Insights from Aon’s 2021 ESG in the Boardroom Pulse Survey highlight ways organizations are ramping up board oversight of key ESG topics, including diversity, inclusion and climate change. The survey results also reveal areas where firms may need to catch up to investor sentiments and regulatory changes.

Corporate boards and the corner office are expanding their oversight of environmental, social and governance (ESG) issues and, in many cases, developing a more robust strategy to address ESG risks. Aon’s 2021 ESG in the Boardroom Pulse Survey[1] provides a snapshot into the ways large organizations primarily in the United States are monitoring and managing these issues through board composition, corporate strategies, metrics, disclosures and incentives.

In this article, we provide an overview of how boardrooms are reviewing ESG issues and tips for how to elevate these conversations and implement oversight responsibility.

Board Oversight of Human Capital Management

Human capital management (HCM) involves a company’s strategy to attract, retain and develop employees. While HCM has traditionally centered on compensation practices, it now spans many other issues, including recruitment strategy, people management and company culture. HCM disclosures have gained attention from regulators and investors as human capital is increasingly considered a driver of long-term value. Beginning in November 2020, the SEC required companies to disclose their human capital management in the Form 10-K based on a principles-based disclosure. The agency has since said it’s considering adopting a more metrics-based approach.

In addition to this regulatory shift, the coronavirus (COVID-19) pandemic and social justice protests in 2020 put a spotlight on HCM issues. Just over three-quarters of our ESG survey respondents indicated they have renewed their focus on this topic given the events of 2020, and 71 percent currently have a defined HCM strategy. Like any material ESG risk, HCM poses liability concerns if a company is a market outlier. As such, appropriate board and executive oversight that prioritizes stakeholder views are vital to mitigate this risk.

Board Diversity and Inclusion

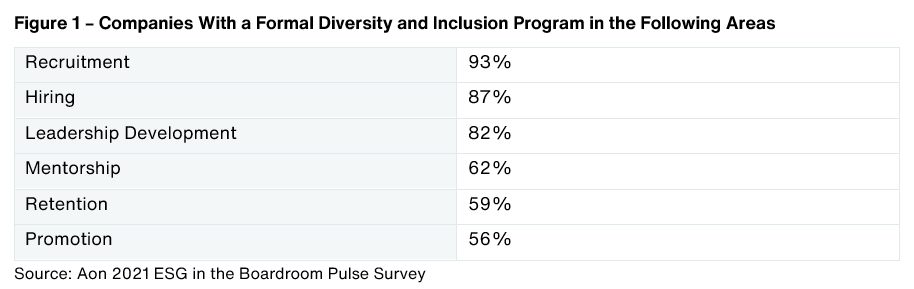

Diversity and inclusion (D&I) can be a pillar within an HCM strategy or a standalone material ESG issue. Of responding companies with a defined HCM strategy, over 90 percent have D&I as component. Figure 1 highlights the areas where D&I is being embedded within HCM strategy.

Many companies are investing more time and resources into their D&I strategy given recent shifts in investor expectations and regulatory disclosures. In February 2021, proxy advisory firm Institutional Shareholder Services (ISS) began recommending against nominating committee chairs and other relevant directors when there are no women on the board. Starting this year, Glass Lewis is recommending against nominating committee chairs and other relevant directors when there are fewer than two women on the board.

Despite these policy shifts, only 42 percent of survey respondents said they have a formal board diversity policy. Of these, most respondents define diversity as gender, race and ethnicity. Companies may utilize a board diversity matrix when evaluating gaps in board expertise and diversity. A board diversity matrix can include gender, race and ethnicity, and priority skills, among other qualifications. These matrices will become more prevalent with Nasdaq requiring a listed company to submit a board diversity matrix by August 8, 2022, or the date it files its proxy statement for its annual meeting in calendar year 2022.

Climate Change Oversight Not Widespread

Climate change-related regulation is spreading across the world (see our recent article for more information about regulations in the European Union and the United States). However, 58 percent of survey respondents said they do not have formal board and c-suite oversight of climate change. Of the 42 percent that do have formal oversight of climate change, most designate oversight to a specific board committee. Companies with formal climate oversight were more likely to disclose a climate change policy and climate risks, including risks related to transitions to a lower-carbon economy and the physical impacts of climate change.

Next Steps

When it comes to various areas of ESG, regulatory pressures paired with investor expectations are prompting a shift in company policy and practices.

“While companies are in different stages on their ESG maturity curve, all organizations should keep in mind the anticipated increase in regulatory requirements and the mounting investor expectations,” says Karla Bos, an associate partner within Aon’s global governance group. Failure to do so can bring a competitive disadvantage and close the door to new sources of capital, she says.

“If efforts to address ESG in the boardroom are perceived as inadequate, a business will be held to account by investors and potentially open the door to a range of activism — or close it to investors applying robust ESG investment screens,” Bos adds.

[1] Survey was conducted throughout the summer of 2021 with 84 participating organizations across industries. Most companies were multinational and headquartered in the United States with predominately $1 billion or more in annual revenue.