Newly proposed SEC rules would require companies to report and disclose more on their relationship between executive compensation and the company’s financial performance.

When the Dodd-Frank Act of 2010 was enacted, Section 14(i) was added to the Securities Exchange Act of 1934, which directed the SEC to adopt new rules requiring companies to disclose specific aspects of executive compensation paid out to shareholders.

Item 402 of Regulation S-K of the U.S. Securities Act of 1933 requires companies to provide a clear description of any disclosed compensation, including information that shows the relationship between executive compensation “actually paid” and a company’s financial performance.

Under the proposed pay for performance rules, companies would be required to disclose the following to help shareholders better understand the relationship between executive pay and financial performance:

- Add a new Section (v) to Item 402(v) of Regulation S-K which would require companies to describe how the executive compensation actually paid by the company related to the financial performance of the company for each of the most recent five fiscal years;

- The CEO’s total compensation and the average of the other named executive officers’ (“NEOs”) total compensations reported in the Summary Compensation Table (SCT);

- The CEO’s actual compensation and the average of the other NEOs actual compensation;

- The company’s and its peers’ annual total shareholder return (TSR), using the definition of TSR from Item 201(e) of Regulation S-K and using either the peer group used in the SEC filings or reported in the Compensation Discussion and Analysis (CD&A) in the proxy; and

- Three new financial measures that we discuss under #3 and #4 in the following section.

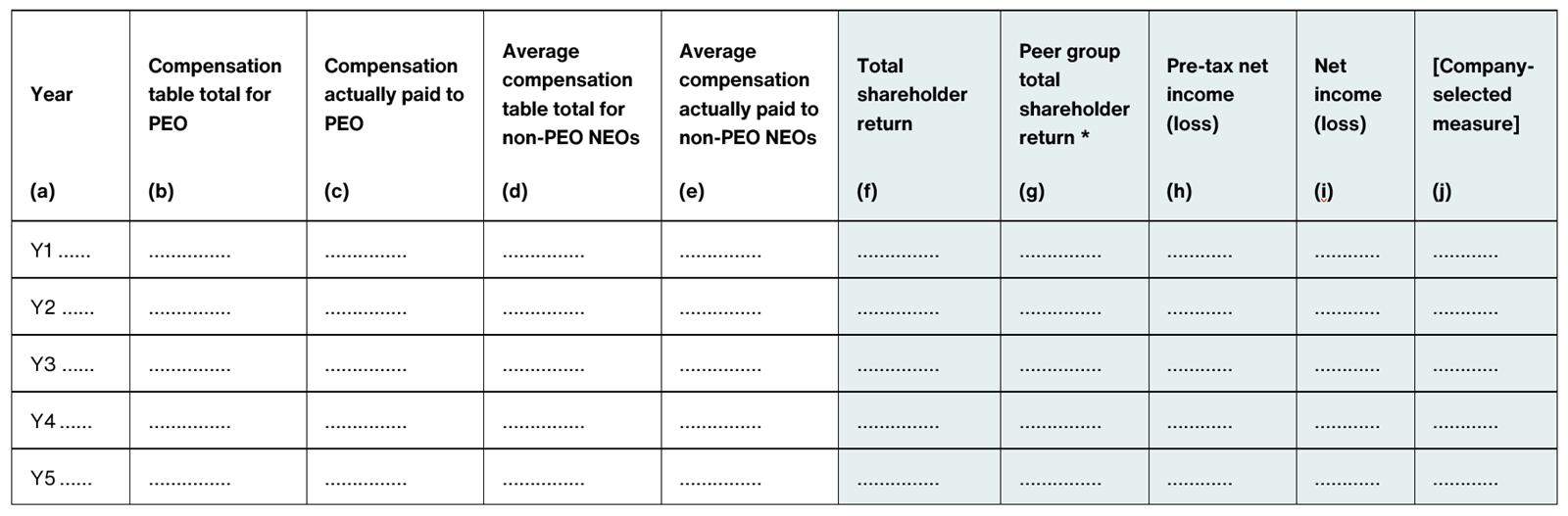

A Revised Reporting Table for Improved Disclosure

If more pay for performance reporting disclosures took effect, companies would be required to provide additional disclosures in an enhanced reporting table. The following table example adds more columns for financial metrics specifically columns (f) to (j) which are highlighted below.

