While many firms already use geographic pay differentials for base salaries, the decision to differentiate other forms of pay by location is as pressing as ever as more employees work remotely. In particular, the question of whether or not to apply geographic differentials to equity compensation looms large. In this article, we consider the pros and cons.

As the COVID-19 pandemic continues to accelerate the adoption of remote working practices and the decentralization of workforces away from cities and traditional innovation hubs, HR and rewards professionals increasingly face this burning question: Should we differentiate our equity grant guidelines by location?

While the use of geographic pay differentials for base salaries is a long-standing and widely accepted practice across many companies, the same cannot be said for equity compensation. Indeed, with the exception of broad equity grant discount factors across a handful of key countries or regions, companies have long refrained from adopting this course of action, so why change now?

Yes, the pandemic is driving an unprecedented level of workforce change, and it is extremely tempting to reduce costs when employees move to areas with a lower cost of labor, but perhaps there is an appropriate limit to this line of thinking? In this article, we explore several key factors you and your team need to consider before adopting geographic differentials for equity compensation and ways you can broaden the conversation with business and finance leaders who might be primarily focused on potential cost savings.

First, a Quick Reminder of What’s at Stake

Companies always face pressure to manage costs, and these demands have only mounted as a result of the COVID-19 pandemic. Thus, with merit budgets already smaller than in past years and bonus pools less frothy than before — and in the face of an increasingly remote and geographically dispersed workforce — the idea of using geographic differentials for equity compensation has suddenly emerged as an attractive option.

Consider this illustrative example: Let’s say a software engineer earning a base salary of $150,000 in San Francisco hopes to permanently relocate to Denver where median base salaries for the same role at the same level are 10% lower. If the software engineer’s company has a strong geographic differentials policy in place for base pay, they may ask the employee to take a reduced salary of $135,000 in exchange for approving the move.

Applying the same logic, would it not also make sense to reduce the software engineer’s target long-term incentive award to reflect the Denver market as well, especially if the differential between San Francisco and Denver is even larger in this case? Let’s say the same software engineer has a target equity award of $50,000 a year in San Francisco; but in Denver, the median target for the same role and level is 20% lower at $40,000.

If you add up these changes, and assume a static annual target bonus opportunity of 20% of base salary, then suddenly target total compensation for the software engineer moves from $230,000 in San Francisco to $202,000 in Denver. It’s a cumulative savings of $28,000 or 12%.

As an abstract exercise, it all makes sense and unquestionably saves the company money. However, in the real world, when you consider issues such as culture, pay philosophy, history, administrative burdens and pay equity challenges, is this the right choice for your company? Below, we explore these questions in more detail.

An Important Note

The example above is illustrative, and in our experience, companies often do not ask employees to take an immediate base salary cut when they change locations. Typically, companies phase in adjustments over a period of time by not granting merit increases. Managing pay transitions across locations is an important topic unto itself and something we’ve addressed in other articles.

Weighing the Pros and Cons of Geographic Differentials for Equity Awards

Cost Savings and Share Utilization

Let’s cut right to the chase. In a world where equity burn rates and new stock plans are heavily scrutinized by investors, anything that allows companies to reduce their equity compensation expense and slow down the rate at which they utilize shares is worth investigating. For this reason alone, exploring the potential use of geographic differentials for equity compensation is not a bad use of time.

It does not hurt to examine available market data more closely to see if significant differences in equity grant behaviors exist from one region of the U.S. to another, or across country lines, and if these differences could have a material impact on your costs and share utilization. Of course, the actual location and distribution of your employees will matter a great deal here — you may ultimately discover potential cost and share savings are limited in scope and not worth pursuing.

Culture and Pay Philosophy

The biggest driver of where companies ultimately land on the issue of using geographic differentials for equity compensation will likely be their culture and pay philosophy. Does your company currently view equity awards as an additional layer of income for employees, or as a long-term retention tool to reward for specific skills, critical expertise and the level of impact an employee has on your organization? Adding a location-based pay adjustment to equity awards can signal to employees that equity compensation at the firm is being used in a similar fashion as cash compensation rather than as a retention tool.

As Octavio Cardenas, a partner in the Rewards Solutions practice at Aon, notes: “While the allure of reducing costs and share utilization is attractive in concept, most of our clients think about equity as a means to reward individuals who make an outsized impact on their companies.” He adds, “with limited merit budgets and bonus pools this year, equity awards are often where pay for performance shows up most. This means culture and pay philosophy often superceded cost-savings opportunities for the clients I’ve supported this year.”

Accounting for the History of Merit- and Skills-Based Pay

Building on questions related to your company’s culture and pay philosophy, it’s also helpful to consider a brief history of merit- and skills-based approaches to pay, which stand in stark contrast to adopting a narrower focus on the cost of living or labor.

