Several of our leading workforce indicators point to a potential slowdown in the competition for talent in China; yet, the real story is probably far more interesting and complex.

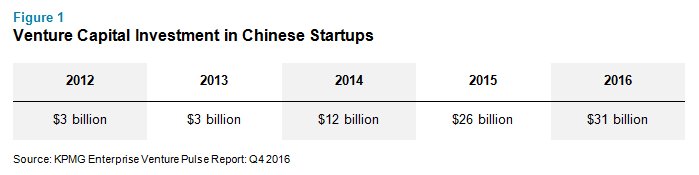

The Chinese technology sector continues to grow at a rapid pace. According to the National Bureau of Statistics in China, overall investment in the sector grew by 15.8% in 2016, far outpacing overall GDP growth in the country. Furthermore, as Figure 1 below illustrates, the amount of venture capital funding flowing into Chinese startups has accelerated dramatically from 2012 to 2016, and now accounts for roughly one-fifth of global venture capital investment. Clearly, opportunities abound in China—for entrepreneurs, investors and employees alike.

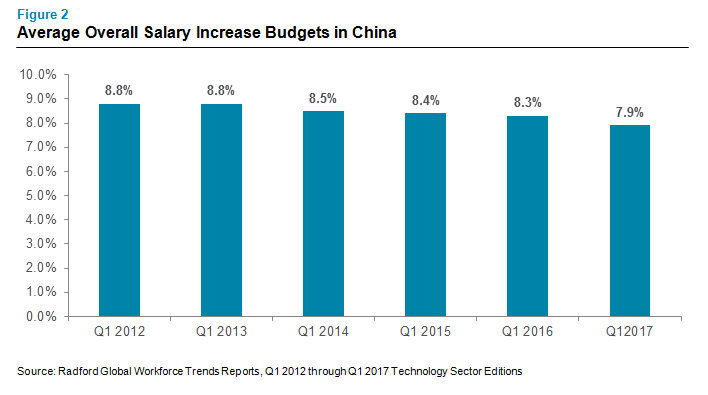

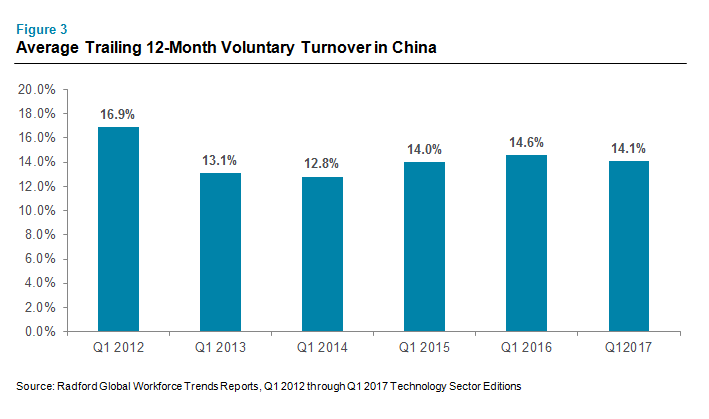

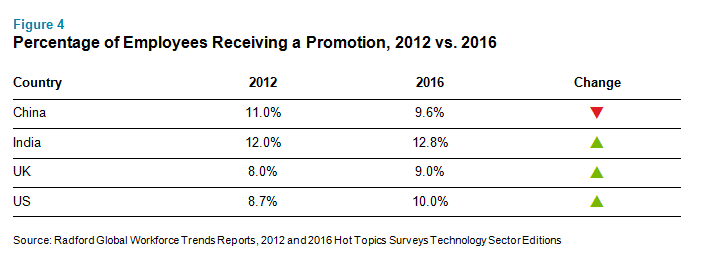

However, despite the very positive news cited above, new data from the Radford Global Technology Survey suggests employees and employers in China are less bullish than outside observers might expect. As of the first quarter of 2017, average salary increase budgets in China fell below 8.0% and voluntary turnover rates dropped from the same time last year (but remain historically high). Furthermore, between 2012 and 2016, our last two points of measurement, employee promotion rates in China also declined.

