When the founder at a company asks for more equity — not an uncommon request — private company boards must understand the competitive landscape and nuances within market data.

Founder equity sparks a timeless debate in the private market world: Over time, how does a board motivate and retain founders who already have meaningful equity in a company?

It’s a tricky question — and the concept has become even more prevalent over the last six months as the IPO window swung wide open, and as appetite for private company investments continued. As companies begin to solidify a path to liquidity, founders are eager to ensure they have a stake that accurately represents their contribution.

To answer this type of question, private company boards must understand the competitive market and nuances within competitive market data. Is the founder’s stake lower, on par, or higher than the market? This can be challenging to assess because data can be easily manipulated to convey a certain picture.

Here are some factors to consider when using external data:

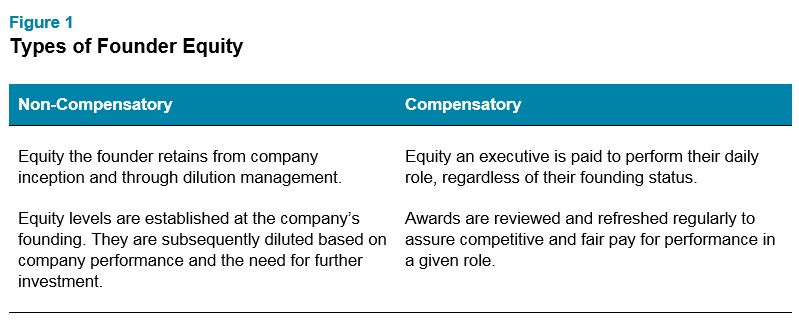

- Does the market data separate compensatory from non-compensatory founder equity? This is critical, as we describe in greater detail below.

- Obtain a data sample that is large enough to prevent outliers from skewing the overall picture. We recommend creating a peer group of at least 10 companies.

- Ensure the data is objective: Don’t rely on self-reported surveys where the accuracy of the data comes into question.

- The value of equity matters when selecting the right peer group: A founder with a 3% stake in a $500M business holds equity with significantly more value than a founder with a 10% stake in a $50M business.

- Ensure there is buy-in from all parties. The founder needs to agree that the data is objective and fair, or the process could be contentious from the start.

Once you have data to assess the competitiveness of a founder’s ownership stake, think about founder equity through two separate lenses. First, consider equity obtained by founders when starting the business (non-compensatory awards). Second, consider awards received for fulfilling job duties such as CEO or executive chair (compensatory awards). When a founder approaches the board about an equity refresh, it’s typically related to go-forward compensatory awards since equity associated with founding the business will already be established. (If this doesn’t appear to be the case, you may need to have a level-setting conversation with your founder.)

We should note that equity granted for new roles — in other words, a promotion or a complete change in job role — is treated differently than awards for continued service in a role.

Let’s look at an example where a private company board wanted to know how the equity stake of its co-founder, who also holds an executive role at the organization, compared to the market. The co-founder’s total equity stake (2.5% post-financing) was significantly above market when benchmarked to his executive role. However, the co-founder’s compensatory equity holdings were found to be significantly lower than the targeted market percentile once separated from non-compensatory equity. Following this analysis, a refresh equity award of 1% post-financing in stock options was recommended and approved.

Next Steps

Founders expect to be compensated for their contributions, and the nature of refresh grants assumes a founder is contributing to the business in an ongoing capacity. When a founder approaches the board for more equity, there are 2 primary actions we recommend taking:

- Obtain objective and relevant benchmark data to determine how the founder’s equity compares to the current market.

- Look at equity through a compensatory and non-compensatory lens. What is the founder doing today to continue to build value for the business?

Looking for specific data? We recently conducted a survey of private market participants on founder equity refresh grants. If you’d like more information about survey results or have questions about this topic, please reach out.

Related Articles