To succeed, firms will need to take a hybrid approach of ‘tech touch’ and ‘high touch’ to meet client needs.

The COVID-19 pandemic has turbo-charged digitalisation in the Asia wealth management industry. To date, there have been several false dawns, but this time really does seem different. Trends continue to converge, heightening the level of urgency around many firms’ digital initiatives.

To start, investor expectations are escalating after 12 months of clients seeing both the advantages and shortcomings of their providers’ platform capabilities. Simultaneously, profitability pressures and an aging advisor workforce make the old, ‘white glove’ model of service look commercially unviable.

Unsurprisingly, most wealth management firms are dialling up their tech investment efforts to support their advisors through the shift towards remote work and digital communications. In a recent pulse survey[1] conducted by Aon’s Human Capital Solutions (HCS) on HR initiatives for 2021, 56% of responding firms identified digitalisation as one of their top three strategic priorities. This further highlights the new reality for the Asia wealth management industry.

The tech population is anticipated to grow as firms scale up digital hires

As firms increase their technology investment, they are not only looking at how to best enable their workforce with necessary digital tools, but also how to acquire the right talent with the right technological skills.

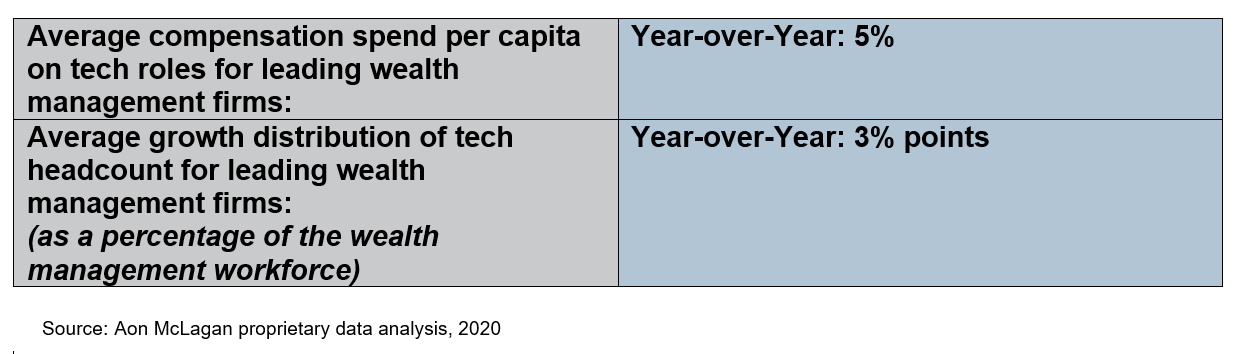

However, this is proving to be an expensive way to improve digital capabilities. Our Aon McLagan proprietary data analysis indicates that average compensation spend per capita for tech roles by leading wealth management firms increased by 5% in 2020. On top of that, the share of tech roles as a proportion of the wealth management workforce grew by 3%. Hiring is expected to trend upwards in the next three to five years as initiatives are rolled out, indicating more competition for talent.

Premium compensation and scarcity of tech specialists are driving a bidding war for talent

With industry demand for tech talent outweighing the availability in the market, there is no doubt that the talent war is heating up. The challenges of finding top talent are even more intense for specific roles; particularly data analysts, who are skilled in examining large volumes of diverse internal datasets for firms and converting them into insights. Their contribution to firm strategy can range from assessing demographic and behavioural insights for marketing and communications, to analysing investment information to empower portfolio management.

Such roles are expensive but considered worth it. They help unlock value creation by, for example, providing advisors with actionable insights for their client relationship management or by pinpointing opportunities for product development.

A pulse survey study[2] conducted in Q1 2021 by Aon’s Human Capital Solutions, revealed that tech talent was already one of the three most challenging roles to hire in 2020. This is creating a bidding war, putting upward pressure on pay, especially for data specialist roles. In fact, our Aon McLagan proprietary data analysis finds that same-store [3] total compensation for data analytics and management specialists was up by 6% in 2020, compared to an increase of 4% for other technology roles.

To succeed, it will be important for firms to identify the premium pay gap for specialist roles and consider other ways to attract them. A compensation bidding war is unsustainable, but other parts of the employee value proposition – such as remote working opportunities, lifestyle benefits or a focus on work-life balance and wellness – could resonate strongly instead. Investing in these areas also has potential to usher in productivity improvements for the wider firm.

A hybrid client approach of tech touch and high touch could help address this new reality

It is well documented that millennial investors are demanding changes to their digital experience. Yet, similar sentiments are now prevalent among older generations, too.

Research

[4] conducted by Aon Client Insight with high-net worth clients uncovered that it is highly important for clients to have access to digital offerings from their wealth management firms, while also maintaining some personal interaction with their advisors. Firms who offer this hybrid model reap the benefits in higher satisfaction scores. Segmented by age, close to 70% of millennials gave hybrid offerings high scores for importance and satisfaction, compared to around 40% of older generations.

A hybrid approach is also key to achieving higher productivity through offering clients support via digital solutions for straightforward requirements. This way, wealth advisors can focus on interacting with clients who have more complex issues or require more personalised advice, ultimately resulting in better client management and satisfaction.

Underpinning these strategies is robust client insight, so firms can prioritise the initiatives that will improve client engagement and wallet share. Firms should challenge themselves to develop their understanding of not just the client journey, but also the critical moments that could be digitalised to benefit the overall client experience.

Conclusion

There is no doubt that competitive compensation is critical to acquire top tech talent. Firms need a comprehensive and timely understanding of the pay premium for specific specialist roles to support their hiring and/or talent retention strategies.

However, compensation is not the only tool at their disposal. Other aspects of the employee value proposition include opportunities for differentiation. Careful scrutiny of tech costs should also be applied to investments in new technology. By benchmarking the client experience, firms can identify priority gaps that should be addressed to improve share of wallet and client retention.

It is easy to get swept up in the excitement of this new era of innovation. But remember – the firms that choose to take a cool-headed approach to making digital pay, through smart and strategic investments in tech talent and tools, will be best positioned for success.