Nasdaq’s diversity rules contain a “comply or explain” mandate for listed companies without at least two “diverse” directors. Firms must also provide a board diversity matrix starting in 2022.

On August 6, 2021, the United States (U.S.) Securities and Exchange Commission (SEC) approved a proposal from Nasdaq for new board diversity rules. The rules, which were originally filed with the SEC on December 1, 2020, are now codified in the new Nasdaq Listing Rules 5605(f) and 5606.

In this alert, we detail what public companies listing on Nasdaq need to know in order to comply with the new rules. We also expect that shareholders — who are increasingly concerned with boardroom diversity and how boards are providing oversight of diversity, equity and inclusion within their organizations — will look for all public companies to adopt similar measures.

Diverse Board Representation Under Rule 5605(f) — the “Comply-or-Explain Provision”

This rule requires Nasdaq-listed companies to have at least one self-identified female director and one director self-identified as an underrepresented minority or as LGBTQ+[1].

If a company has not satisfied the diversity objectives, it must disclose in either its website, proxy statement or annual 10-K report the particular aspect of board diversity it has not satisfied and the reasons why it does not have two diverse directors.

There are alternative requirements applicable to Foreign Private Issuers and Smaller Reporting Companies. Foreign Private Issuers may fulfill the requirement in one of three ways: with two female directors, or with one female director and one director who self-identifies as LGBTQ+, or with one female director and one director that is underrepresented in the country where the company’s principal executive offices are located.

A Smaller Reporting Company may satisfy the rule in one of the following three ways: one female director and one director who is an underrepresented minority, or one female director and one director who self-identifies as LGBTQ+, or two female directors.

For any Nasdaq-listed company with five or fewer board members, one diverse director is enough.

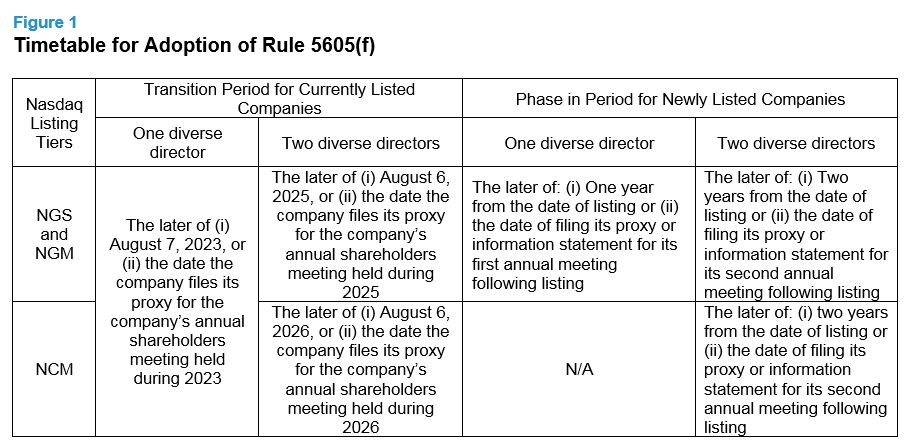

This rule provides a transition period for existing listed companies and a phase-in period for newly listed companies based on the companies’ listing tiers: Nasdaq Global Select Market (NGS), Nasdaq Global Market (NGM) and Nasdaq Capital Market (NCM). The transition and phase-in periods allow companies to comply with one diverse director first and then two diverse directors in subsequent years, as follows:

If a company fails to comply, it will have its next annual meeting or 180 days from the event causing the deficiency to comply (whichever comes later). A company that does not maintain compliance due to a board vacancy will have either one year from the date of the vacancy or the date it files its proxy or information statement (or Form 10-K or 20-F) in the calendar year following the year of the vacancy to comply (again, whichever comes later). A company that relies on this grace period should disclose such reliance in advance of its next annual meeting of shareholders in its proxy or information statement or on its website.

Annual Disclosure under Rule 5606 — Creating a Board Diversity Matrix

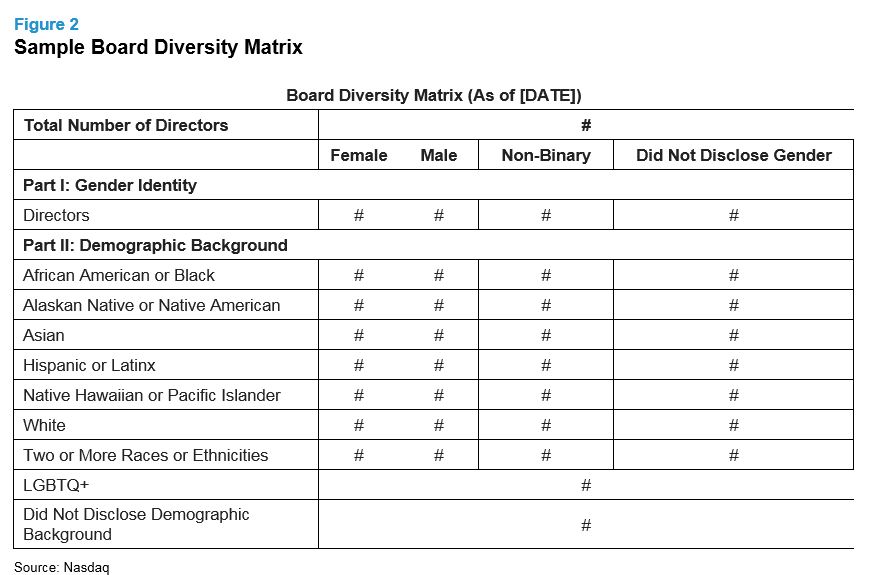

New Rule 5606(a) requires annual disclosure of statistical information on companies’ board diversity in a format similar to the Board Diversity Matrix in Figure 2.

A company has until August 8, 2022, or the date it files its proxy statement or information statement for its annual meeting in calendar year 2022 (whichever comes latest) to provide its initial board diversity matrix. The rule will require disclosure for the current year and the preceding year. Newly listed companies must comply within one year of listing.

Certain companies are exempt from these requirements, including SPACs, asset-backed issuers, other passive issuers, cooperatives, limited partnerships and management investment companies, among others. For Foreign Private Issuers, the definition of diverse may be based on the ethnic, cultural or linguistic identity in the country of the company’s principal executive offices.

Board Recruiting Services

Separately, Nasdaq says companies that do not have two diverse directors meeting the definition in the new rules are eligible for one year of complimentary access to its board recruiting service, which Nasdaq says has a network of board-ready diverse candidates for companies to identify and evaluate.

Next Steps

It remains to be seen whether the NYSE will adopt a similar rule for companies listed on its exchange. Even for companies not traded on Nasdaq, there has been pressure on companies to disclose information regarding board diversity and a company’s strategy for achieving it in order to meet evolving investor expectations.

Companies will need to update their Director and Officer Questionnaires in order to capture the information required to be disclosed and should establish appropriate disclosure controls and procedures in connection with the recording, aggregation and disclosure of such sensitive information.

Boards should ensure that diverse candidates are included in their director candidate pools, including consulting advisors regarding the processes and approaches to use in recruiting diverse directors, such as the use of potentially sensitive information.

Aon’s global governance team helps clients build diverse boards, disclose the right information to stakeholders and stay up to date on evolving governance best practices. If you have questions about this topic or other corporate governance-related matters, please contact one of the authors or write to [email protected].

[1] “Underrepresented Minority” means an individual who self-identifies as one or more of the following: Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or two or more Races or Ethnicities. LGBTQ+ means an individual who self-identifies as any of the following: lesbian, gay, bisexual, transgender, or as a member of the queer community.