A clear and strategic long-term incentive plan that aligns to broader business goals can help position your credit union for success. Here are key elements and market trends to consider.

In today’s fiercely competitive market, credit unions are increasingly competing with the broader financial services market for top talent. One way to stay competitive is to adopt a long-term incentive (LTI) plan for executives.

Aon’s McLagan 2021 Regional & Community Banking compensation survey showed that 25 percent of CEOs at credit unions above $1 billion in assets received long-term incentives, up from just 10 percent of CEOs in 2017. In a tight market for executive talent, leading-edge credit unions are considering how long-term incentives can best position their organizations for the future. This article takes a closer look at key trends in the market and considerations for implementing a strategic long-term incentives strategy.

What is a long-term incentive?

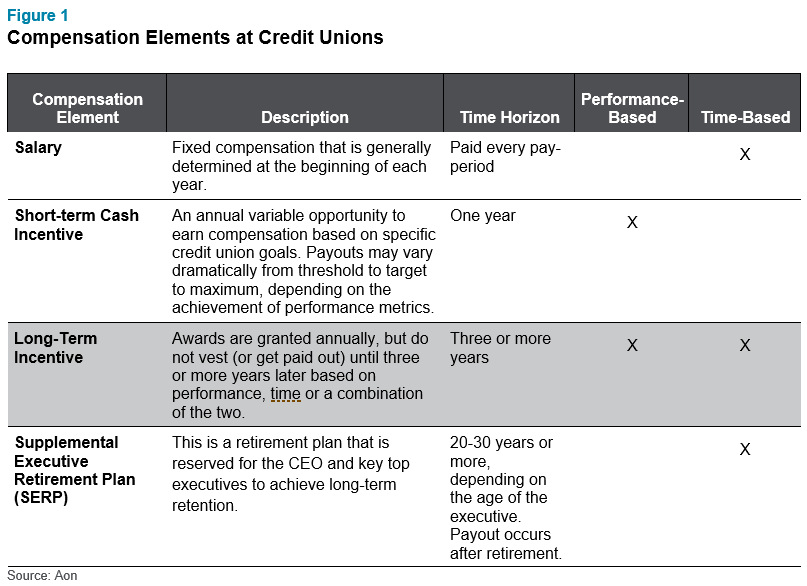

At credit unions, a long-term incentive is typically designed as a cash incentive that is earned based on the organization’s performance over three to five years. Normally, these performance-based LTI plans are used in addition to existing annual cash incentives and time-based retirement plans.

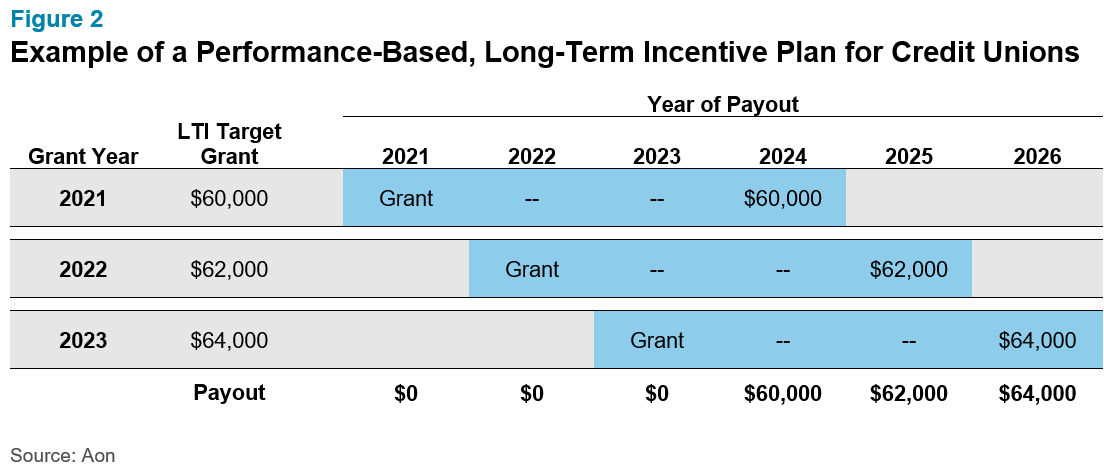

The exhibit below shows a standard, performance-based, long-term incentive plan design that is commonly seen in the market. Under this plan, the executive receives an annual LTI grant, with each grant covering a three-year period. For example, an LTI grant that is made to a group of executives at the beginning of 2021 would vest based on strategic performance metrics over the three-year period from 2021 to 2023. The goals are typically related to the longer-term strategic plan and are commonly financial in nature or related to members; for example, three-year average return on average assets (ROAA) and loan growth. LTI grants can be 100 percent performance vested, or a combination of time and performance vested over the three-year period, depending on the other compensation programs already in place. The long-term incentive award vests according to the level of goal achievement and is paid out in early 2024. The example below shows vesting based on target performance, but the award can range from 0 to 150 percent of the target award.

LTI trends in the market

Long-term incentives have always effectively supported retention and alignment of executive pay with long-term strategic goals. However, there are four macro level factors that are converging, leading to increased usage. These include a focus on performance-based pay, increasing credit union size, risk mitigation and excise tax considerations. We discuss these in more detail below.

Performance-based pay

There has been a pronounced trend over the last decade towards more performance-based compensation across all organizational levels and industries (banks and credit unions included). This allows a company to have lower compensation expense in down times, while also better aligning individual pay with performance. The shift to performance-based pay has been particularly pronounced in executive compensation where there has been a decrease in the prevalence of retention-based vehicles (e.g., time-vested awards, retirement packages) and an increase in performance-vested LTI.

