On August 25, 2022, the Securities and Exchange Commission (“SEC”) adopted final rules to require companies to disclose information reflecting the relationship between executive compensation actually paid by a company and the company’s financial performance in annual meeting proxy statements making it effective for the 2023 proxy season.

The rules implement one of the last two executive compensation requirements mandated by the Dodd-Frank Act of 2010 (clawback policies are still on the horizon). The SEC proposed pay versus performance disclosure rules in 2015 and reopened the comment period in January of this year. Aon described the proposal earlier this year here.

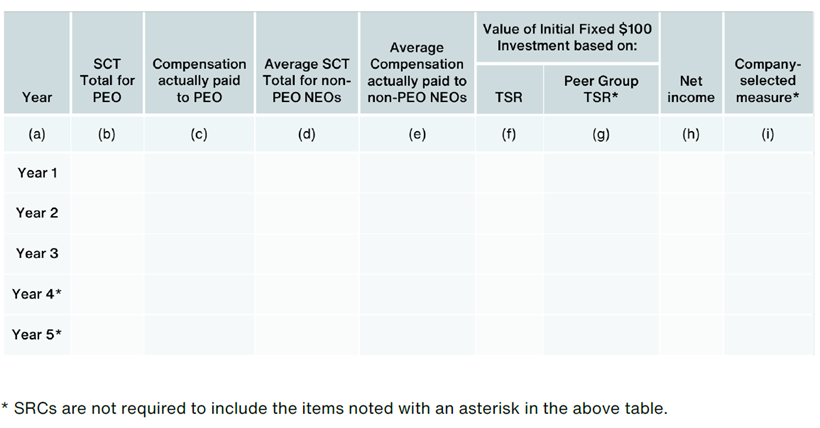

The final rules will require public companies to provide a table of information for their five most recently completed fiscal years featuring:

- the total compensation reported in the Summary Compensation Table (“SCT”) for the Principal Executive Officer (“PEO” which is most often the chief executive officer) and an average of the total compensation reported in the Summary Compensation Table for the other Named Executive Officers (“NEOs”),

- the compensation “actually paid” to the PEO, and an average of the compensation “actually paid” to the other NEOs,

- the company’s total shareholder return (“TSR”),

- the TSR of companies in the company's peer group,

- the company’s net income, and

- a financial performance measure chosen by the company.

This chosen performance measure, in the company’s assessment, must represent the “most important” financial performance measure the company used to link compensation actually paid to NEOs to company performance for the most recently completed fiscal year.

Companies will be required to describe the relationships between the executive compensation actually paid and each of the performance measures shown in the table, as well as the relationship between the company's TSR and the TSR of its selected peer group (if applicable). These relationships can be disclosed graphically, using descriptive text, or a combination of the two provided the selected description make the connection clear.

In the original proposal, companies were required to list GAAP pre-tax income as part of the table but that requirement was dropped from the final rule.

Under the final rule, companies must provide a tabular list of three to seven other financial performance measures that the company has determined represent the most important financial performance measures used to link compensation actually paid for the most recent fiscal year to company performance. Unlike the proposed rule, this table is no longer required to be listed in ranked order of importance. So long as at least three of the measures are financial performance measures (or fewer than three, if the company uses fewer than three financial performance measures), the company may include non-financial performance measures in the tabular lists which for example, may include measures focuses on Environmental, Social, or Governance (“ESG”) or, for life science companies, goals towards drug development. A company that does not use any financial performance measures to link compensation actually paid to performance in the most recent fiscal year is not required to present a tabular list or disclose a company-selected financial measure.

Effective Dates

The rules which will be added as Item 402(v) to Regulation S-K will become effective 30 days following publication of the release in the Federal Register. Companies that are subject to the new rule (see below) must begin to comply with these disclosure requirements in proxy and information statements that are required to include Item 402 executive compensation disclosure for fiscal years ending on or after December 16, 2022.

Reporting Companies Subject to the New Disclosure Rules

The final rules require pay versus performance disclosure for all companies except for emerging growth companies (which are statutorily exempt from the requirements), foreign private issuers, and registered investment companies other than business development companies (“BDCs”) and does not require disclosure for any fiscal year prior to the company going public.

Transitioning to the New Disclosure Rules Including Smaller Reporting Companies

Companies, other than smaller reporting companies (“SRCs”), will be required to provide the information for a total of five years, providing three years in the first proxy or information statement in which they provide the disclosure, adding another year of disclosure in each of the two subsequent annual proxy statements. Also, all non-SRC companies will have to submit their tabular disclosure using Inline XBRL, while SRCs will be exempt until their third filing.