Figure 1 - New Pay for Performance Disclosures

The newly-added columns in the proposed pay for performance table would allow investors to understand executive compensation amounts “actually paid” in relation to actual financial performance. The new table will:

- Require executive compensation amounts actually paid to be presented separately for the principal executive officer (PEO) and as an average for the remaining NEOs;

- Exclude changes in actuarial present value of benefits under defined benefit and actuarial pension plans not attributable to the applicable year of service and replaced with “service cost” that was not defined by the Proposed Regs;

- Include the value of equity awards at vesting rather than when granted. This simplifies the valuation for some award types as it is the value of the share at vest, but for other awards, such as options or awards with post vest holding period will require a more sophisticated valuation technique to be applied.

- Require a company’s TSR, as defined in Item 201(e) of Regulation S-K, and the TSR of the company’s peer group as measures of financial performance;

- Require a company to disclose two new financial measures of GAPP pre-tax income and net income;

- Require a “company-selected measure” that will be based on the company’s assessment of the most important performance measure that is not already included in the table which represents the metric with the strongest link between compensation actually paid and company performance.

- Require a company to use the information in the proposed table above to provide a clear description of not only the relationship between executive compensation actually paid to the company’s NEOs and the cumulative TSR of the company, but also the relationship between the company’s TSR and the TSR of a peer group chosen by the company. In addition, the three new proposed financial metrics in each case over the company’s five most recently completed fiscal years.

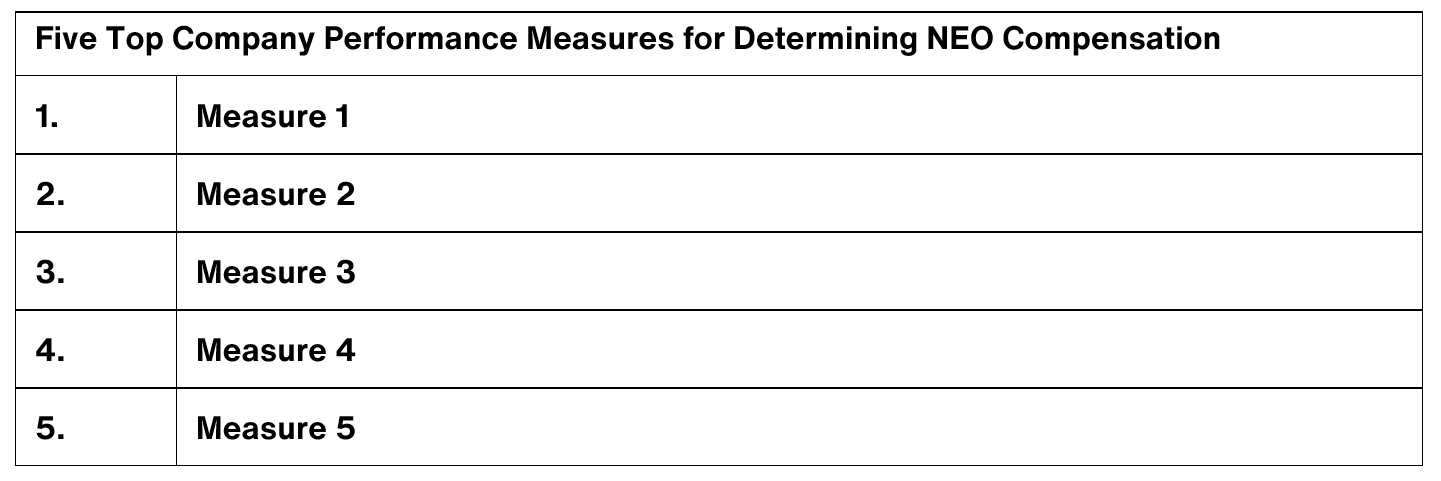

Top Five Performance Measures to Disclose

Companies would also be required to list a second and new pay for performance table, in descending order, with key incentive plan metrics listed that drive compensation outcomes.

The SEC believes tabulated disclosure will enable investors to better assess which performance metrics have the largest impact on compensation actually paid and make their own judgments as to whether compensation appropriately incentivizes management.

The disclosure of the five most important performance measures that drove compensation actually paid might also provide investors with context that could be useful in interpreting the remainder of the pay versus performance disclosure.

For more insight, read Aon’s full commentary to the SEC regarding the proposed pay for performance disclosure rule. Aon’s Human Capital Solutions’ overall position is that no additional disclosure of performance measures in the tabular section will enhance the totality of the pay disclosure in a way that meets our proposed criteria.

Next Steps

Companies might be required to include the disclosure in their 2023 proxy filing given the comments on the proposed rules were due on or before March 4, 2022. Therefore, companies should revisit their proxy preparation strategy given the new tables listed above that might be required in future years.

Companies should think about their one performance measure that drives executive pay. This measure will impact shareholder perception as the success or lack thereof of the company business plan.

Please write to us at equityleaders@aon.com with any questions you might have or if you would like to speak with one of our experts.