With year-end planning in full swing, it’s important to take a step back and reflect on this past year and the impact of COVID-19 on CEO and director compensation. Here are your top questions answered.

Our team recently hosted a webinar to highlight key topics in compensation for credit unions, providing insights and actionable tips for firms to consider. From the impact of COVID-19 on CEO compensation to director pay and shifting job architectures to support an agile workforce, this article uses our 2020 survey results to answer some of your most pressing questions.

In response to the economic impact of COVID-19, what does CEO compensation look like for credit unions and how should any changes be addressed?

In 2019, median CEO compensation increased in all asset categories for credit unions. CEO salaries grew by 5% at credit unions last year compared to 4% at banks. The largest increase was seen in cash compensation.

While bonus payouts over the past few years have been slightly above target, we anticipate that median 2020 bonus payout will be materially lower than 2019 (i.e., 10% to 40% below target) due to the impact of COVID-19. Firms took varying approaches to annual incentive plan modifications throughout the year, with their need and desire to make changes dependent upon the degree to which profitability metrics were used in 2020 scorecards.

The combination of COVID-19 and the need to materially increase reserves made forecasting difficult and traditional metrics an incomplete picture of a firm’s performance. This reality has resulted in the increased use of discretion in award determinations at year-end. This also impacts goal setting for 2021 incentive plans.

As a result of business uncertainty, we’re expecting to see an increased use of relative credit quality metrics and pre-provision net revenue (PPNR) in annual incentive plans and relative performance measurement of long-term incentive (LTI) goals (three-year or longer performance periods). The process of adjusting incentive plans going forward takes time; be sure to begin conversations about 2021 changes earlier than normal.

How are credit union compensation plans changing for executives?

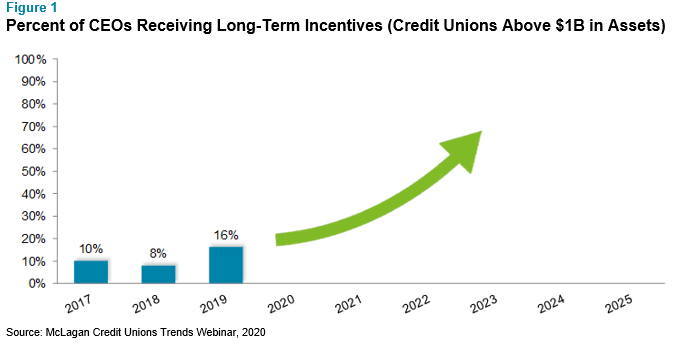

Over the last decade, the trend has been towards more performance-based compensation for all levels in the organization and across the industry. This allows for better alignment between credit union results and pay levels. The increase in performance-based pay has been particularly pronounced in executive compensation and there are four factors that influence this in the market. First, the shift to more performance-based pay has decreased the prevalence of retention-based vehicles, such as time-vested plans and retirement packages. Second, as credit unions have increased in size, they are competing for talent with banks, which have a longer history of using LTI as part of the executive compensation package. Third, best practices for risk mitigation place the focus on a longer-term performance period (i.e., three or more years). Finally, recent tax law changes have caused challenges with traditional 457(f) time-vested plans. Due to these and other factors, more credit unions are adopting long-term incentives. This is a trend we expect to see continue in future years (See Figure 1).

What trends are you seeing in director compensation?

While federally-chartered credit unions are not allowed to pay directors, state-chartered credit unions are governed by their respective state’s statutes. The number of states permitting director compensation is increasing, with the goal of recruiting the most qualified members for board positions. Sixteen states now permit director compensation, with Arizona, Colorado and Illinois most recently added.

Implementing this change should not be taken lightly. There are clear benefits to offering director compensation, such as recognition for increased responsibility and time demands and being able to attract more skilled and experienced candidates. However, there are also some drawbacks to consider, including the historical preference for volunteer boards

According to past McLagan analysis, seventy-one percent of the largest credit unions that can compensate their directors are doing so. It’s important to additionally note that many directors are reaching retirement age, posing even more reason for credit unions to carefully consider director compensation and how to strategically use it to attract new talent with the right qualifications in the future.

How are firms planning for salary budgets this year?

Planned salary increase budgets are much more uncertain this year than in the past. Initial projections for merit increases for banking firms have remained steady at around 3%. However, there were a few caveats in our findings that led us to anticipate this data being at the higher end for most firms. Overall, 2021 salary budget increases will likely be adjusted to come in at around 2% to 2.5% across the industry, with some firms even lower.

All of these decisions need to be made on a case-by-case basis. For example, if your firm decided to slow down and make salary cuts or eliminate raises in 2020 out of an abundance of caution, depending on your current financial situation, you may need to revisit these decisions for the coming year. Pay decisions made now will have longer term retention and cultural implications as things hopefully begin to normalize in 2021 and return to normal in 2022. This provides good reason to be more aggressive going forward.

How are firms shifting their job architecture frameworks to support a more agile workforce?

As firms continue to adapt to new working structures and environments due to effects of COVID-19, we are seeing heightened attention around creating more agile workforces across industries. Addressing this new objective starts with your job architecture. Agility does not happen by accident — firms need to establish a clear, simple way to communicate a framework for decision-making. Rewards, recognition and career structures can be built off this to encourage lateral moves and more agile career thinking and progression.

There are many reasons credit unions should reassess their current plans. Here are some of the potential benefits:

- Optimize your talent lifecycle – Collaborate with your line of business leaders to build the right team to execute the strategy. Throughout the process, provide job clarity (responsibilities, skills, decision-making), enable career pathing and movement across the organization and build an employment proposition that attracts and retains your employee of choice. It’s important to foster innovative approaches to source, secure and retain hires.

- Mitigate statutory risk/challenges – This includes using job architecture to help navigate pay equity, inclusion and diversity, wage and hour regulations and turnover costs. We offer new McLagan tools this year that can help your firm benchmark many of these topics.

- Efficiently deliver HR services – It’s essential to automate HR processes and eliminate manual work. This will enable functionality of HR systems and ensure data integrity and a consistent approach to role-based security.

To learn more about credit union compensation trends and how to prepare your firm for the future, please reach out to one of the authors or write to [email protected].

Related Articles