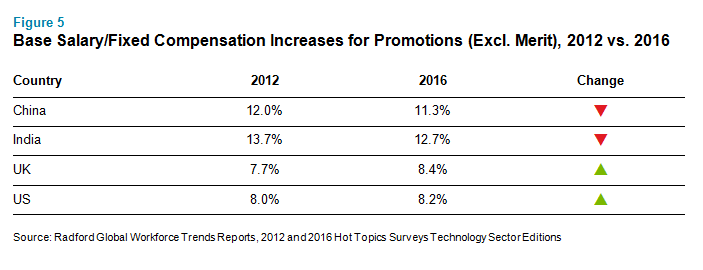

Before exploring why these shifts might be underway, let’s look at the data. Below, Figure 2 displays average overall salary increase budgets, including both merit and annual pay adjustments, in China over the past six years, followed by Figure 3, which displays average trailing 12-month turnover rates over the same six-year timeframe. Finally, Figures 4 and 5 compare promotion practices in China to those in India, the United Kingdom (UK) and the United States (US). In all cases, the data below reflects practices from across the entire technology sector, including companies of various sizes and in multiple industries (e.g., animation and gaming, communications, ecommerce, financial technology, hardware, internet, networking, semiconductors, and software products and services, among others.)

What Does This All Mean?

On one hand, we encourage clients to take this information at face value. This data suggests the incredibly fierce competition for talent in China could be easing slightly. That’s the good news for employers in the country.

However, although salary increase budgets and turnover rates in China are falling, they remain very high relative to most of the rest of the world. For example, in France, Germany, the UK and the US, average overall merit budgets continue to hover between 3.0% and 4.0%. Similarly, average voluntary turnover rates in the same four countries sit between 7.0% and 12.0%, all below China at 14.1%. This is the bad news.

Yet, a number for more subtle or hard-to-measure forces are likely at play here. Chief among them, the maturing of the Chinese economy and workforce, plus improved human resources practices in the country. For example, declining promotion rates are not necessarily a sign of fewer opportunities for upward mobility. They could just as easily indicate that human resources teams are getting better at managing and controlling the promotion process. Furthermore, reduced rates of turnover could be the result of improvements in corporate culture and better retention and recognition programs. In our view, all of the above is true, especially in a market as large and diverse as China.

In sum, companies in China can take some solace in declining salary budgets and turnover rates, but shouldn’t take their foot off the gas when it comes to investing in the programs that are very likely playing a key role in driving down overall costs and leading to improved turnover outcomes. These programs include high-potential identification and retention, leadership development, and improved pay-for-performance and promotion practices.

Next Steps

Taken at face value, our newest workforce trends data shows the competition for talent in China’s technology sector remains very strong, but may not be as robust as it once was. Overall, Chinese technology companies enjoy strong levels of investment, but are increasingly cost-conscious and looking for ways to improve workforce productivity rather than spending money lavishly to grow headcount as fast as possible to meet global demand. Furthermore, China continues to mature from a low-cost labor source for manufacturing to a high-cost home for leading ecommerce, internet and software companies.

These ongoing shifts place the spotlight firmly on workforce planning, people analytics and talent programs. For example, a growing number of our clients now use the Radford Workforce Analytics platform to better understand and benchmark the overall cost of their people in China, while also modeling out different scenarios for the required headcounts and organizational structures needed to efficiently support growth.

On the talent side of things, as rewards budgets continue to contract in China, the need to develop compelling employee value propositions and effective high-potential and leadership development programs will only accelerate. Increasingly, these programs will be paramount to combating voluntary turnover.

To learn more about the data cited in this article and joining a Radford survey, please contact our team. To speak to a member of talent and rewards consulting teams, please write to [email protected].

Related Articles