A new shareholder proposal requesting companies conduct racial equity audits emerged in the 2021 proxy season. With relatively strong support for a new proposal, we take a look at data trends and how companies can proactively address this movement through oversight and improved disclosure.

We know that businesses benefit from a racially and ethnically diverse workforce. This is especially relevant now as diversity, equity and inclusion (DE&I) is a central topic for investors and proxy advisors. Given this focus and a new requirement that companies disclose their human capital management, we are seeing an increase in proactive oversight and disclosure of DE&I.

Is this commitment enough to satisfy stakeholders — some of whom are asking companies to initiate racial audits? We explore the latest data trends and provide advice for taking proactive action.

DE&I Disclosure Trends

By the end of 2021, 55 percent of companies across the Russell 1000 were disclosing some form of race and ethnic data about their workforce, according to Just Capital. That’s up from 32 percent that disclosed this information in January 2021. However, only 11 percent of companies are disclosing specific details, leaving investors to fill in the knowledge gaps with their own interpretation.

“It’s not a good idea to leave room for shareholders to create a narrative that might be different from what is really happening,” says Sahar Hassan, a senior ESG consultant in Aon’s global governance team.

“Companies should be transparent about their DE&I efforts and goals, but also not too specific in setting goals that they are not likely to reach. Once those targets are disclosed, investors will be following up on whether they were achieved,” Hassan says.

It’s easy to see why investors and other stakeholders are continuing to press this issue: Certain gender and ethnicities are still widely underrepresented across parts of the workforce in the United States (U.S.). According to a 2021 McKinsey report[1], women enter the workforce in almost equal numbers as men. However, women comprise only 22 percent of executive-level jobs. Similarly, racial minorities comprise 33 percent of entry-level positions and only 13 percent of executive jobs. Improving these gaps is one of the first steps to reduce racial and gender inequality. (Other steps should include a racial and gender pay equity gap analysis and actional steps to develop fair pay policies.)

Shareholder Activism Trends

Given that real progress on DE&I in the workforce still needs to be made, there has been an increase in shareholder proposals asking companies to evaluate and report on the actions they had taken to address racial justice issues and whether those actions had been effective. Many firms are responding — either proactively or as a result of receiving such a proposal. One such response is undertaking a civil rights audit or racial equity audit. Prominent companies such as Airbnb, Starbucks and Meta (Facebook’s parent company) have all completed these types of audits in recent years. A year after Meta’s audit, the company’s legal advisors said 65 of the 117 actions and recommendations from the audit were implemented and 42 were in progress, according to a progress report.

What Is a Civil Rights Audit?

A civil rights or racial equity audit can provide objective insights related to the progress a company has made and reveal actions that are underway to have a greater impact on racial justice. Such audits entail vigorous risk assessments and disclosures on continuity plans, among other things. These audits are recommended to reduce reputational risks as well as mitigate potential investor scrutiny. It is also an opportunity to provide insights on the company’s culture and highlight efforts to address inequalities in the workforce.

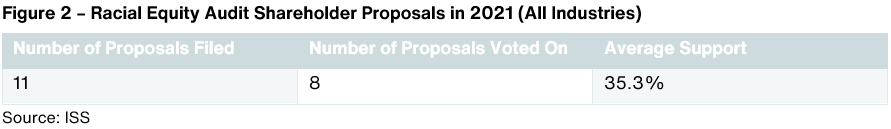

Investors have filed more than two dozen shareholder proposals this year asking companies to conduct civil rights or racial equity audits and other racial justice initiatives, according to several media reports. Last year around 40 race or gender-related shareholder proposals were filed, averaging 29 percent support, according to ISS Governance Analytics.

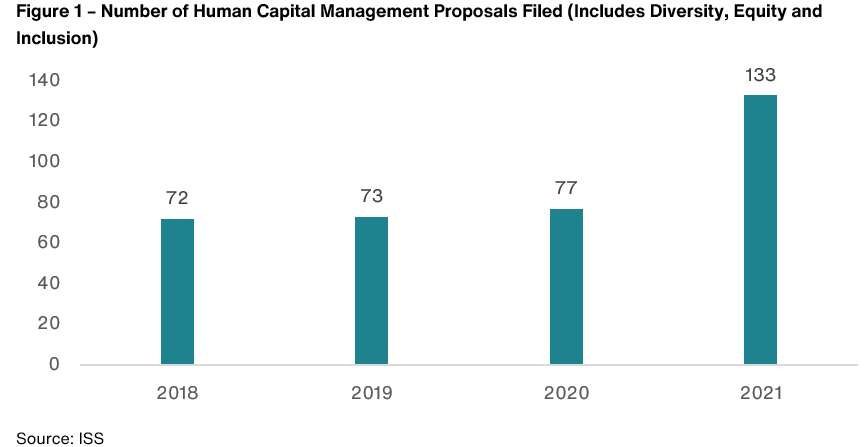

Overall, there was huge momentum among shareholders and activists for human capital management related proposals (including that involving DE&I) in 2021. This momentum is likely a combination of concern about racial justice following 2020 protests and the impact of the pandemic on workers and racial minorities in particular.

