It's been a year since the SEC proposed pay-vs.-performance disclosure rules. While the rules haven't been finalized, it's not too early to think about model disclosure.

On April 29, 2015 the Securities and Exchange Commission (SEC) proposed additional executive compensation disclosure requirements in compliance with the Dodd-Frank Act. The rules are intended to help shareholders gain a better understanding of how executive pay compares to company performance by: (1) comparing Named Executive Officer (NEO) compensation as described in the Summary Compensation Table to what the SEC is calling "compensation actually paid"; (2) using Total Shareholder Return (TSR) as the metric for comparing performance to compensation actually paid; and (3) using the TSR of a company's peer group (either the peer group listed in the CD&A for compensation or performance purposes or the one used in the performance graph disclosure) to provide additional context for the company's performance.

While the SEC hasn't finalized its disclosure rules, we're seeing voluntary disclosure in many companies' 2016 proxy filings. Calculating actual pay vs. performance under the proposed definitions will help companies provide the descriptive analysis of the data in proxy disclosure.

Under the proposed rules, registrants will need to add a new table to the proxy statement disclosing the following items:

- The total compensation of the Principal Executive Officer (PEO) reported in the Summary Compensation Table

- The compensation actually paid to the PEO

- The average total compensation of the other NEOs reported in the Summary Compensation Table

- The average compensation actually paid to the other NEOs

- The cumulative Total Shareholder Return ("TSR") of the company measured as of the end of the year

- The cumulative TSR of a peer group selected by the company

Additionally, companies would be required to provide a clear description of the relationship between the compensation actually paid and cumulative TSR, either as a narrative, graphically, or some combination thereof.

Required Calculations

Under the proposed rules, compensation actually paid to named executives is a new concept and separate from the total compensation found in the Summary Compensation Table. For each fiscal year, compensation actually paid is equal to the sum of:

- Base salary*

- Bonus*

- Non-equity incentives*

- Equity vested during the year

- Service cost

- Above market earnings*

- All other compensation*

The items above with an asterisk can be pulled directly from the Summary Compensation Table. Service cost and equity vested during the year are new items requiring further calculations. It is worth highlighting that equity vested during the year should be valued as of the vest date under ASC 718. In contrast, the stock awards section of the Summary Compensation Table shows the fair value of awards granted during the year as of the grant date under ASC 718.

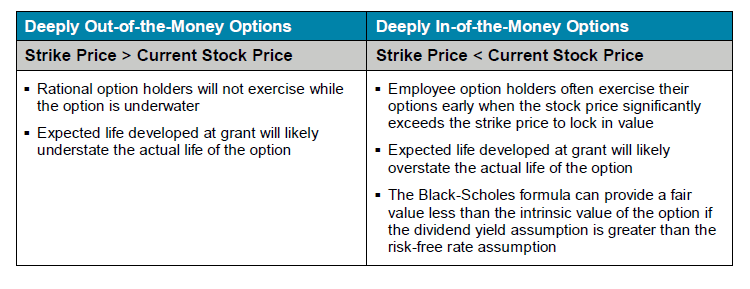

Valuing at-the-money stock options is fairly simple, as companies can follow the same methodologies that were used to value the option on the date of grant. However, the valuation process becomes more complex when the options are no longer relatively at-the-money on the vest date, as summarized in the table below.

In the case of options that are no longer at-the-money, an open form model like a lattice model or Monte Carlo simulation can be used to simulate the value of the option. These models simulate many individual stock price paths for the company, so that the time at which the option reaches the money can be determined or an assumption regarding employee exercise can be incorporated.

The Cox-Ross-Rubenstein Binomial model can be used to avoid a flaw in the Black-Scholes formula where the fair value falls below the intrinsic value. This problem can occur when the dividend yield of a company exceeds the risk-free rate, creating a negative drift rate. The error is avoided by assuming option holders will exercise early when the present value of expected future dividends exceeds the fair value of the option. Companies will be allowed to make a one-time special election to value the awards at vest using a model other than the model used to value options at grant, without having to adopt the new model going forward.

Full value awards (restricted or performance shares) are easy to value as of the vest date— the fair value is simply equal to the stock price of the company on the vest date. However, if the awards contain a holding period that limits the sale of the award after vesting, the fair value should be discounted to reflect the award's illiquidity. In the case of awards with post-vest holding restrictions, several methods have been developed to determine the impact of the award's illiquidity on the fair value. The most prominent methods are the Chaffe Model and the Finnerty Model. Both models utilize a formula that takes into account the length of the holding period and properties of the underlying stock to quantify the discount in a way that aligns with empirical evidence. For more information on post-vest holding periods, see our article, Maximize Your Investment in Equity Compensation and be a Good Corporate Citizen at the Same Time.

Compensation Actually Paid vs. TSR

Another new requirement under the proposed rules is the disclosure of the relationship between compensation actually paid and the TSR of the company. This can be done as a narrative, graphically, or some combination of both. The calculation of TSR should be consistent with the established performance graph in the company's annual 10-K, whereby TSR is shown as the growth of a $100 investment from a fixed starting point, assuming that dividends are reinvested and appropriate adjustments are made for stock splits and other corporate transactions. The TSR of the company will need to be compared to the TSR of the peer group listed in the Compensation Discussion and Analysis of the company's proxy, the index or group used within the performance graph of the annual 10-K filing, or another industry index. The TSR of the peer group or index should be weighted for market cap. While the returns of indices are typically already market cap weighted, this calculation will need to be done manually for a custom peer group. This calculation can be very complicated and can skew results, since the market cap is fixed at the start of the measurement period. The calculation of TSR can also produce obstacles such as the incorporation of spinoffs, special dividends and adjusting for different currencies. For more information on special situations regarding TSR calculation, see our paper, Managing Relative TSR with Global Peers.