Cost of labor indicies (often known as COLA), first appeared in the 1800s and were created to ensure citizens had a common level of purchasing power across different locations. The problem with this concept is that it failed to incorporate how merit- or skills-based factors might impact pay, especially as global workforces took on increasingly complex tasks requiring more education and training.

For this reason, by the 1950s, companies began to shift their attention from an entitlement-based pay approach to rewarding employees for results and their individual contributions. Today’s pay systems build on this shift and tend to focus heavily on pay for performance, with some differentiation based on where people live, but also a healthy emphasis on what they do and how they perform.

Thus, from a financial standpoint, while it makes perfect sense to use cost of living or labor as an important factor in setting pay for employees who move from one location to another, there may be a limit to how far this logic goes. Yes, given the fact that base salaries are closely linked to local purchasing power, the use of geographic differentials for base pay is fairly common. However, at the same time, companies have generally stayed away from using geographic differentials for equity grant guidelines because this form of pay is traditionally linked to rewarding for merit, skill and performance.

Outside of global guidelines to localize pay in Europe and Asia relative to the U.S., the use of geographic differentials for equity is not a dominant practice today. So, as we noted at the start of this article, why change now?

Administration

Let’s assume you analyze the market data and discover your company could save millions in equity compensation expense by adopting geographic differentials for equity grants — this dosen’t mean it’s time to celebrate yet. You first need to consider the hidden costs of this change. A differentiated approach to equity will be harder to maintain than a consistent set of equity guidelines and requires a round of education across your people managers and business. As with any potential change in practice, especially one this significant, make sure you consider the administrative hurdles your team may encounter.

Pay Equity

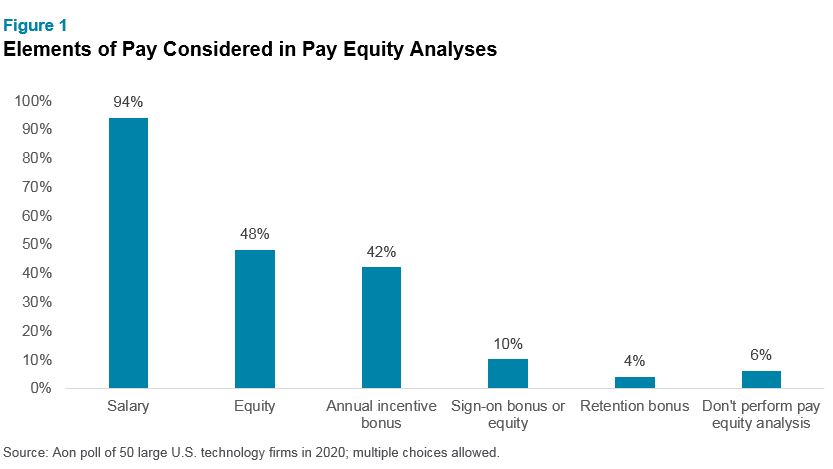

Finally, we get to the important issue of pay equity. One reason we do not already see wider use of geographic differentials for equity grants is that long-term incentives, rightly or wrongly, have not been a driving focus of internal pay equity assessments. Most organizations continue to focus on base salaries when they audit their pay structures to ensure pay is fair and compliant with various national and local laws.

However, we are starting to see equity awards play a larger role in pay equity analyses. In fact, when we polled our 50 largest technology sector clients in 2020, nearly half said they now factor equity awards into their audits.

If this trend continues, it’s possible more companies will adopt geographic differentials for equity compensation as a means to fairly align pay levels for employees who move to join teams in areas with a lower cost of living or labor. However, this can also be avoided entirely if companies adopt a single set of national equity grant guidelines within a country that are backed by a strong set of policies to determine how award levels are derived.

Next Steps

As we look out at the world today, we now know work can be performed effectively at scale with large segments of the workforce operating remotely outside of traditional office environments. In time, this could actually lead to less differentiation in pay by location as labor markets become more decentralized. Thus, we believe geographic pay differentials for equity compensation are a step too far for most companies, especially if you think equity awards are designed to reward for merit, skill and criticality to the organization.

“Core to this question is whether companies want to pay for where an employee works or lives, or if pay is for skills, performance, success, potential and so on. The answer you choose should align to your firm’s pay philosophy, and commitment to a culture built on the premise of ownership and that, more than anything, should be the driving force behind whether or not pay in general should be localized from a total compensation viewpoint,” says Linda E. Amuso, a senior partner in the Rewards Solutions practice at Aon.

Our advice is for firms to very carefully consider the pros and cons of differentiating equity based on an employee’s location. Part of your calculation must be determining exactly how many location reference points you’ll need, how many employees would be impacted, how changes would be made to existing pay arrangements, how much the firm would save and how excess equity shares could be used in a better fashion than they are today.

If you have questions about the pros and cons of using geographic differentials for equity compensation and would like to speak with one of our experts, please contact one of the authors or write to rewards-solutions@aon.com.

Related Articles