What is your credit union’s compensation philosophy? When well thought out, compensation philosophies provide the groundwork for important pay decisions for your organization. Far too often, though, these philosophies are antiquated and include general phrases like, “we strive to provide competitive compensation” and “the goal of our compensation structure is to attract, retain and motivate.” While few can disagree with these types of platitudes, they are rarely helpful when making actual decisions.

The purpose of a compensation philosophy is to provide a framework for compensation decision-making. However, the clichés associated with a standard compensation philosophy typically do not provide an actionable foundation for the board of directors when setting CEO compensation, or for human resources when designing salary structures and incentive plans. If your approach to pay is so broad that it doesn’t support decision-making or guide strategy, what is its benefit? As American author, salesman and motivational speaker Zig Ziglar once said, “If you aim at nothing, you will hit it every time.” To bring actionable specificity to your philosophy, we recommend having answers to the following key questions:

- Who are your biggest competitors for talent?

- How does your credit union want to compare to the market?

This article focuses on these core questions that credit unions should be asking themselves when setting meaningful compensation policies that align with their unique business goals.

Question #1: Who are Your Biggest Competitors for Talent?

To whom do you lose talent? From where do you recruit?

When setting compensation, it is essential to understand who your biggest competitors for talent are. To explore this question further, ask where recent hires have come from and where talent is going when they leave. The answers to these questions may vary by job level or function. We often hear that credit unions’ biggest competitors are both credit unions and banks. Because of this, credit unions must maintain a strong understanding of pay in both industries.

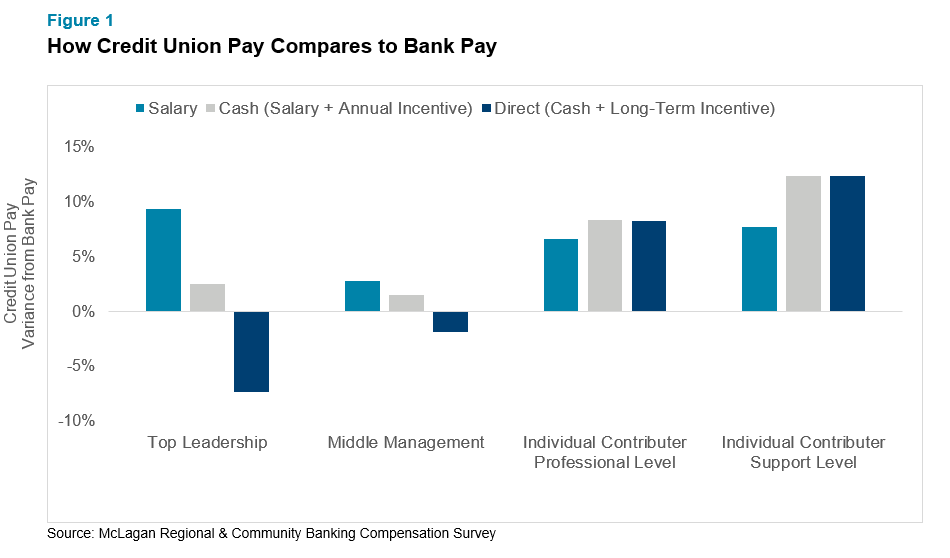

The chart below shows how compensation differs by level at credit unions and banks with a median asset size of approximately $5 billion. For example, +10% means that credit unions are paying 10% more than banks and -5% means that credit unions are paying 5% less than banks. These variances can change significantly depending on asset size, especially for management-level positions.

There are several distinctions between credit union and bank compensation to note:

- Level: At higher levels in the organization, direct compensation for credit unions (salary, annual cash incentive and long-term incentive or LTI) falls below direct compensation at banks. Individual contributors at credit unions are compensated at higher levels than banks.

- Annual cash incentives: Credit unions pay annual cash incentives to individual contributors more often and at a higher percentage of salary than banks. For management positions, credit unions pay annual cash incentives at a similar prevalence to banks, but actual payouts are lower.

- Long-term incentives: Banks’ long-term incentive vehicle is usually equity and becomes more prevalent for incumbents with salaries over $150,000. Long-term incentives at credit unions are an emerging trend, but still much less prevalent than at banks. When utilized, LTI plans are cash-based and earned based on three to five years of performance goals.

Question #2: How Does Your Credit Union Want to Compare?

Should you lead, lag or meet the market?

Once a competitive market is defined, we recommend specifying how your credit union will ideally compare to that market. At the most basic level, credit unions should determine whether their strategy will focus on meeting, leading or lagging the market. While many organizations choose to meet the market, commonly defined as the 50th percentile, some firms target the 55

th, 60

th or even the 75

th percentile due to ambitious growth plans, high expectations or workloads and the desire to be seen as an employer of choice with competitive pay opportunities. Compensation philosophy decisions should be unique to each credit union’s goals and values.

What should the mix of pay be?

In setting a compensation philosophy, credit unions must also consider their desired pay mix of salary and variable compensation. Over the last decade, there has been a trend towards more performance-based compensation at both banks and credit unions across all levels of the organization. This creates greater alignment between individual pay and performance.

Should you think about having long-term incentives in place for executives?

As credit unions continue to grow, they are increasingly competing for talent with banks, who often utilize long-term incentives to compensate their executives. Therefore, long-term incentives are one of the fastest growing trends among credit unions. According to results from our Regional & Community Banking Compensation Survey, in 2019, 18% of CEOs at credit unions above $1 billion in assets received long-term incentives, up from 10% of CEOs in 2017. In addition to their recruitment and retention benefits, long-term incentives reduce sensitivity towards short-term performance factors and provide greater tax efficiency over traditional time- and retention-based 457(f) plans. Therefore, all leading-edge credit unions are considering how long-term incentives can best position their organizations for the future. Read our article,

Should Your Credit Union Think About Long-Term Incentives, to learn more on this topic.

Next Steps

Compensation structures are built around specific market positioning that answer the questions discussed above. While this is crucial to credit unions, it is also important to realize that not all employees will be perfectly aligned to the desired positioning. Decision-makers have the flexibility to compensate below the desired positioning for new or underperforming staff and above the desired positioning for experienced or high-performing staff.

After a compensation philosophy has been set, credit unions will also need to consider how transparent they should be in communicating compensation expectations to employees. We recommend considering your firm’s culture, historical practice, budget and executive team feedback when developing an approach that is consistent with your compensation philosophy goals. Pay transparency exists on a spectrum, ranging broadly from sharing only an employee’s current pay to openness about the entire organization’s salary structure. As transparency increases, effective manager training is critical to ensure the right messages are being shared in the right manner with employees. HR should be engaged in providing communication materials to managers, helping to answer questions and providing support for manager discussions.

It’s quite clear that establishing a specific, actionable and meaningful compensation philosophy at your credit union can be complicated. However, understanding the answers to the questions discussed above can help start the process and provide a strong framework for designing compensation structures, making individual pay decisions and determining if you are achieving your compensation goals.

Are you interested in digging deeper into compensation philosophies to build out effective pay structures for your credit union? Our consultants are experienced in working with credit unions and will provide you with the expertise needed to help set your organization on the right path. To learn more about participating in a survey or to speak with one of our experts, please visit our website

here or write to

[email protected].