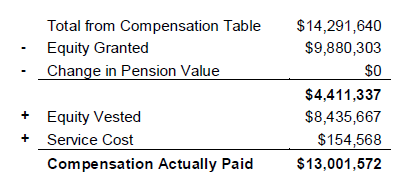

Compensation Actually Paid can be calculated as the sum of the seven items outlined previously, but given the large overlap with the "total" column of the Summary Compensation Table, a shortcut can be taken. The values not included in Compensation Actually Paid (change in pension value and equity granted) should be removed and the new values (equity vested during the year and service cost) should be added.

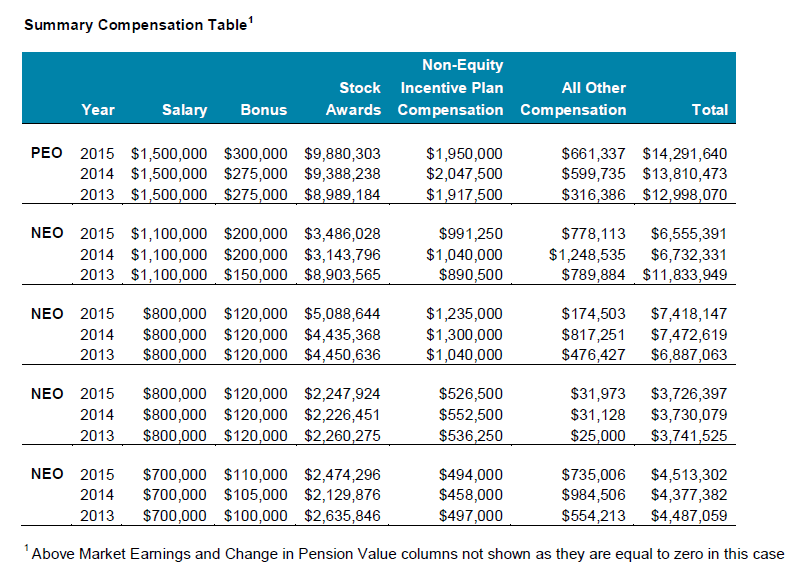

Once the Actual Compensation Paid has been calculated for the PEO and each NEO, the new Pay-vs.-Performance Disclosure Table can start to be constructed. The "Total" column of the Summary Compensation Table is displayed again.

2015 PEO Compensation Actually Paid

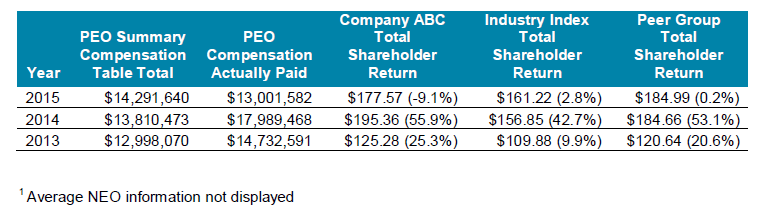

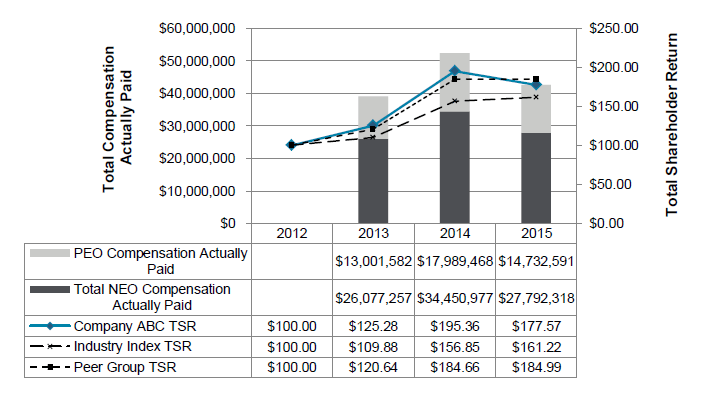

The PEO value is displayed directly, while only the average NEO total is required. The PEO Compensation Actually Paid and average NEO Compensation Actually Paid are then added. The company TSR and peer group or index TSR should be displayed as well, calculated as described above. A sample Pay-vs.-Performance Disclosure Table is shown below, including both the TSR of an industry index and a peer group.

Pay-vs-Performance Disclosure Table 1

In addition to the new disclosure table, companies will be required to provide a clear description of the relationship between Compensation Actually Paid and cumulative TSR. A sample of a graphic representation is shown below.

Next Steps

We anticipate that the most difficult part of the potential disclosure process will be crafting a narrative explaining the relationship of compensation actually paid to TSR performance, potentially comparing compensation and performance against multiple peer groups and indices. Compensation actually paid is a new concept, and estimating the fair value of awards vesting during the year as of the vest date presents a challenge because normal valuation processes can start to fall apart when valuing awards as of a date other than the grant date. The calculation of TSR for companies and indices also contains significant considerations at times, particularly if the TSR is market cap weighted.

If you have questions about your company's Pay-vs.-Performance calculations and disclosure, please contact our team. To learn more about the Equity Services team at Aon, visit our website: radford.com/home/valuation.

Related Articles