Credit union size

As credit unions grow in size, many firms are adopting executive LTI plans, which are more common in the broader market. According to our research, data from S&P Capital IQ shows that since 2000, the United States has gone from having 67 credit unions above $1 billion in assets to having 411 credit unions above $1 billion in assets. With this increase in size and sophistication, there are more credit unions competing for talent with banks, who often use LTI to compensate their executives.

Risk mitigation

Regulators favor incentive arrangements that balance risk and financial results in a manner that does not encourage employees to expose their organization to imprudent risk. Well-designed incentive plans mitigate risk by balancing annual and long-term performance metrics (usually three years or more) within their plans. Including long-term metrics in incentive plans helps align executive pay with the mission of the credit union and the long-term interests of its members, while also ensuring that executives have a balanced perspective of risk and reward. This ultimately helps the board communicate to members that sound incentive, risk and corporate governance practices are in place.

Excise tax

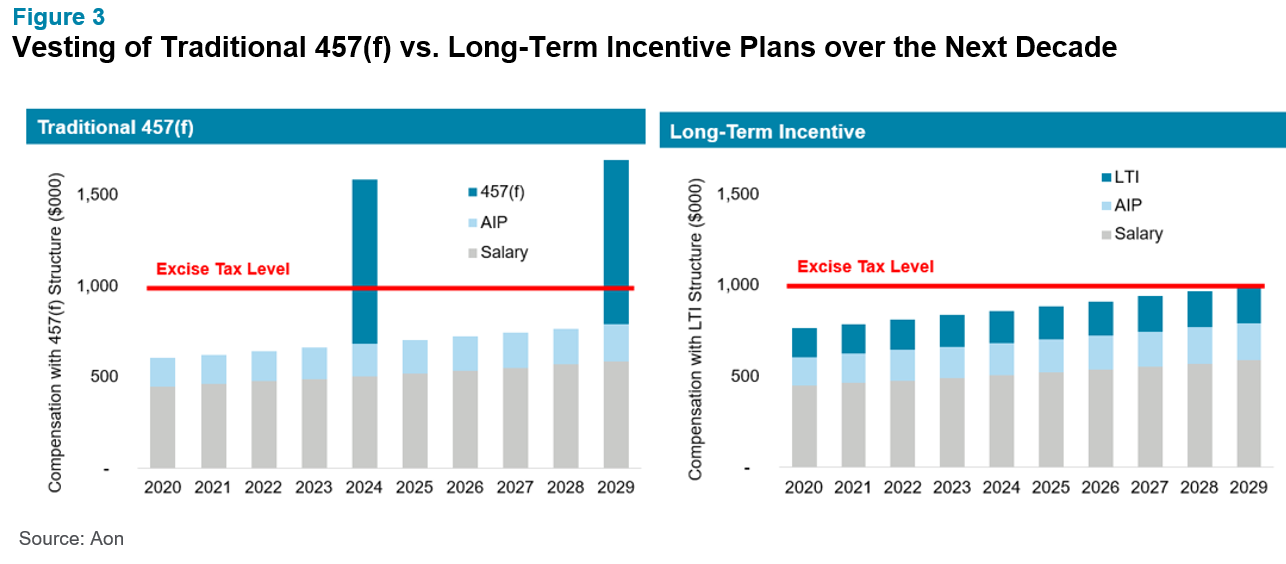

The Tax Cuts and Jobs Act of 2017 introduced a 21% excise tax for credit unions on any executive pay in excess of $1 million annually. The chart below illustrates a traditional 457(f) plan over the next decade. These plans are typically time-based awards that vest in large tranches. The uneven nature of the vesting makes them tax inefficient under the new tax law. In the traditional example below, a $269,211 excise tax is owed. Long-term incentive awards are typically awarded annually with overlapping performance periods. This means that something may vest each year, which makes them more tax efficient under the new tax law. Despite the same amount of compensation being delivered over the same timeframe as in the 457(f) example, $0 in excise tax is owed under the long-term incentive example to the right.

Considerations

To better understand whether an executive LTI plan makes sense at your credit union, consider the following questions:

What is the compensation philosophy at your credit union?

LTI plans provide another avenue for performance-based compensation and can offer more competitive total compensation positioning relative to market. Revisit your credit union’s compensation philosophy to understand your firm’s desired market positioning and the targeted mix of salary and variable compensation.

How do your executives currently compare to market?

Make sure you have a clear understanding of how your current compensation compares to the market before making decisions regarding long-term incentives. If your executives are currently falling short of your desired market positioning, implementing an LTI plan is an effective way to make up for compensation shortfalls. If your executives are already competitively positioned, your firm could consider gradually phasing in an LTI plan to preserve its positioning relative to market, while also reaping the motivational and retention benefits that long-term incentives provide.

How can you connect LTI with your credit union’s strategic plan?

Long-term incentives are commonly used to place emphasis on long-term strategic priorities in addition to annual goals. They are typically earned based on a multi-year performance period and can be tied to key performance metrics that are central to your credit union’s long-term goals. Try to tie LTI to existing strategic plans that are already established. By carefully setting goals that align with your firm’s strategic vision, long-term incentives create alignment between corporate performance, organizational value and participant interests.

Next Steps

A long-term incentive plan provides a competitive total compensation package to the broader financial services industry and can serve as a link to the future strategy of your credit union. You can start by revisiting your compensation philosophy, comparing total compensation to market and evaluating if a long-term incentive plan is a good fit for your credit union. If you would like more information or are interested in scheduling a board education session on compensation practices, please write to [email protected].