Despite the momentum for racial audits, DE&I proposals that touch on general disclosure around a company’s efforts have higher overall shareholder support. Resolutions asking American Express, IBM and Union Pacific to publish an annual report assessing the effectiveness of their DE&I efforts passed last year with 60 percent, 94 percent and 81 percent support, respectively. In the case of IBM, the company endorsed the shareholder proposal.

Additionally, we’ve seen a rise in the number of companies’ EEO-1 reports that include statements supporting racial equality, diversity and inclusion. The EEO-1 report gives investors and the public a comprehensive breakdown of a company’s U.S. workforce by race, ethnicity and gender based on 10 employment categories.

Spotlight on DE&I Proposals in the Life Sciences Sector

While racial equity audits are being addressed at all types of companies, we see particular interest in this topic among our life sciences clients, especially for those firms experiencing high growth and raising their profile among investors and proxy advisory firms. Additionally, these organizations have mission-driven cultures that align with efforts to improve inclusion and diversity.

“I’m getting inquiries from a number of my life sciences clients who want to stay on top of diversity and inclusion issues. When it comes to racial equity audits, they are starting to ask more about what they can do and whether it will help them deliver on their diversity goals,” says Meaghan Piscitelli, partner in Aon’s human capital business and co-leader of the life sciences vertical globally.

AbbVie, Amgen, Biogen, Bristol-Myers Squibb, Medtronic and UnitedHealth Group were among the first companies in the industry to commit to disclosing detailed diversity data of the workforce in their EEO-1 reports.

In 2021, several DE&I-related proposals were filed at life sciences firms, requesting reports on gender and racial pay gap statistics. Such proposals can be triggered in different ways, but they received modest support overall.

Proxy Advisor and Investor Positions on Racial Equity Audits

Proxy advisory firms have different approaches to shareholder proposals on racial equity audits. Glass Lewis mostly supports them while ISS remains agnostic. According to Bloomberg, Glass Lewis has broadly said conducting these audits would help companies reduce risks of high-profile controversies that may result in customer and employee attrition, regulatory inquiries and significant fines. Meanwhile, ISS says it will evaluate racial audits on a case-by-case basis, considering a number of factors[1].

Investors are also weighing in on a case-by-case basis. To date, shareholder proposals have been submitted by special interest groups and pension and labor funds. As these proposals become more widespread, we expect to see heightened interest from larger, mainstream investors like BlackRock, State Street and Vanguard. Currently, BlackRock asks companies in the U.S. to disclose workforce demographics including race, gender and ethnicity in line with EEO-1.

Vanguard’s global head of investment stewardship, John Galloway, told the Proxy Monthly publication that his firm has supported shareholder proposals where the management team or board has embraced the call for a third-party racial or social justice audit. In some instances, however, Galloway notes that Vanguard has not supported proposals “where we came to the view that it was either overly prescriptive, too broad, or misaligned with the company’s actual issues.”

How Companies Can Take Action

In addition to pressure from investors, the regulatory environment around DE&I is changing rapidly. Consider the following developments:

- NASDAQ’s board diversity rule, passed in August 2021, requires at least two diverse members on the board, including one who identifies as a female and another who identifies as either an underrepresented minority or LGBTQ

- The New York City Comptroller’s Office Board Accountability Project 3.0 launched in 2020 and calls on 56 companies to interview minority searches for new board members and CEOs (also known as the “Rooney Rule”)

- We should also note the California Assembly Bill 979 that requires public companies headquartered in the state to have at least one director from an “underrepresented community.” The legislation was struck down on April 1, 2022, by the Los Angeles County Superior Court following a lawsuit by a conservative advocacy group. The state has the right to appeal or draft subsequent legislation, but it's unclear if it will choose to do so.

Given the growing pressure from investors, regulators and employees, we expect to see increased movement toward disclosing and proactively addressing DE&I, and racial equity in particular, this year and beyond. It’s incumbent on every organization to consider whether a racial equity audit makes sense at this time and to re-evaluate their disclosure to see if there is an opportunity to increase the level of detail and transparency. These audits are a way for companies to hold themselves accountable, demonstrate change and define how they are addressing it.

Taking action on DE&I also means thinking beyond the production of a racial equity audit. Real progress happens once a business evaluates the results and next steps of its audit. This includes measurable goals on diversity, equity and inclusion when it comes to talent acquisition, development and retention, and total rewards practices.

If you have questions about this topic or other corporate governance-related matters, please contact us at [email protected].

[1] Factors include the company’s established process or framework for addressing racial inequity and discrimination internally; whether the company has issued a public statement related to its racial justice efforts in recent years, or has committed to internal policy review; the company’s track record in recent years of racial justice measures and outreach; and whether the company has been the subject to recent controversy, litigation, or regulatory actions related to racial inequity or discrimination.