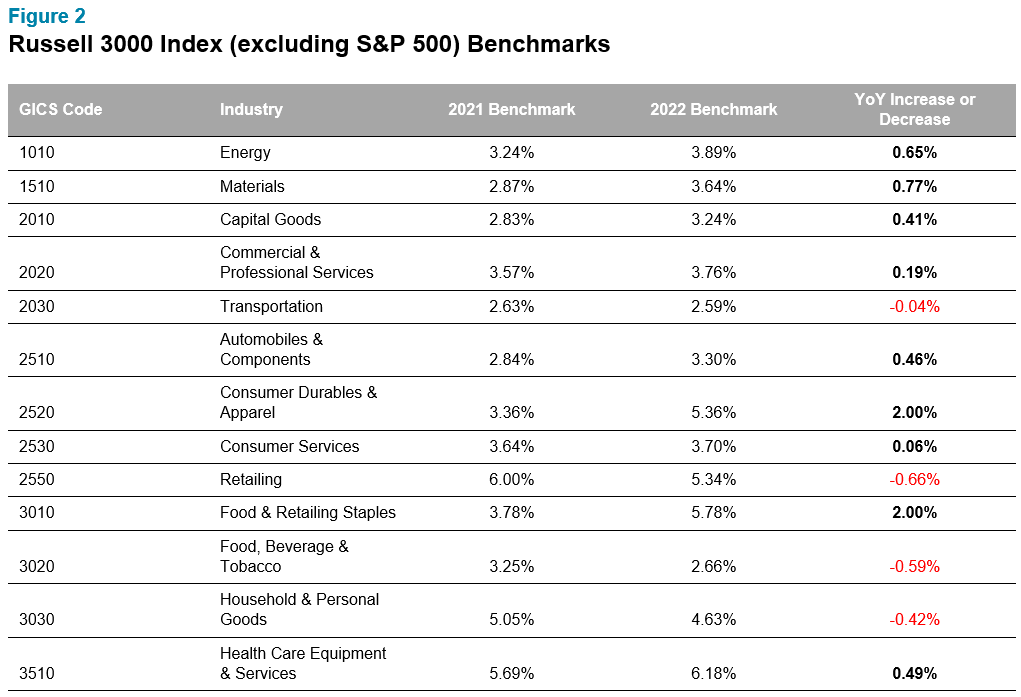

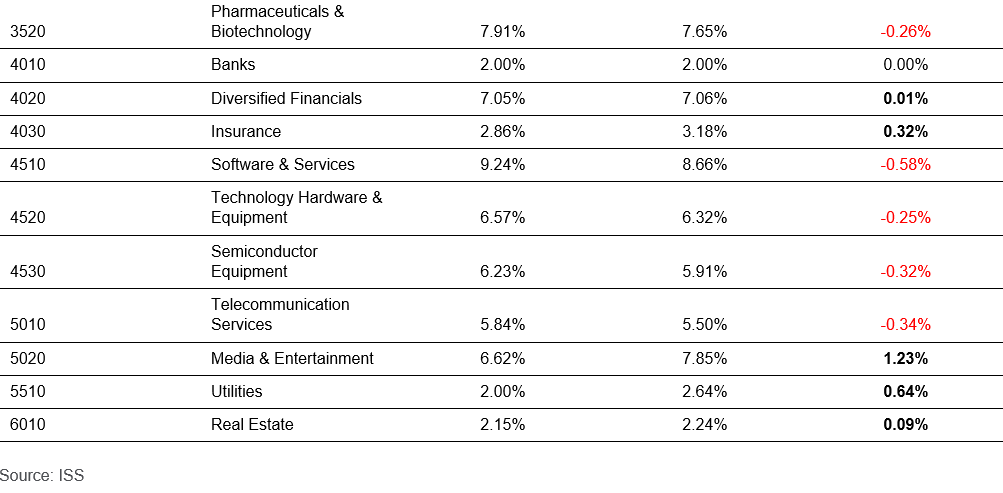

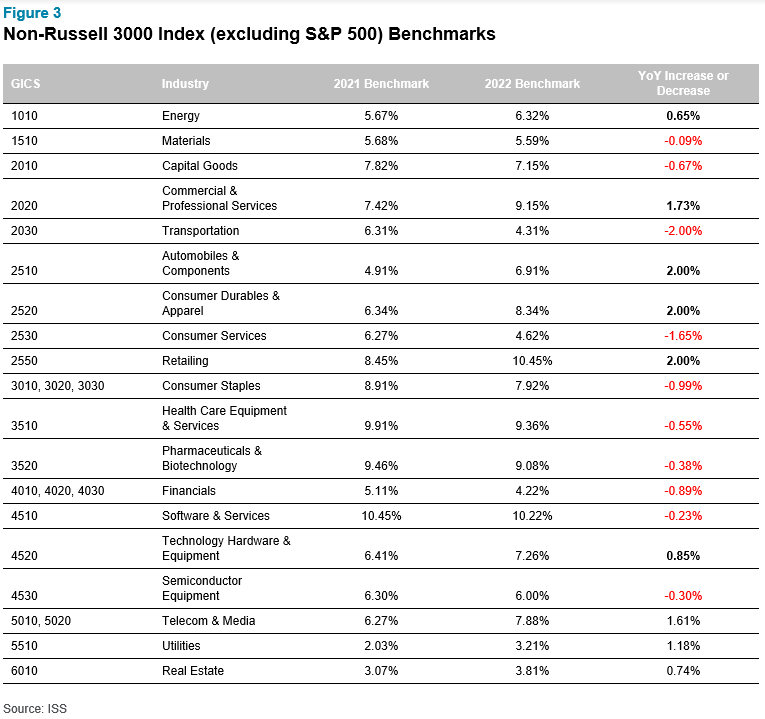

The burn rate benchmarks applicable for meetings on or after Feb. 1, 2022 are shown below, with a comparison of the prior year’s benchmarks. As noted, the minimum burn rate benchmark for each index and industry group is 2.00%.

We recommend that companies evaluate annual equity usage by utilizing a few different burn rate methodologies as part of the annual benchmarking process. Specifically, it is important to evaluate burn rate against methodologies from ISS and Glass Lewis (another prominent proxy advisor), as well as use a simple unadjusted run rate calculation (accounting for all awards granted on a one-for-one basis as a percentage of common shares outstanding). Depending on a company’s investor base, any one of these calculations could be an important factor when seeking shareholder approval for an equity compensation plan.

Figure 1 shows limited year-over-year movement in the S&P 500 benchmarks. The exception was a material increase in the GICS 35 Health benchmark of +0.68% (from 2.22% in 2021 to 2.90% in 2022).

In Figure 2, 14 of the 24 GICS groupings saw meaningful benchmark increases year-over-year, with some industries receiving the maximum 2.00% year-over-year increase (GICS 2520 Consumer Durables & Apparel and GICS 3010 Food & Retailing Staples). Nine of the categories saw meaningful decreases in thresholds, with only GICS 4010 Banks maintaining a flat threshold year-over-year.

Among the Non-Russell 3000 companies in Figure 3, nine of the 19 GICS groupings saw meaningful increases, with three companies getting the 2.00% maximum increase (GICS 2510 Automobiles & Components, GICS 2520 Consumer Durables & Apparel and GICS 2550 Retailing). However, unlike the other two index categories, 10 of the 19 groupings saw meaningful declines in the thresholds.

Next Steps

We recommend that companies review their Form 10-K stock plan footnote disclosures and proxy proposal disclosures to ensure they maximize their ISS burn rate profiles with adequate granting information. This is especially important when equity compensation is granted in lieu of earned annual bonus or when there has been substantial M&A activity.

If you have questions about the new ISS burn rate thresholds or go-forward policy changes and would like to speak with one of our experts, please write to

humancapital@aon.com.