SRCs will be required to provide the information for a total of three years (rather than five years), providing two years of disclosure initially, and adding one additional year of disclosure in the subsequent annual proxy or information statement. In addition, an SRC is not required to provide the peer group TSR or the company-selected financial performance measure in the new table, and an SRC is not required to provide the tabular list of other financial performance measures. SRCs will also not have to adjust the pension amounts in the executive compensation actually paid calculation.

Disclosure Structure

Following is the table companies must provide together with certain required footnote disclosure, and which will be followed by the additional narrative and/or graphic comparative requirements and table of additional metrics.

If a company had more than one PEO during the year, the rule requires the addition of an additional column(s) showing the Summary Compensation Table total (column (b)) and Compensation Actually Paid (column (c)) for the other PEOs.

Calculation of Compensation Actually Paid

The calculation of compensation actually paid is the same information reported in the Summary Compensation Table with adjustments for equity awards and pension values. The final rules change how the adjustments were calculated from what was proposed, increasing the complexity of these calculations.

Pension Values

The proposed rules required companies to deduct the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans that appear in the Summary Compensation Table, while adding back in service cost. The final rules require the same deduction as well as the addition of service cost (calculated as the actuarial present value of each NEO’s benefit attributable to services rendered during the fiscal year), but also require the addition of prior service cost (calculated as the entire cost of benefits resulting from a plan amendment or initiation during the fiscal year). As noted above, SRCs are not required to make this adjustment to pension value.

Equity Awards

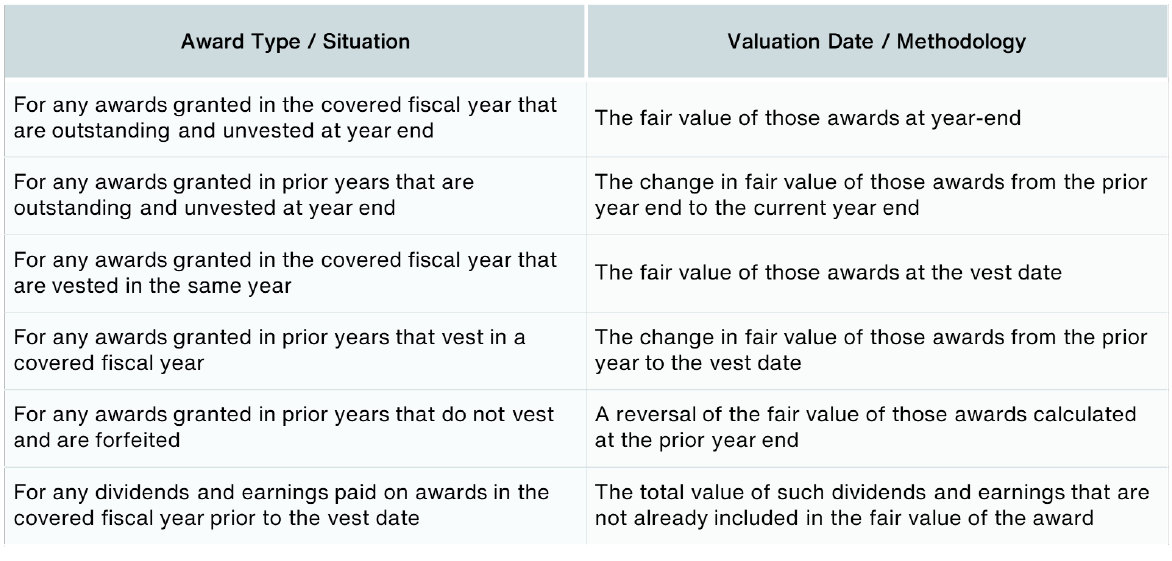

The SEC expanded and made more complex the calculation of compensation actually paid for equity awards. The proposed rules required the value of outstanding equity awards upon vesting in a covered year to be presented in the disclosure. The final rules expand the value of outstanding awards significantly, requiring companies to determine the value of both unvested and vested awards in each covered year of disclosure, in a manner consistent with the methodology required in the Summary Compensation Table, using fair value as calculated in accordance with ASC Topic 718. Specifically, companies must determine the following values for each equity award:

