Our most recent analysis indicates that median revenue growth rates had already fallen to just 3.4% for the first half of 2020, compared to 9.3% growth from 2017 to 2018.

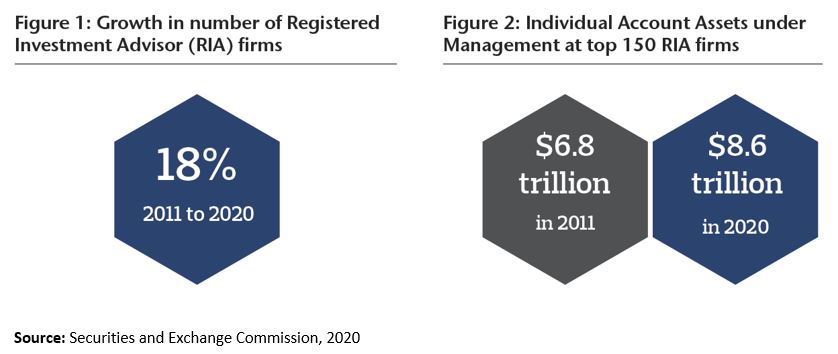

Looking closer, it is apparent that the gains from growth over the past decade have mostly gone to the top end of the RIA market. According to the SEC, individual account assets under management have grown by 27% since 2011 at the biggest 150 RIA firms.

New client assets are being won, but at the expense of smaller boutiques. Whether the result of competition, over-servicing or difficult market conditions, many RIAs are struggling to convert client-centricity into stellar business performance.

In this article, we argue a more commercially-focused approach to client insight is needed to get 2021 off to a running start. Without understanding where they are falling short, RIAs will struggle to improve share of wallet, drive referrals or reduce attrition among clients acquired through M&A.

Organic revenue growth is not covering escalating cost pressures

The primary challenge for RIAs is that organic growth has been weak in recent years.

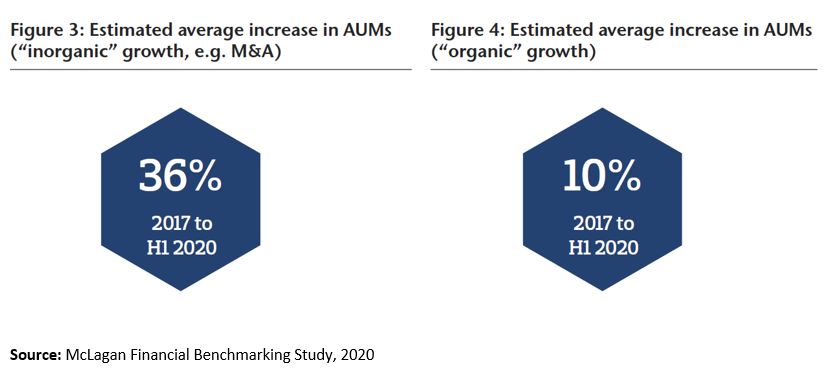

Our Aon proprietary data helps identify the underlying drivers, showing that although AUM went up by 10% between 2017 and H1 2020 for firms that relied on organic growth, there was a 1% decrease in their overall number of client relationships.

In any case, much of that asset growth would have resulted from market appreciation during the Bull Market years – and not enough to cover the 27% rise in average operating expenses experienced over the same period.

The picture looks slightly better for firms that have grown ‘inorganically’, through the acquisitions of smaller RIAs or RM teams. These businesses increased their Assets under Management much more substantially, by 36%, and experienced a 21% growth in their client relationships.

But a short-term improvement in revenues can only be maintained if followed by a sustained effort to integrate new clients and understand their needs. It is here many RIAs may be surprised to learn they are falling short.

Financial planning incidence is a client experience weak spot

A sector that prides itself on client-centricity may have allowed blind spots to build up.

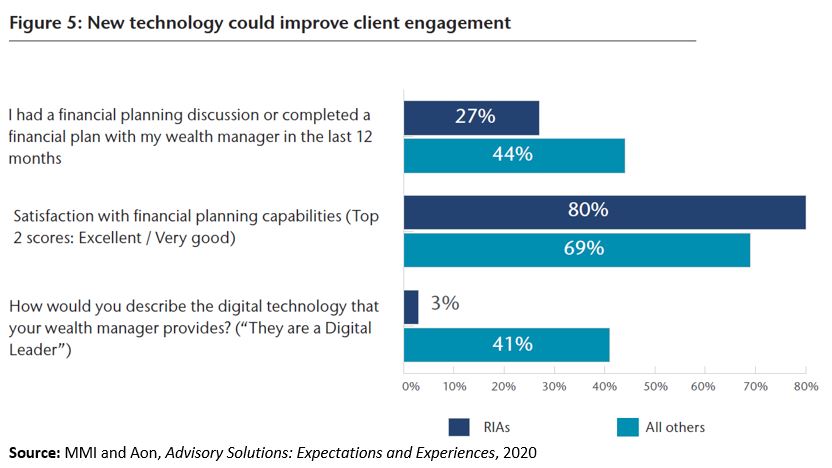

Our recent study on behalf of the Money Management Institute (MMI) found that clients of RIAs are far less likely than clients of other wealth managers to have had (or be able to recall) a financial planning discussion with their advisor in the last 12 months. Just over a quarter can remember completing a financial plan, compared to the average of 44% for the rest of wealth managers.

Why does this matter? Clients who have been through the financial planning process tend to see its value; they are also significantly more likely to make a recommendation to friends or family members, generating new business for the firm.

The potential for growth is there: After all, 80% of RIA clients who had completed financial planning gave their firm top scores for this capability. Having more frequent financial planning discussions could be a straightforward way to boost referrals.

A second growth lever could be a significant upgrade of the digital experience. Only 3% of RIA clients feel that their firm is a digital leader, compared to an average of 41% across the wider wealth management industry.

As our MMI study shows, clients are aware of the potential of new technology to improve their engagement with their finances and their wealth managers.

With operating budgets under scrutiny from the pandemic (and possibly already stretched to cover the transition to remote working), cost effectiveness and risk mitigation will be the mantras of future tech investment.

Therefore, identifying for RIAs how innovation should be effectively targeted and which tools will meaningfully improve engagement can be powerful. For instance, should RIAs invest in technology that helps clients visualize their retirement pathway? Or would they engage better with technology that helps reflect their values in their plans? |

Conclusion: ‘One size fits all’ won’t be enough

Following a difficult year, RIAs of all sizes will be carefully evaluating how to source new revenues. With budgets squeezed, it becomes imperative to focus on a few risk-mitigated initiatives that have the best chance of delighting clients, with the ultimate goal of improving satisfaction, loyalty and assets.

Firms with the best track records in this area go further and benchmark their performance against their peers to be more targeted. A systematic approach to measuring and tracking the client experience is the right starting point. With competition intensifying with larger firms, becoming more strategic about client management may address the challenge of weakening business performance.

RIAs are rightly proud of how well they know their clients. But looking closely at the moments of interaction that matter most to them could still yield some surprising results. |

|