Voluntary salesforce turnover is slowing across the US technology and life sciences sectors after more than five years of steady increases. What's behind the numbers?

Two years ago, we took a five-year look back at voluntary sales employee turnover at technology companies using Radford's quarterly workforce trends data. At the time, median turnover on a 12-month trailing basis was at a five-year high. Last fall, we took another pulse of the state of salesforce turnover and found it had gained another record high across most of the technology and life sciences industries.

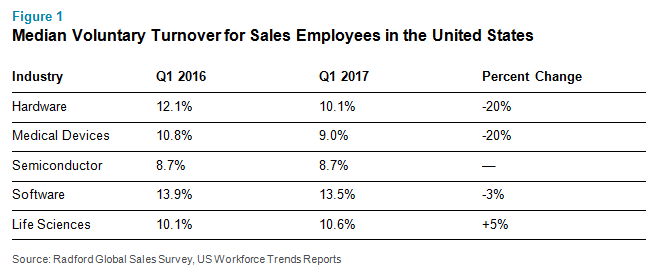

With some reports circulating about softening in the technology sector, particularly in Northern California, we wanted to see how sales turnover has changed, if at all, from just six months ago. The chart below provides a snapshot of slowing voluntary turnover in every key technology industry in the past year.

With the exception of modest increases in voluntary turnover among life sciences companies, every other industry we looked at has seen fewer sales people switch jobs. Hardware and medical devices have seen a 20% reduction in voluntary turnover.

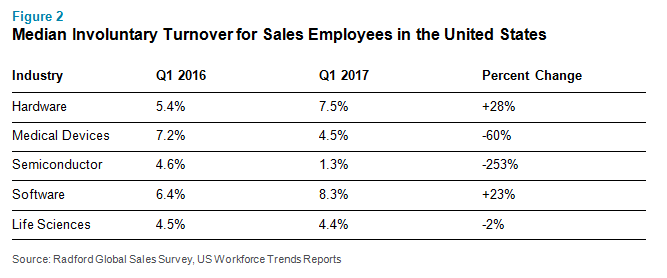

When we look at involuntary turnover (e.g., terminations and layoffs), there has not been a consistent change across industries. Interestingly, software and hardware have slowing voluntary turnover (i.e., fewer employees willingly leaving their jobs), while also experiencing an increase in involuntary turnover. The semiconductor industry, which by some reports is booming due to rising demand in connected devices, has seen a remarkable drop in involuntary turnover over the past year, from 4.6% to 1.3%.

So, what are the forces behind the latest turnover data? There can be a number of economic, industry-specific and internal issues that affect turnover. Our data and insights from working with hundreds of sales teams annually suggest a variety of factors are at play. For one, many companies are developing more effective total rewards and talent programs for their sales staff after more than five years of facing the costs of high turnover. Last year, and continuing into this year, we observed many of our clients successfully implemented job architecture initiatives designed to clarify job roles and sales employee career opportunities. The upshot is a path for salespeople that's longer term and more strategic. Having a path and plan that are part of frequent development discussions gives the sales professional and manager something to grasp other than pipeline and quota achievement — which for even high achievers can, in a given quarter, be discouraging to the point of flight risk. Career development continues to be a highly-ranked factor of sales employee engagement, based on our research.

Secondly, there may be softening of the hot technology and life sciences sectors, particularly in the San Francisco Bay area, as some companies and employees flee to lower cost tech hubs such as Austin, Texas, and Denver.

Finally, as we look to the economy, there are really two different stories playing out: One is Wall Street's bull run, reflecting investors' confidence that the government will lower corporate tax rates, repatriate corporate earnings held abroad and loosen regulatory burdens. The other story is one of political uncertainty, and this could be playing in the minds of some employees who are hesitant to take a bet on a new job when the future of business may be optimistic to some but also largely uncertain. Whatever the case, companies should embrace lower voluntary turnover and take this opportunity to refine and invest in their talent programs.

If you have questions about your sales compensation plan or sales force planning and want to speak to a member of our consulting practice, please write to [email protected]. To learn more about participating in a Radford survey, please contact our team.

Related Articles