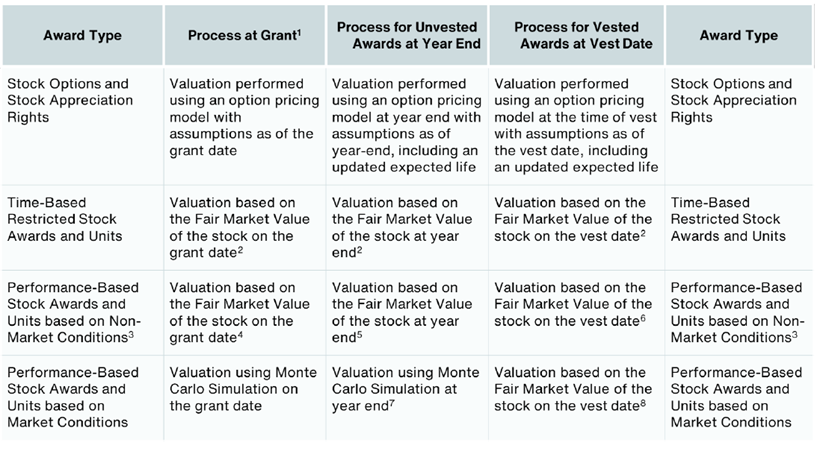

In the Appendix, we have provided an overview of the general valuation process for different types of equity awards.

Peer Group Selection, Calculation of TSR and Net Income

For the TSR calculation, the company may select the same peer group as disclosed in the Compensation Discussion and Analysis section (“CD&A”) of the proxy statement, or it may use the index or peer group disclosed in the stock performance graph requirements of Item 201(e) of Regulation S-K (this is the 5 year stock performance graph required in a company’s annual report). The disclosure each year must reflect any changes made to the company’s peer group, and supplemental disclosure must be provided to discuss the rationale of the changes as well as how the change impacted performance in compliance with Item 201(e) of Regulation S-K. Note, no peer group or TSR disclosure is required for SRCs.

The company must also calculate TSR in a manner consistent with the stock performance graph disclosure requirements under Item 201(e) of Regulation S-K. Additionally, the TSR will be represented over a cumulative period over the period covered in disclosure (i.e., for the first year in the table will represent the TSR over the first year, the TSR for the second year will represent the cumulative TSR over the first and the second years, etc.). Additionally, TSR must be calculated to cover the covered fiscal year, with a base investment of $100. The same methodology must be applied to the peer group’s calculation of TSR, where the TSR is weighted by each peer’s market cap at the beginning of the period.

The calculation of net income will be as disclosed under U.S. GAAP, and the company selected measure may be a non-GAAP financial measure. If a non-GAAP measure is used, a full reconciliation is not required but any adjustments must be disclosed and determinable from the company’s audited financial statements.

Aon’s Perspective

While the final rules were expected once the SEC reopened the comment period in 2022, the final rules have arrived very quickly with some significant changes, such as the representation of equity values over time, that will create further complexity around this disclosure. The Aon Human Capital Solutions team is here to help you and your company understand this new required disclosure, calculate the equity and TSR measures as well as draft and provide graphics for the additional required disclosure. Please do not hesitate to contact us if you need any support.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Appendix

Under ASC Topic 718, the accounting for share-based payments is tied to the “fair value” of the instruments being issued to employees. Since the final rules of this disclosure require companies to value both unvested and vested equity in accordance with ASC Topic 718, it is worth understanding the valuation process associated with different awards at different points in time. Please see the table below summarizing the general valuation process for these scenarios. Note, specific circumstances can exist with certain awards where a different or supplemental valuation may be needed, such as the fair value discount associated with a post-vest holding period. Aon’s Equity Services team is happy to review your awards to help you determine the best valuation process for you going forward.

Footnotes:

1 – The process at grant aligns with the valuation methodology and numbers reported in the Summary Compensation Table

2 – The fair value could be discounted for any dividends not provided to employees through the award

3 – Non-market conditions would be internal metrics, like earnings or revenue, not tied to stock price

4 – Total cost at grant is based on the expected payout in the future, typically target on the grant date

5 – Total cost at year end is based on the updated expected payout including data through year end

6 – Total cost at vest is based on the number of shares actually earned underlying performance

7 – The updated valuation must include performance through the year-end date, which could drastically change the fair value from the grant date

8 – Ultimately the final value illustrated will represent the number of shares earned multiplied by the vest date Fair Market Value